Updated 10:18 am EDT

Nvidia (NVDA) -) stock on Thursday was sharply higher, putting its market value well north of $1 trillion, after its earnings report late Wednesday crushed Wall Street forecasts and the company said AI-chip sales would accelerate further over the coming months.

Nvidia, by far the dominant player in the rapidly developing AI-chip market, said fiscal-second-quarter adjusted earnings rose nearly tenfold from a year earlier, to $2.48 a share. Overall revenue was up nearly 88% to a record $13.51 billion, thanks to big gains from data-center-chip sales tied to its developing AI technologies.

Looking into the current quarter, Nvidia sees revenue of around $16 billion, plus or minus 2%, a tally that was firmly ahead of the Wall Street consensus of around $11.5 billion.

"Major companies including [Amazon Web Services], Google Cloud, Meta, Microsoft Azure, and Oracle Cloud, as well as a growing number of [graphics-processing-unit] cloud providers are deploying in-volume HGX systems based on our Hopper and Ampere architecture tensor core GPUs," Chief Financial Officer Colette Kress told investors on a conference call late Wednesday.

"There is tremendous demand for Nvidia accelerated computing and AI platforms. Our supply partners have been exceptional in ramping capacity to support our needs," she added. "We expect supply to increase each quarter through next year. By geography, data center growth was strongest in the U.S. as customers direct their capital investments to AI and accelerated computing."

At last check Nvidia shares were 4% higher around $490. The company's market capitalization sits around $1.13 trillion.

"We believe NVDA is capitalizing on the need for cloud customers to upgrade their infrastructure, which we see as a multiyear process, and enterprise customers investing in AI initiatives for fear of being left behind," said CFRA analyst Angelo Zino, who carries a buy rating on Nvidia stock with a $500 price target.

"Overall, we see the accelerator market growing at a +40% annualized pace over the next three years, with NVDA taking a bulk of the wallet share. We also see massive opportunities on the software side."

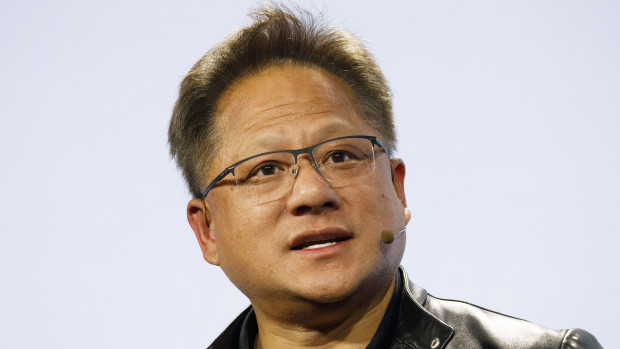

Earlier this year, Nvidia Chief Executive Jensen Huang described AI as having reached an "inflection point" as the world's fastest-developing technology after the group unveiled a new AI supercomputer known as Nvidia DGX.

The platform enables business customers to access AI-related technology through cloud computing providers such as Microsoft and Oracle, essentially creating a new market for AI-as-a-service to thousands of companies worldwide.

That ability to address the new AI investment explosion, sparked in part by the unveiling of the ChatGPT chatbot earlier this year, could put Nvidia in a leadership position within a market that could be valued at more than $600 billion.

Gartner, the management consultancy group, predicts so-called generative AI will account for around 10% of all data produced by the year 2025, up from just 1% in 2021. Analysts at KGI see this as adding between $5 billion and $6 billion to Nvidia's top-line revenue within the next three years.

- Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.