Nvidia (NVDA) earnings have become one of Wall Street's most-anticipated events. Indeed, who can forget when the company gave jaw-dropping forward guidance in May 2023 thanks to snowballing demand for all things artificial intelligence (AI) – sending the chipmaker catapulting north of a $1 trillion market cap.

The company's fiscal fourth-quarter results were released after the market closed on Wednesday, February 26. Nvidia reported earnings of 89 cents per share on $39.3 billion in revenue, beating analysts' estimates for earnings of 85 cents per share on revenue of $38.1 billion.

Here, Kiplinger experts shared the news surrounding Nvidia's earnings report and conference call as well as our analysis.

Increased AI spending will continue to benefit Nvidia, says UBS

UBS Global Research analyst Timothy Arcuri lifted his price target on Nvidia on November 10, to $185 from $150 – representing implied upside of more than 25% to current levels.

Arcuri expects the chipmaker to report strong results and guidance this time around, though he anticipates a decline in gross margin, to 73% from 75.1% in Q2.

The analyst believes that capital expenditures from large-scale data centers will continue to improve and he expects the gap between incremental hyperscaler spending and Nvidia's incremental data center revenue to close over the next 12 months.

"On top of this, sovereign AI represents a major demand vector for NVDA (already worth more than $10 billion in calendar year 2024) with each of the large sovereigns (particularly in the Middle East) looking to us like their spending could approach that of a big U.S. hyperscaler over the next few years," Arcuri adds. India, for one, unveiled a $1.2 billion budget for AI projects in March.

- Karee Venema

Related content:

This will mark Nvidia's first time reporting as a Dow Jones constituent, with the semiconductor stock joining the 30-stock index back on November 8.

NVDA shares are well known for their post-earnings volatility, which could have an impact on the price-weighted Dow. Most recently, the stock sank more than 6% in August after its fiscal Q2 results and jumped 9% in May following its fiscal Q1 report.

However, as Dan Burrows, senior investing writer at Kiplinger.com, explains in his feature, "Nvidia Stock Is Joining the Dow. Is It Time to Buy?," NVDA and its $3.6 trillion market valuation will likely have a larger impact on the cap-weighted S&P 500 and Nasdaq Composite.

Indeed, based on its current share price of roughly $150, "NVDA stock will be as important to the DJIA as, roughly, 3M (MMM)," he writes.

- Karee Venema

Will the Supreme Court allow a class action lawsuit against Nvidia to proceed?

Nvidia's earnings announcement on November 20 is (probably) the Next Big Thing for stocks, investors and hardcore artificial intelligence nerds. (We'll see whether Federal Reserve Chair Jerome Powell breaks stride this afternoon…)

Tech generally has been underperforming the broader market in recent months, but the AI story is still driving up share prices across sectors. And Nvidia's hardware is supporting a lot of the buildout and the efficiencies end-users plan/hope to realize.

Making new high after new high, NVDA stock continues to reflect almost unanimous support among market participants as well as AI utilitarians.

It's another kind of thing to appear before the U.S. Supreme Court, though, which is where lawyers for Jensen Huang's juggernaut found themselves on Wednesday.

As Ronald Mann of ScotusBlog explains, a group of Nvidia shareholders has filed a proposed class action lawsuit under the 1995 Private Securities Litigation Reform Act alleging the company and key executives "made false and misleading statements about the extent to which use in crypto mining was propping up Nvidia's chip sales."

Following oral arguments on Wednesday, "The Supreme Court seemed inclined on Wednesday to allow a lawsuit accusing Nvidia, the giant maker of computer chips, of misrepresenting its reliance on the cryptocurrency mining industry in 2017 and 2018," observes Adam Liptak of The New York Times.

And yet Nvidia still enjoys broader tailwinds: The 1995 law imposes a difficult burden on plaintiffs.

"The shareholders have a hard time showing that Huang spoke falsely when he made statements downplaying the share of NVIDIA chip sales attributable to crypto mining," Mann writes. "The shareholders do not have any documents or statements that directly show any reason to think Huang knew what share of sales were made to crypto miners."

NVDA stock was up nearly 1% an hour after Thursday's opening bell, even as the three major equity indexes were in the red.

- David Dittman

Wedbush girds for another beat-and-raise quarter

Nvidia heads into its November 20 earnings release as one of Wall Street's top S&P 500 stocks to buy. On Thursday, Wedbush Securities analyst Matt Bryson helped explain why.

Bryson, who rates NVDA at Outperform (the equivalent of Buy), writes in a new note to clients that the pace-setting chipmaker has forced him to confront an age-old tongue twister: "How much sales acceleration can an accelerator accelerate if an accelerator can accelerate sales?"

