Parting is such sweet sorrow, especially when Nvidia (NVDA) does the parting.

It's always good to have friends, of course, and when you have friends in high places, so much the better. In the tech sector, friends don't get much higher--or bigger-than Nvidia.

💵💰Don't miss the move: Subscribe to TheStreet's free daily newsletter 💰💵

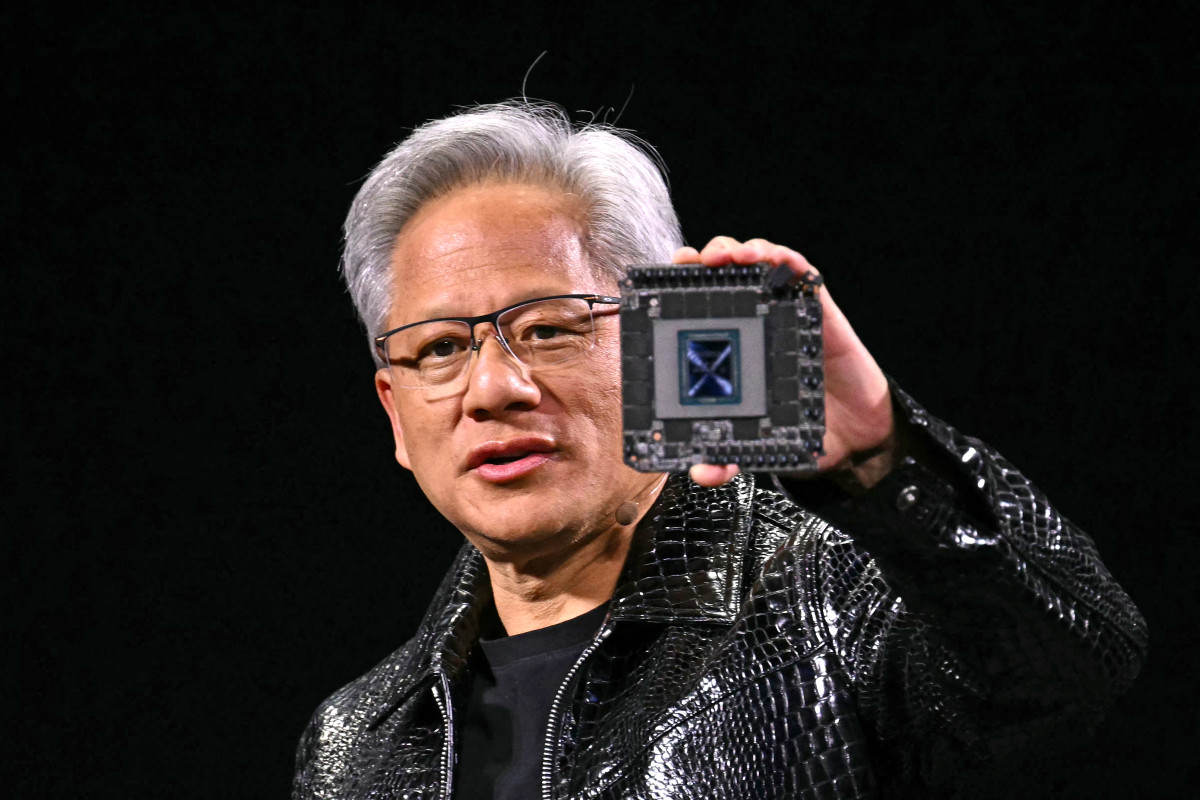

The AI chipmaking planetoid, co-founded in 1993 by CEO Jensen Huang, has a market cap of $3.40 trillion, making it the second largest publicly traded company on earth behind computer kingpin Apple (AAPL) .

Nvidia's stock took a major hit last month with the debut of Chinese AI chatbot DeepSeek. Its makers claimed it could do the work of American chatbots but for a much smaller price tag. Several analysts have since disputed the company's claims.

