The surge in Nvidia's stock price puts the semiconductor manufacturer in good company.

Shares of the graphics-chip maker at last check were 24% higher at around $380 after it reported fiscal-first-quarter earnings.

DON'T MISS: Nvidia Silences Its Critics

Nvidia's market cap of around $958 billion on Thursday is approaching the $1 trillion threshold, putting it in the ranks of other big tech companies such as Apple (AAPL), Alphabet (GOOGL), Amazon (AMZN) and Microsoft (MSFT). Apple in 2018 was the first tech company to entire the trillion dollar market-cap club.

Nvidia’s stock would have to reach $404.86 to secure its $1 trillion market valuation, The Wall Street Journal calculated.

Shareholders have been rewarded for their patience as tech companies have rebounded from a slump. Nvidia's shares in the past six months have more than doubled (up 143%).

Nvidia's First-Quarter Report Beat Wall Street

As TheStreet's Martin Baccardax reported, a surge in demand for Nvidia's AI-focused semiconductors powered a fiscal-first-quarter earnings beat and a robust near-term outlook.

For the first quarter ended April 30, the company blasted Wall Street forecasts. An adjusted bottom line of $1.09 a share beat the consensus estimate of 92 cents a share. And revenue fell 13% to $7.19 billion, but analysts were looking for just $6.52 billion.

Nvidia sees current-quarter revenue of around $11 billion, plus or minus 2%, compared with the Wall Street consensus of $7.15 billion.

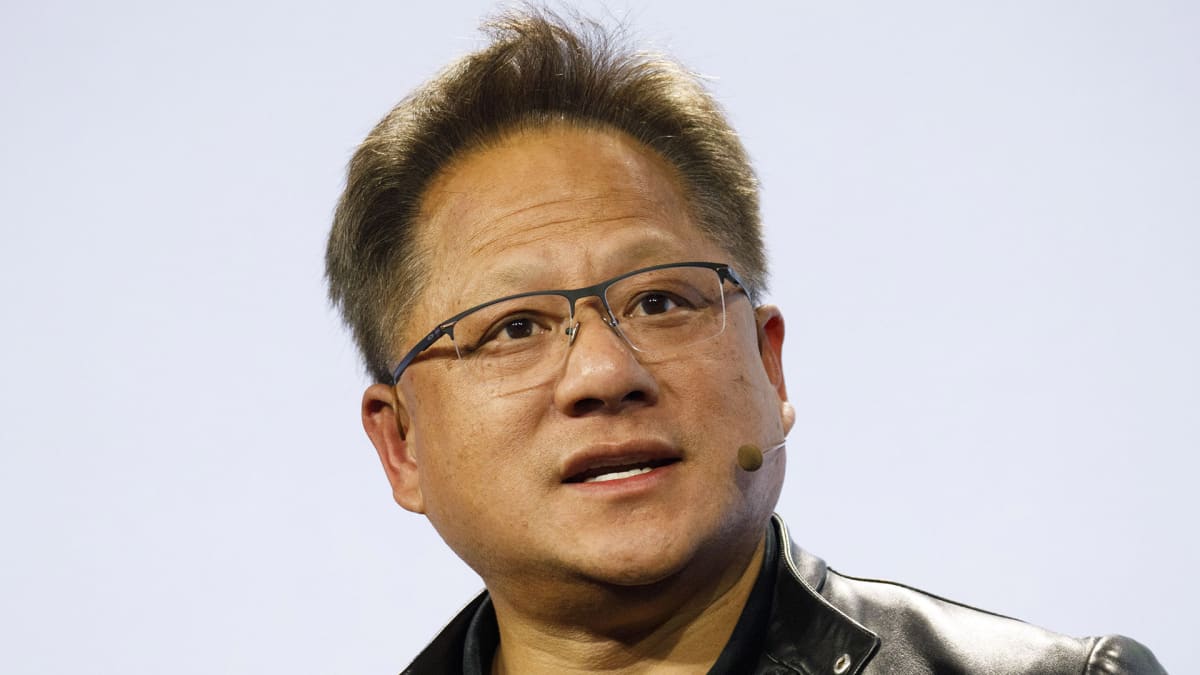

"The computer industry is going through two simultaneous transitions — accelerated computing and generative AI,” said Jensen Huang, founder and CEO of Nvidia. "A trillion dollars of installed global data center infrastructure will transition from general purpose to accelerated computing as companies race to apply generative AI into every product, service and business process."

He added that Nvidia is ready to meet the demand.

"Our entire data center family of products — H100, Grace CPU, Grace Hopper Superchip, NVLink, Quantum 400 InfiniBand and BlueField-3 DPU — is in production," Huang said. "We are significantly increasing our supply to meet surging demand for them."

The group achieved dominance in the videogame market with its graphics cards. It is extending its strengths to artificial intelligence, as the use of AI is projected to increase exponentially across many industries.

"Nvidia's bullish long-term forecast of $11 billion for the next quarter is fueled by the growth of generative AI and the increasing acceleration and need for high-performance computing within data centers," said Lucas Keh, analyst at global research firm Third Bridge.

"Despite the persistent slowdown and decline in PC market revenue, the company has found a way to offset these losses and target the growing opportunities."

AI Competition a Benefit to Nvidia

One of Nvidia's weapons to dominate the use of AI is its all-new H100 data center graphics processing unit. The H100 is said to be nine times faster than its predecessor in AI training and up to 30 times faster in AI inference for large language models like chatbots ChatGPT from OpenAI and Bard from Alphabet's Google.

The data-center division recorded $4.28 billion in sales, up 14% from a year earlier.

This division benefits from the AI arms race among big-tech companies like Microsoft, Alphabet and Meta Platforms as well as startups and the cloud war among Amazon, Microsoft and Google.

Don't Miss: Nvidia Stock at Records; Here's How to Trade It

"There is not one better indicator around underlying AI demand going on in the hyperscale/cloud and overall enterprise market than the foundational Nvidia story," said Wedbush analyst Dan Ives.

"We view Nvidia at the core hearts and lungs of the AI revolution given its core chips train and deploy generative AI applications like ChatGPT," he added.

"For any investor calling this an AI bubble (crypto, metaverse, now AI bubble thesis) we would point them to this Nvidia quarter and especially guidance which cements our bullish thesis around AI and speaks to the Fourth Industrial Revolution now on the doorstep with AI."

Memorial Day Savings! Unlock trusted portfolio guidance for a fraction of the price. Subscribe now.