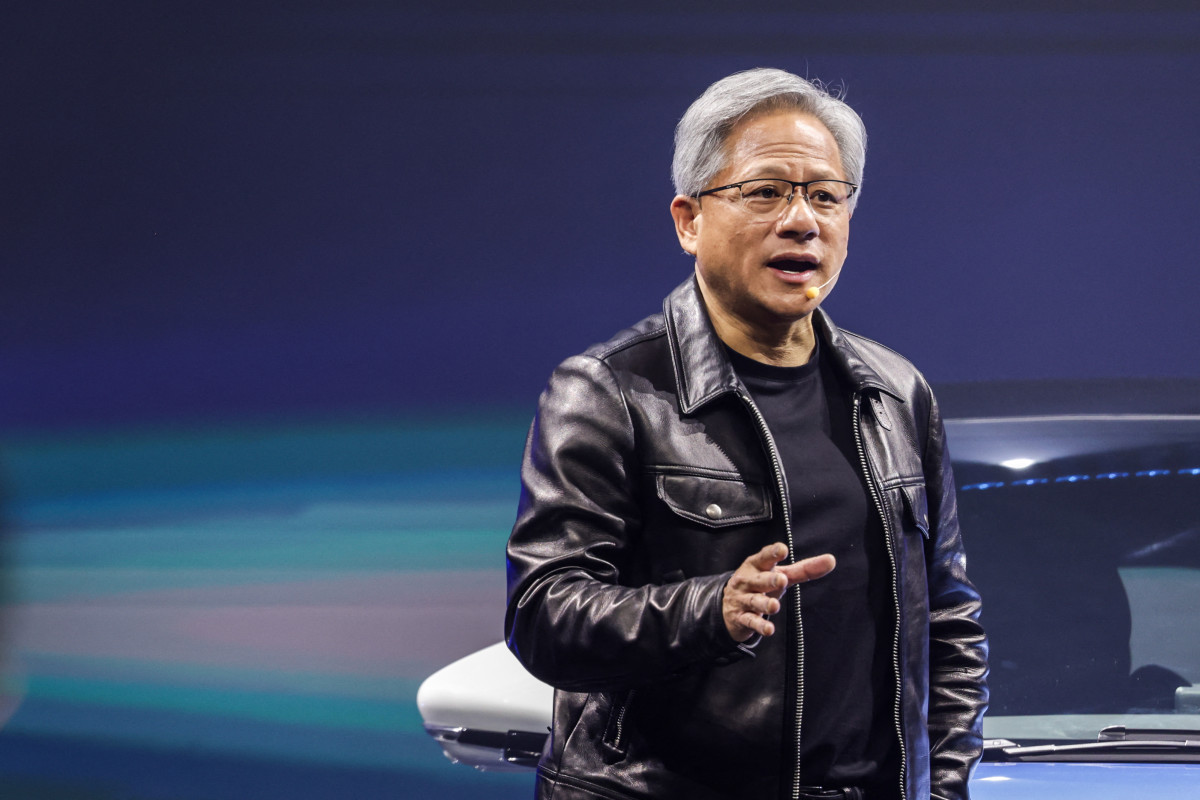

It was a great week to be Jensen Huang, the CEO and co-founder of chip giant Nvidia (NVDA) .

His company's shares, at $141.54 on Friday, were up a solid 2.6% on the week and are up 16.6% so far in October. And, of course, the shares are up 186% in calendar 2024.

💰💸 Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter 💰💸

He jetted off to ink a deal to make Nvidia's chips available to tech companies in India.

And when the week ended, Nvidia's market capitalization stood at $3.47 trillion, barely second behind Apple's (AAPL) $3.52 trillion.

In fact, at 11:22 a.m. Friday, according to Nasdaq data, Nvidia shares hit $144.06, producing a market capitalization of $3.53 trillion, ever so slightly larger than Apple.

Related: Analyst adjusts Meta stock price target with earnings on tap

But Nvidia fell back to close at $141.54 and that $3.47 trillion market cap. Apple's market cap remained at $3.52 trillion.

This was the second time in 2024 that Nvidia was Numero Uno. The first time was in June. Then, the stock sagged to as low as $98.91, while Apple and Microsoft (MSFT) retook their top positions. It's up 43% since.

Big Tech stocks' earnings calls will hat-tip Nvidia

This week, Nvidia, whether named or not, will be part of the earnings reports due from five of the biggest tech or tech-related companies:

- Google-parent Alphabet (GOOGL) on Tuesday.

- Microsoft and Meta Platforms (META) on Wednesday.

- Apple and Amazon.com (AMZN) on Thursday.

(Tesla (TSLA) reported last week. Nvidia reports on Nov. 20.)

A big question the CEOs of each company may have to answer during earnings calls is, "How much do you expect to spend on artificial intelligence? And do you have the most powerful technology to get the job done?"

