By many accounts, Nvidia (NVDA) has been the leader of the current stock market rally.

Not only has the stock put together a booming rally of its own, but it’s pulled other stocks higher. It’s done its part to improve investor sentiment this year.

At the recent high, Nvidia stock had triple for the year and quadrupled off its 52-week low.

Amid the rally, investors saw its market cap boom past the $1 trillion mark, making it one of the world's most valuable companies.

Don't Miss: C3.ai Stock Is Struggling for Support; Here's the Setup

Along the way, it’s helped spur other stocks higher, too, like Advanced Micro Devices (AMD), Super Micro Computer (SMCI), Broadcom (AVGO) and others.

Those firms have also provided their own bullish catalysts, but Nvidia’s done a great job shifting the bear-market narrative and taking the AI-stock trade to new heights.

But headlines on Tuesday evening said the Biden administration is weighing whether to allow AI-chip sales to China, sending Nvidia lower in after-hours trading.

While the stock is bouncing off the morning lows — and is currently down less than 1% on the day — it’s got investors wondering whether a larger and longer pullback could be in the cards.

Where to Buy the Dip in Nvidia Stock

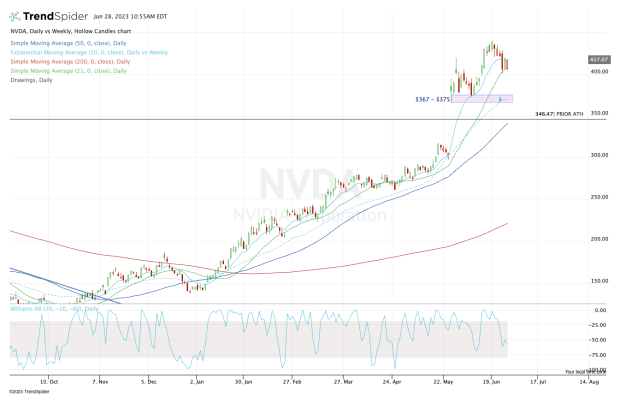

Chart courtesy of TrendSpider.com

Nvidia stock put in an inside day on Tuesday, as its range was completely contained within Monday’s 3.75% decline. So far — and surprisingly — the stock is putting in another inside day on Wednesday.

That’s a sign of consolidation. And the fact that NVDA shares are doing it at the 21-day moving average is a positive for the bulls.

Should Nvidia stock rotate back over $420, it could open the door right back to the recent highs near $440.

Don't Miss: Microsoft Keeping Monthly Streak Alive? Check the Chart

If, however, the stock rotates below the multiday low in the low-$400s, we could be looking at a larger decline.

Should that come to pass, the bulls may want to keep an eye on the 10-week moving average, a measure that was most recently tested right before the graphics-chip specialist reported blowout earnings.

If a correction down to this level happens in the near term, a test of this measure would also align with the $367 to $375 support zone.

A larger correction would likely have some bulls frazzled, but a dip down to the prior all-time high near $346.50 and the 50-day moving average would likely be an excellent buying opportunity for investors.

July 4th Sale! Receive full access to real-time market analysis along with stock, commodities, and options trading recommendations. Sign up for Real Money Pro now for 65% off.