Nvidia extended its recent slump last week, falling more than 15% over the five-day period despite stronger-than-expected fourth-quarter earnings and a robust demand outlook for its market-leading AI chips.

Nvidia (NVDA) shares, one of the market's key sentiment lynchpins, have stagnated for much of the past six months, rising only 10% compared to an 8.2% gain for the Nasdaq, as investors pared bets on the chipmaker's ability to match its extraordinary revenue growth over the coming year, despite its commanding share of a key tech sector marketplace.

💸💰 Don't miss the move: Subscribe to TheStreet's free daily newsletter 💰💸

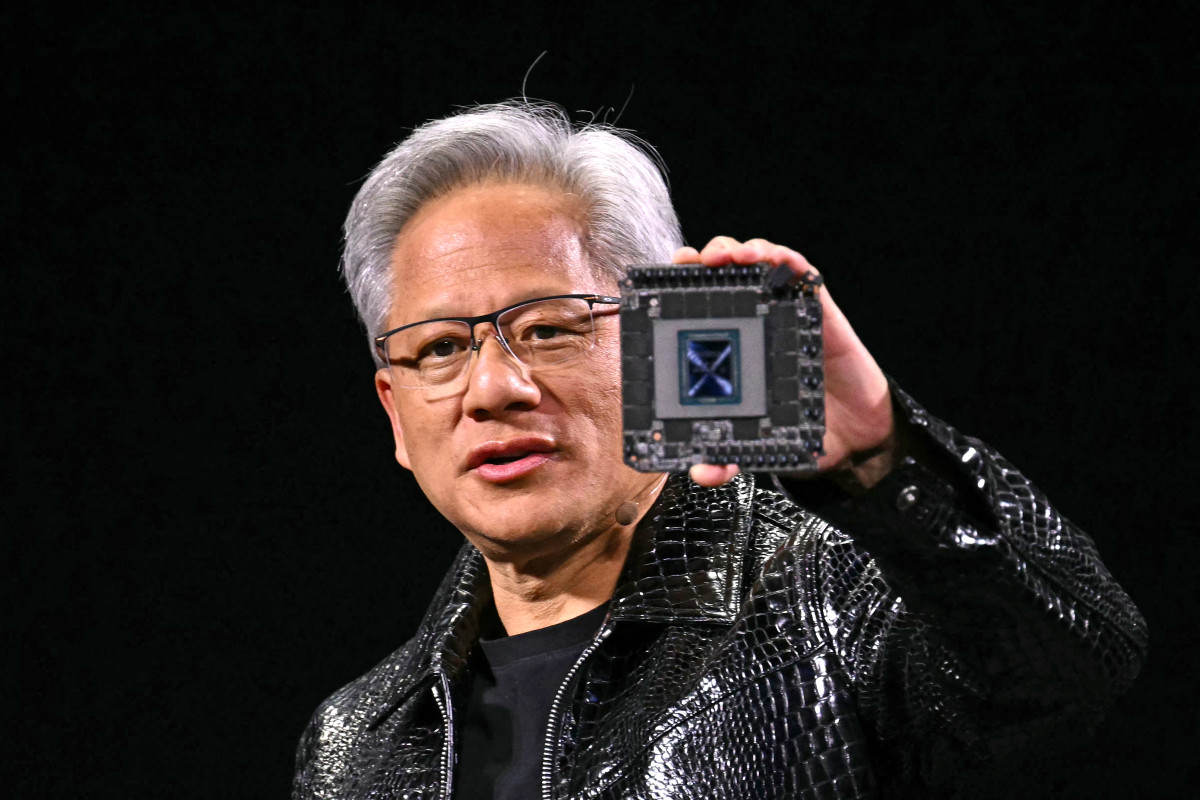

Fundamentally, there's little to be concerned about regarding Nvidia's near-term outlook; CEO Jensen Huang cited "incredible" demand for its new line of Blackwell processors, and its biggest customers are committed to spending billions on AI infrastructure over the coming years.

Nvidia expects its current quarter sales to rise around 61% from last year to $42 billion, with earnings up nearly 55% to $27 billion and analysts see a fiscal year tally of more than $200 billion.