These are important questions. Here's why.

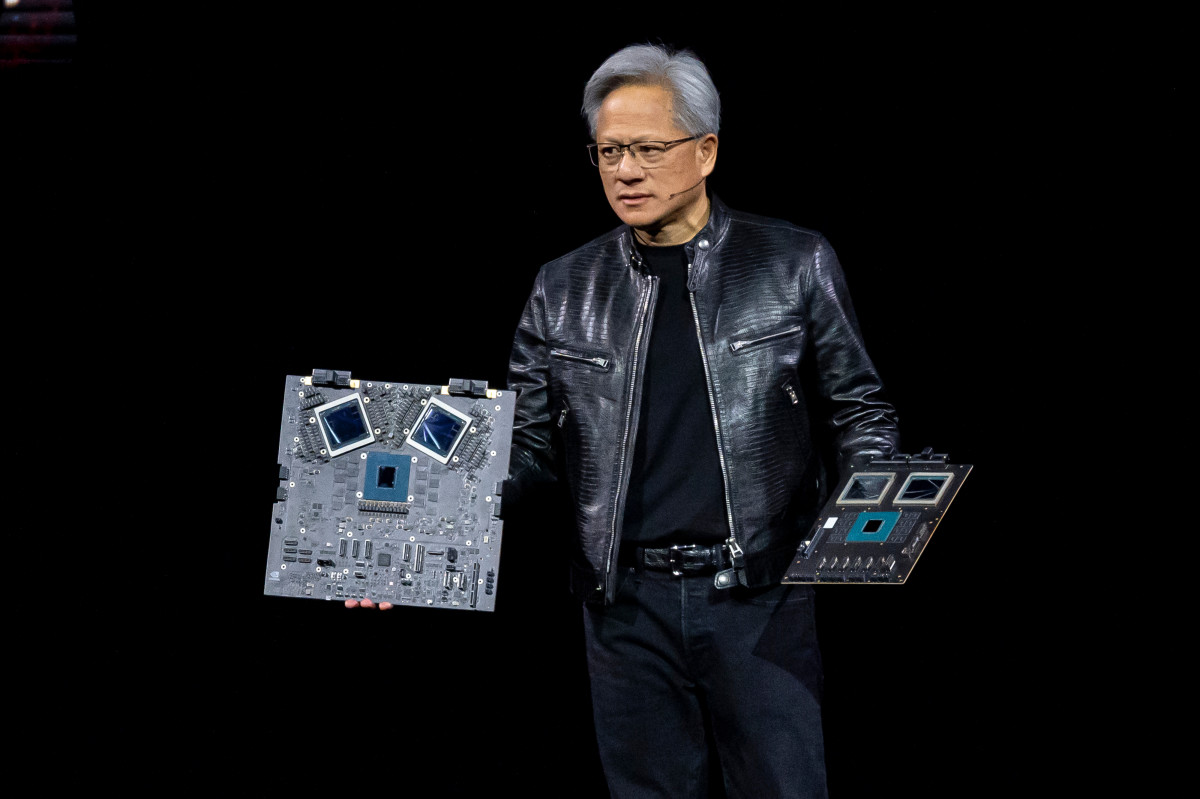

The frenzy over Nvidia's Blackwell chips

The most powerful artificial intelligence technology right now is Nvidia's. The company reportedly supplies 80% to 85% of the graphic processing units (GPUs) needed to make AI work.

GPUs are rapidly displacing central processing units (CPUs) in data centers because they can handle the intense workloads associated with training and operating AI models, such as ChatGPT and Google's Gemini, more efficiently.

This means everybody wants Nvidia's newest, hottest chips, the Blackwell family. (Microsoft, Meta, Amazon, and Alphabet are Nvidia's biggest customers.)

They will form the guts of new AI servers manufactured by Dell Technologies (DELL) .

Blackwell chips will start shipping in November and become more available in early 2025.

More Tech Stocks:

- Analysts update outlook for Nvidia's Blackwell chips amid AI boom

- Analysts update Meta stock price target with Q3 earnings in focus

- Analyst updates Tesla stock price target ahead of key robotaxi event

Better still, issues with the Blackwell chips, which had delayed their release, have been fixed.

If you haven't put in your order, well, too bad. The next year's production is already pre-sold.

Big tech chieftains beg for Blackwell

Blackwell demand is so intense, Fortune noted, that Oracle's executive chairman (ORCL) Larry Ellison and Tesla CEO Elon Musk took Jensen Huang to dinner.

At a September analyst meeting, Ellison described the meeting as "Oracle — me and Elon begging Jensen for GPUs."

He added the duo told their guest, "Please take our money. Please take our money. By the way, I got dinner. No, no take more of it. We need you to take more of our money please."

Related: Veteran fund manager sees world of pain coming for stocks