Louis Navellier, chairman and founder of Navellier & Associates, said the narrative that DeepSeek would revolutionize AI is false

"I only recommend and own Nvidia in the Magnificent 7 (my wife owns Amazon (AMZN) and Apple in a personal account), which should reassert its market leadership," he said, referring to the group of top tech stocks.

Nvidia invested in many AI companies

Nvidia has 87 subsidiaries and operating units, and investments in more than 40 companies.

These companies have benefited from their association with the Santa Clara, Calf.-based tech titan.

More 2025 stock market forecasts

- Veteran trader who correctly picked Palantir as top stock in ‘24 reveals best stock for ‘25

- 5 quantum computing stocks investors are targeting in 2025

- Goldman Sachs picks top sectors to own in 2025

- Every major Wall Street analyst's S&P 500 forecast for 2025

On the flip side, when Nvidia packs up and walks out on a company, it can result in some first-class heartache for the jilted party,

Investors closely monitor Nvidia's ownership because it can influence the stock prices of companies it buys or sells while providing insights into artificial intelligence trends.

"There is no greater vote of confidence than Nvidia taking a stake in your company," Dennis Dick, a trader at Triple D Trading, told Reuters.

Several companies cranked up the drama on Feb. 14 — Valentine's Day — when Nvidia revealed its holdings and sales in recent filings with the Securities and Exchange Commission.

The 13F filing, which must be filed quarterly, revealed that Nvidia had sold its entire stakes in SoundHound AI (SOUN) , Serve Robotics SERV, and Nano-X Imaging (NNOX) .

All three companies saw their stocks tumble on the news. Shares of SoundHound AI, which makes AI products used to offer voice services in automobiles, TV and customer service, such as restaurant ordering, were down 28% on Feb. 14.

Serve Robotics, which develops and operates autonomous delivery robots that deliver food and other items, was down about 40%,

And Nano-X Imaging, which makes medical imaging devices and AI-powered software to help detect chronic diseases early, dropped 11%.

Nvidia, which reports quarterly results on Feb. 6, also reduced its stake in British chip firm Arm Holdings (ARM) by about 44%.

Stocks rise as Nvidia reveals holdings

The Cambridge, UK-based company's technology is used in many of the world's devices, including smartphones, servers, and sensors. Shares were down about 3.2%.

Other companies saw their stocks rise after Nvidia disclosed its holdings as of the end of 2024.

Related: Analyst makes bold call on Nvidia stock ahead of earnings

These included Applied Digital APLD, which designs, builds, and manages data centers and cloud services for AI, machine learning, and high-performance computing. The company's shares jumped 15.2%.

Recursion Pharmaceuticals (RXRX) , which uses AI and other technologies to discover new drugs, was also on the list, and its stock finished up nearly 24%.

WeRide WRD shares skyrocketed nearly 84% when Nvidia revealed that it owned a stake in the Chinese company specializing in autonomous vehicles and street cleaners.

On Feb. 6, WeRide launched the Robovan W5, featuring self-developed Level 4 autonomous technology that the company said operates 24/7 in all weather conditions.

AI data center infrastructure provider Nebius Group NBIS is also one of Nvidia's holdings, and the stock climbed 6.7%.

TheStreet Pro's James "Rev Shark" DePorre named Nebius as his new data center pick.

“I’ve been complaining recently about not finding many good entry points, but I continue to dig and have found a few things of interest,” he wrote

DePorre said Critron issued a report on Nebius in December that projected the company would generate nearly $1 billion in revenue by 2025, largely driven by its data center infrastructure.

"This business is growing rapidly, and the recent $700 million capital raise from Nvidia and Accel Partners provides a strong financial foundation for Nebius' future growth," per the report.

"While AI stocks remain volatile, the optionality in Nebius is immense," the report said. "If the AI market continues to grow at its current pace, Nebius is well-positioned to capitalize, with a stock price potentially reaching $50 or more."

Nvidia was represented at the third annual artificial intelligence summit in Paris recently as they are backing Mistral AI. The French startup is known for its AI assistant "Le Chat" and is planning to launch the largest supercomputer in Europe.

Related: Veteran fund manager issues dire S&P 500 warning for 2025