Nvidia Corporation (NASDAQ:NVDA) announced strong results for the fourth quarter of its fiscal year 2022 Wednesday, helped by performance in its data center and gaming businesses.

The automotive segment was a sore spot, as revenues declined due to supply constraints and softer demand from legacy automakers.

The company forecast strong revenue growth for the first quarter of the next fiscal year.

Nvidia shares were languishing in after-hours trading, apparently due to the slowdown in year-over-year revenue growth and flat margins.

Nvidia's Key Q4 Metrics: Santa Clara, California-based Nvidia reported fourth-quarter revenue of $7.64 billion, up 53% year-over-year. This exceeded the year-ago revenues of $5 billion and the consensus estimate of $7.42 billion.

The non-GAAP earnings per share came in at $1.32 compared to the year-ago's 77 cents and the previous quarter's $1.17. Analysts, on average, estimated EPS of $1.22.

"We are seeing exceptional demand for NVIDIA computing platforms" said Jensen Huang, founder and CEO of Nvidia.

"Nvidia is propelling advances in AI, digital biology, climate sciences, gaming, creative design, autonomous vehicles and robotics — some of today's most impactful fields."

The non-GAAP gross margin came in at 67%, flat with the preceding quarter but 150 basis points higher than a year ago.

Credit Suisse analyst John Pitzer was bracing for a fourth-quarter beat, premised on still-lean channel inventories in gaming and accelerating data center revenues.

Cash, cash equivalents and marketable securities were $21.21 billion, up from $11.56 billion a year ago and up from $19.3 billion a quarter ago.

Related Link: Why Nvidia Is Needham's Top AI/ML Stock Pick For 2022

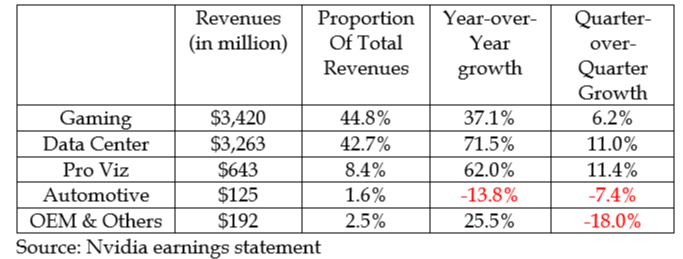

Nvidia's Performance By Segment: Nvidia said it recorded record revenues for its gaming, data center and professional visualization segments.

The data center business saw the strongest growth, both from a year ago and the preceding quarter. The company attributed the strength to the solid uptake of "Nvidia Ampere architecture GPUs across both training and inference for cloud computing and AI workloads such as natural language processing and deep recommender models."

GeForce GPUs propelled a 37% year-over-year increase in gaming revenue. Although the GPUs are capable of cryptocurrency mining, the company noted that all desktop Ampere architecture GeForce GPU shipments are Lite Hash Rate.

The professional visualization segment benefited from the ramp of Ampere architecture products and strong demand for workstations as enterprises support hybrid work environments, as well as growth in workloads such as 3D design, AI and rendering, Nvidia said.

The automotive segment saw year-over-year and sequential declines due to softness in legacy cockpit revenue, as well as supply constraints faced by the end market were partly offset by the ramp of self-driving programs.

Cryptocurrency mining processor revenue, which is part of the OEM and other segment, was $24 million in the quarter, down from $105 million in the third quarter.

Nvidia's Outlook: The company guided to first-quarter revenue of $8.1 billion, while the consensus calls for $7.29 billion in revenues.

The company expects GAAP and non-GAAP gross margins of 65.2% and 67%, respectively, plus or minus 50 basis points.

"We are entering the new year with strong momentum across our businesses and excellent traction with our new software business models with NVIDIA AI, NVIDIA Omniverse and Nvidia Drive. GTC is coming. We will announce many new products, applications and partners for Nvidia computing," CEO Huang said.

Nvidia said it will record a $1.36-billion charge related to the termination of its Arm acquisition in the first quarter.

NVDA Stock: After ending 2021 with a gain of over 125%, Nvidia shares came under pressure in 2022 amid the tech sell-off. Year-to-date, the stock has pulled back about 12%.

In after-hours trading, the stock was seen trading down 0.72% to $263.20. It ended the regular session on Wednesday at $265.11.

Related Link: 7 Tech Predictions For 2022: Apple-Facebook Face-Off In Metaverse, Tesla Reigns Supreme, Quantum Takes A Big Leap, And More