Related: Veteran analyst sounds alarm on Amazon, Microsoft stock

Ramping Blackwell production to meet demand will likely narrow profit margins, but finance chief Colette Kress assured investors that the company expects that trend to improve back to a mid-70% level over the back half of the year.

All that said, Nvidia, while an incredibly profitable company generating double-digit revenue growth and staggeringly high margins, has also been increasingly linked to retail investor exuberance, particularly in the tech sector.

Stocks such as Nvidia and Tesla (TSLA) , alongside digital assets such as bitcoin, which have produced incredible returns over the past five years, are often seen as proxies for broader retail investor risk appetite.

Retail bears emerging

And those investors have become increasingly pessimistic over the past month, according to data from the weekly sentiment survey published by the American Association of Individual Investors.

Around 61% of those polled held a bearish outlook on the market, the highest level in a year, compared to around 19.4% who were bullish, over the period ending on Feb. 26.

"Concerns of an economic slowdown brought on by potential tariffs, stickier inflation, and the possibility of higher-for-longer interest rates, coupled with a meaningful pullback in the technology sector, namely AI-related related stocks, has dented sentiment in recent weeks," said George Smith, portfolio strategist for LPL Financial.

Related: Analyst turns heads with new Nvidia stock price target after earnings

Against that backdrop, Tesla shares are now down more than 40% since their all-time high in mid-December, while bitcoin prices have been caught in a 25% downdraft after peaking on the same date.

Nvidia shares, meanwhile, haven't suffered a similar drawdown yet but are largely unchanged from levels last seen in June, suggesting bigger declines could be forthcoming.

Options market concern rises

However, pricing data from the options market indicate a cautious, if not outright bearish, outlook on Nvidia stock.

Put options give a buyer the right, but not the obligation, to sell shares at some point in the future. In the case of Nvidia, investors are paying a price for those options that is higher than the current stock price.

This so-called "skew," which investors track to determine market sentiment, is trading at the highest level in more than a year, suggesting investors expect notable near-term declines for Nvidia stock in order to generate profit from the put options.

Related: DeepSeek selloff shows AI's future might not need Nvidia

Nvidia also faces a potentially longer-term challenge if the massive spending plans of its biggest hyperscaling customers, such as Microsoft (MSFT) , Amazon (AMZN) , Meta Platforms (META) and Google (GOOGL) , fail to provide the kind of returns their investors are expecting.

"It's expected that Blackwell supply will continue to ramp quickly throughout the year as customer demand for these systems remains strong," said D.A. Davidson analyst Gil Luria. "But we still believe a decline in demand for Nvidia compute is inevitable as customers begin to scrutinize their (return on investment) on AI compute."

Is Nvidia priced for perfection?

It's also worth noting that much of Nvidia's near- and medium-term- demand may already have been priced into its shares.

The stock has added more than $2.1 trillion in market value since it fired the starting gun on the AI investment race in May of 2023, with gains that have outpaced the S&P 500 by a factor of 14.

"While Nvidia’s stock has seen extraordinary gains over the past year (and more), traders may have already priced in the company’s leadership in AI," said Scott Acheychek, chief operating office at REX Financial, who remains bullish on the group's longer-term prospects.

Related: Analysts overhaul Nvidia stock price targets after Q4 earnings surprise

"Alternatively, investors could be waiting for additional catalysts beyond earnings, such as further clarity on next-generation AI infrastructure or regulatory developments affecting the semiconductor industry," added.

Benchmark analyst Cody Acree, also thinks the best is yet to come for Nvidia, and sees the recent sell-off as a opportunity to build a stake in the tech industry’s "most unique investment property."

More AI Stocks:

- AI startup smashes funding round, signals big changes for health care

- Analyst revisits Palantir stock forecast following annual report filing

- Analyst who predicted Palantir rally picks best AI software stocks

"We would argue that near-term volatility notwithstanding, Nvidia still represents a compelling value for thoughtful investors willing to look past the noise," he said. "Nvidia, with its sell-off, an opportunity to build positions in t that is a critical key to the early stages of AI transforming how we, as a people, interact with technology in an ever increasing number of ways."

Nvidia shares closed at $124.92 each on Friday, rising 3.97% on the session to trim their year-to-date decline to around 9.7%. The stock is now valued at around $3.06 trillion.

Related: Veteran fund manager unveils eye-popping S&P 500 forecast