Nvidia on Tuesday published its financial results for the third quarter of its fiscal 2024, which ended on October 29, 2023. The company earned $18.12 billion, setting yet another all-time record as demand for all of its products increased both sequentially and year-over-year. In line with the previous quarter, Nvidia's data center business shined due to unprecedented demand for its GPUs used for artificial intelligence (AI) and high-performance computing (HPC).

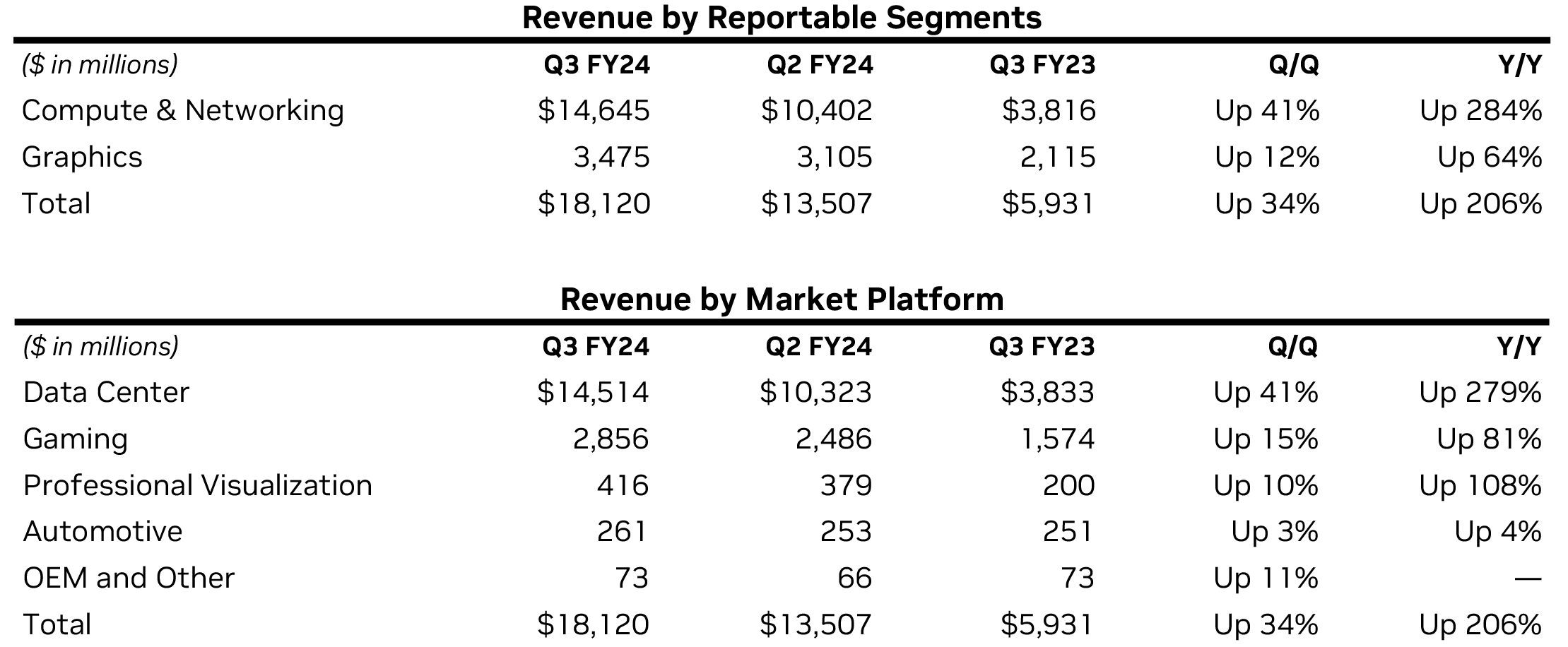

Nvidia reported $18.12 billion in revenue for the quarter, which is up 206% year-over-year (YoY), as well as net income of $9.243 billion, which is up a whopping 1,259% compared to the same quarter a year before. The company's gross margin rose to 74%, which is a 20.4% increase YoY.

“Our strong growth reflects the broad industry platform transition from general-purpose to accelerated computing and generative AI,” said Jensen Huang, founder and CEO of Nvidia.

