Nvidia (NVDA) stock has been on a tear, nearly doubling (up 96%) in 2023. From the October low the shares are up 165%.

Nvidia, Meta (META) and Tesla (TSLA), in combination with megacap tech, has helped power the Nasdaq to a surprising rally to start the year.

With Monday’s rally — up 3.2% at last glance — Nvidia stock is hitting 52-week highs and is breaking out to the upside.

That’s not something investors would have expected just a few months ago when tech was struggling and Nvidia was down massively from its highs.

Don't Miss: Can Intel Stock Hold Key Support After Earnings Rally?

Prior to today’s gains, though, the shares were roughly flat over the past month. (The semiconductor industry's performance more broadly has been underwhelming over the past few weeks.)

Nvidia's moves also some before Advanced Micro Devices (AMD) reports earnings, scheduled for Tuesday after the close.

Let’s have a look at the charts.

Trading Nvidia Stock

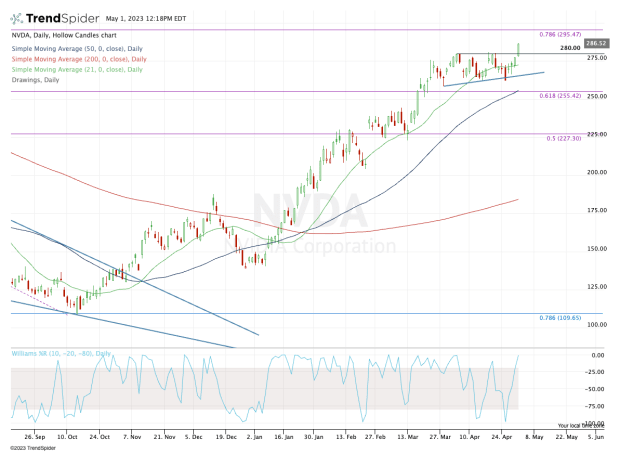

Chart courtesy of TrendSpider.com

Despite Nvidia's relatively flat performance over the past month, most traders would consider that pretty orderly price action given the immense rally that the stock has seen so far this year.

Amid the stock's consolidation, it has continued to put in higher lows, a bullish technical development.

Last week, Nvidia appeared set to give bulls a larger dip to buy when the shares fell 3% on Tuesday April 25 and closed near the session low. The stock responded with a three-day, 5.8% rally to close out the week.

Don't Miss: Disney Breakout Is in Play; Here's the Trade

With Monday’s breakout over $280, Nvidia bulls have to be looking at the $295 to $300 zone next, followed by the $310 to $312 area.

In that first zone — $295 to $300 — investors will find the stock’s 78.6% retracement (from the October 2022 low to the all-time high) near $295.50.

On the downside, it’s pretty simple. Investors will want to see Nvidia stock hold up above the $280 breakout level. Below that puts the 10-day and 21-day moving averages in play.

With AMD earnings on tap, Nvidia could certainly set up as a sympathy play, so keep that in mind.

Otherwise, the approach is simple from here: Above $280 is bullish, while below it is less constructive.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.