Around 60% of Nvidia's DGX and HGX AI datacenter servers may completely avoid recent U.S. tariffs, thanks to their production in Mexico. Stacy Rasgon, writing for Bernstein Private Wealth Management and one of the market's top chip analysts, found that the majority of Nvidia's datacenters going to U.S. hyperscalers might just arrive tariff-free.

In a memo sent to Bernstein clients, Rasgon highlighted fears from investors over the oncoming fate of Nvidia, as while semiconductors have been largely exempted from the "Liberation Day" tariff sweep, server hardware has not. "Analysis suggests the majority of [Nvidia's] US AI server shipments likely come from Mexico," writes Rasgon.

Nvidia's own export regulations website highlights that Nvidia's DGX and HGX servers are sorted under the U.S.'s Harmonized Tariff Schedule (HTS) codes within categories that are exempt from U.S.-Mexico tariffs (8471.50 and 8471.80). This is thanks to the USMCA trade agreement between the U.S., Canada, and Mexico signed in Trump's first term, which lists digital and automatic data processing units as compliant product tags exempt from new tariffs.

It should be noted that the 60% estimate is not an exact percentage. The United States' import data for server-related categories 8471.50 and 8471.80 shows $73 billion of imports in 2024, with around 60% coming from Mexico, and around 30% from Taiwan. This is the data for all server imports entering the United States in 2024, not just Nvidia, though Nvidia's market dominance suggests that this general ratio represents the GPU maker appropriately.

While Nvidia consumer-grade GPUs also fall under protection from tariffs within USMCA, it is unlikely that Nvidia's consumer supply chain flows through Mexico as much as its server hardware does, though the USMCA agreement may see use as a loophole for companies like Nvidia if tariffs continue to increase.

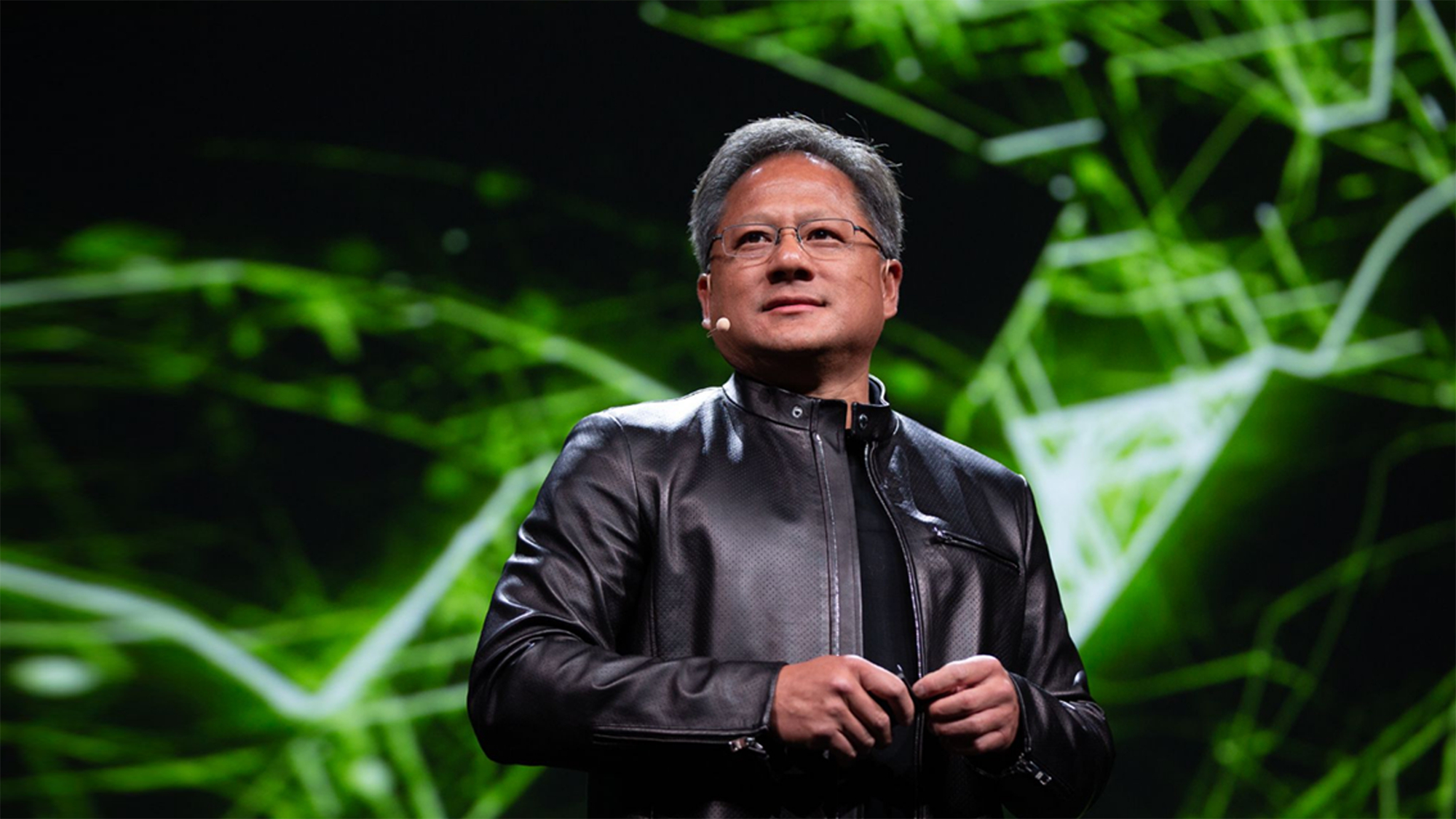

Jensen Huang, longtime Nvidia CEO, has been optimistic about Nvidia's standing in the face of the threat of tariffs. During GTC 2025, Huang claimed, "In the near term, the impact of tariffs will not be meaningful." This bold confidence seemed laughable after Nvidia stock took a terrible stock tumble, but it seems prescient now. Nvidia's server footprint in Mexico is large, and is set to grow even larger as Foxconn completes production this year on its Chihuahua plant dedicated to manufacturing more Nvidia server hardware.

While Nvidia's outlook for AI server imports looks rosy, the average gamer and tech enthusiast will suffer in the wake of new tariffs issued from the United States government. U.S. PC system integrators, especially boutique brands, are set to increase prices by at least 20% in response to tariffs, as price increases come for virtually all consumer PC components. Time will tell whether the new wave of tariffs will last long, but as long as they do, hyperscalers can breathe easy while PC consumers may begin to sweat.