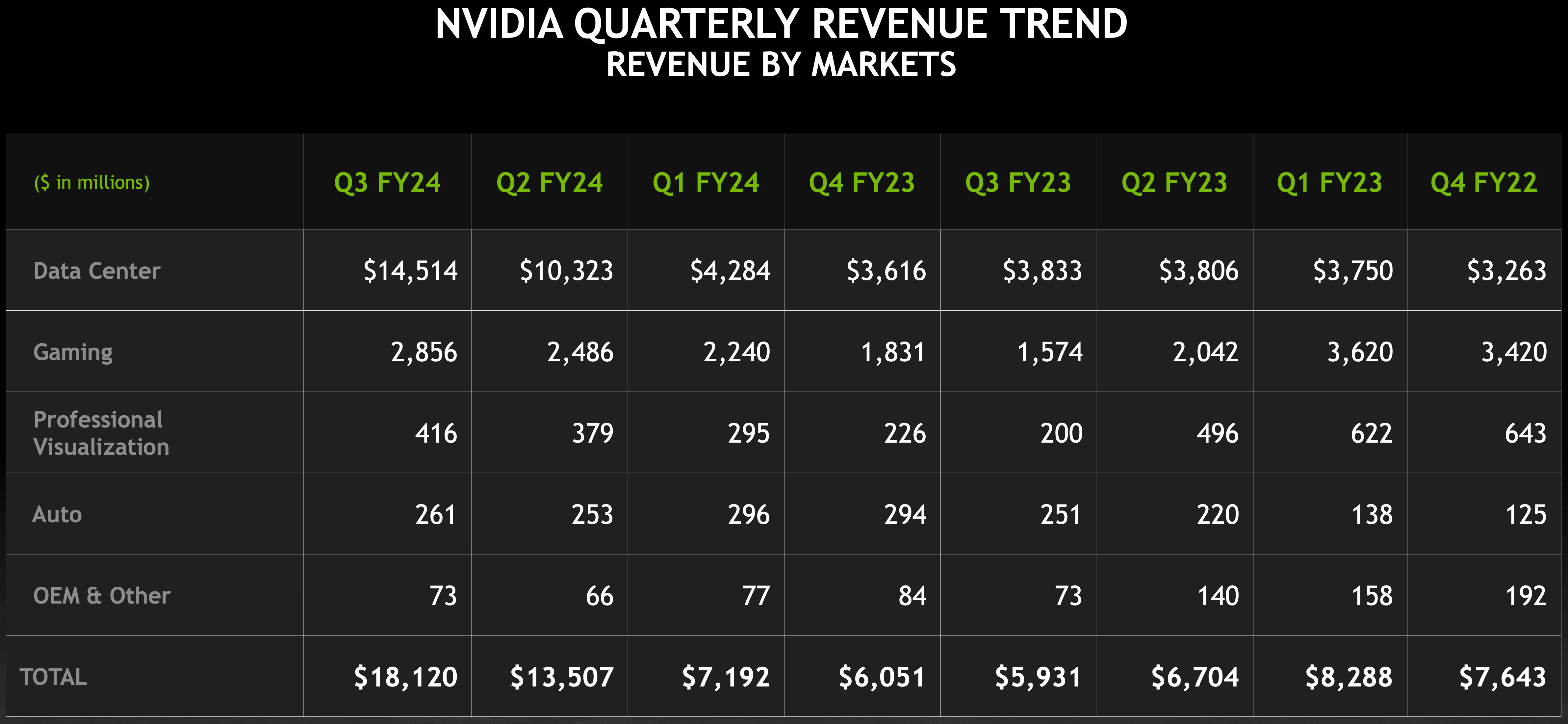

The main driver of Nvidia's rapid revenue and profitability growth was its data center business, which increased 279% year-over-year and 41% quarter-over-quarter to $14.51 billion, which is an all-time record for the company. Demand for Nvidia's HGX platforms based on the Hopper architecture during the quarter from various cloud service providers, startups, and large enterprises was unprecedented, so the company sold everything it could produce. In addition, the company shipped a bunch of other data center products, including those that support its AI and HPC GPUs.

"Datacenter compute grew 324% from a year ago and 38% sequentially, largely reflecting the strong ramp of our Hopper GPU architecture-based HGX platform from cloud service providers (CSPs), including GPU-specialized CSPs; consumer internet companies; and enterprises," said Colette Kress, chief financial officer of Nvidia. "Our sales of Ampere GPU architecture-based data center products were significant but declined sequentially, as we approach the tail end of this architecture."

Meanwhile, 20% - 25% of data center revenue came from Nvidia's Chinese customers, which will no longer be able to procure high-performance AI and HPC GPUs due to U.S. export restrictions. Nvidia does not expect an immediate impact on its business because of this, as demand from other clients will offset demand from Chinese customers.

Although far from historical highs, Nvidia's Gaming Business unit posted $2.856 in revenue, which is up 15% QoQ and up 81% YoY. The company's gaming business was driven by increased sales of GeForce RTX 40-series discrete graphics cards for desktops and standalone graphics processors for notebooks as the PC market demonstrated signs of recovery. In addition to client graphics, the company's Professional Visualization business also grew 10% sequentially and 108% year-over-year to $416 million. Meanwhile, Nvidia's OEM business earned $73 million, flat compared to Q3 FY2023, but up $7 million from the previous quarter.

As for the Automotive business unit, its Q3 FY2024 revenue reached $261 million, representing a 3% increase from the second quarter and a 4% increase from the same period last year.

Nvidia expects revenue to be approximately $20 billion ± 2% in the fourth quarter of fiscal 2024, with GAAP gross margins of around 74.5% ± 0.5%.