What does that mean? Stocks move on surprises, be they to the upside or the downside. NVDA stock has tripled on a price basis over the past 52 weeks in part because it consistently delivers upside surprises on its top line. (Note that NVDA stock is also much more volatile than the broader market, but let's not get into that right now.)

Will NVDA stock pop on its earnings report? That depends partly on delivering beat-and-raise revenue figures.

So, what's the outlook for that, in Bryson's view?

"NVDA has been consistent in delivering a revenue beat of approximately $2 billion, while guiding for $2 billion-plus in growth the past few quarters," the analyst says. "We believe NVDA will likely at least modestly exceed the pattern of 'just' beating forecasts by approximately $2 billion, as we anticipate strength in Q3 AI spend by hyperscale customers, as well as continued solid growth at non-hyperscale accounts will boost FQ3 sales."

There's a lot more to it than that, but the bottom line is Bryson lifted his target price to $160, giving NVDA stock implied upside of 10% from current levels. For context, according to S&P Global Market Intelligence, the Street's average price target stands at just $158.

If this member of the Magnificent 7 prints a big enough beat-and-raise on the top line, you can bet a lot of those NVDA price targets will be revised upwards.

– Dan Burrows

Should you buy Nvidia stock at current levels?

"To buy or not to buy?" is a question a lot of investors have about Nvidia stock ahead of the AI chipmaker's November 20 fiscal third-quarter earnings release.

NVDA stock traded as high as $148.91 today (November 14), within 0.5% of the all-time high it hit intraday on November 8. Nvidia is the biggest company in the world based on market capitalization at $3.6 trillion, and there's some distance developing between it and No. 2 Apple (APPL) as well as No. 3 Microsoft (MSFT).

NVDA has been defying conventional ideas about "valuation" for a while now. It's also been defying conventional rules about big numbers, rising as rapidly as any company ever has up the market-cap ladder thanks to a steady stream of beat-and-raise quarterly reports.

Indeed, according to Anton Shilov of Tom's Hardware, maybe you should consider yourself lucky to still have the opportunity to consider whether you should buy Nvidia at these levels.

"At Nvidia's AI Summit in Tokyo this week," Shilov writes, citing an original report in Fortune, "Jensen Huang, chief executive of Nvidia, and Masayoshi Son, the head of SoftBank, expressed regrets that the former did not privatize Nvidia a decade ago when the latter offered him money to do so."

Huang and Son talked about privatization as well as a potential merger with Arm Limited, a move that was blocked by regulators in February 2022. Arm subsequently went public as Arm Holdings (ARM) in September 2023.

"Masa said, 'Jensen, the market doesn't understand the value of Nvidia. Your future is incredible,'" said Huang. "'Your journey of suffering will continue for some time, so let me give you the money to buy Nvidia.' He wanted to lend me money to buy Nvidia, all of it. Now I regret not taking it."

So, "to buy or not to buy" Nvidia at $149…

- David Dittman

About Elon's xAI and Its $6 Billion Nvidia Chip Buy

According to a report from David Faber of CNBC, Elon Musk's xAI is raising as much as $6 billion to buy 100,000 Nvidia chips.

"Sources told Faber that the funding, which should close early next week, is a combination of $5 billion expected from sovereign funds in the Middle East and $1 billion from other investors, some of whom may want to re-up their investments," CNBC reports. The fresh raise values xAI, which Musk founded in September 2023, at $50 billion.

Bloomberg's Ed Ludlow asks an interesting question on X, the social media platform formerly known as Twitter: "On the report that xAI is going to buy 100,000 NVDA chips… didn't Elon Musk already say that?"

The world's richest person did tease the transaction more than two weeks ago on X, retweeting an invitation from an insider to "Join the xAI compute team!" which itself was a retweet of ServeTheHome's tweet touting its tour of the xAI Colossus AI Supercluster.

"Soon to become a 200k H100/H200 training cluster in a single building," said Musk on October 28 of the facility in Memphis, Tennessee. The supercomputer is rumored to be support for Tesla's (TSLA) Full Self Driving software.

"The money will be used to acquire 100,000 Nvidia chips, per sources familiar with the situation," said CNBC on November 15. It seems "the money" – specifically, the $6 billion and where it's coming from, not so much where it's ultimately going – is indeed the story here.

Nvidia stock is down nearly 4% two hours ahead of Friday's closing bell, giving back some of the lead it had built up recently in the global market capitalization rankings. This slump comes despite the fact that Wedbush Securities analyst Matt Bryson recently bumped his price target on NVDA from $138 to $160.

Tesla stock, meanwhile, is up nearly 3%, rising against the tide as the relationship between the electric vehicle maker's CEO and President-elect Donald Trump appears to be paying off in particular ways, most notably around EV tax credits.

- David Dittman

Related content:

- Should You Buy Tesla Stock After Trump's Election Win?

- Tesla to Launch FSD in Europe and China: What to Know

Analysts race to hike NVDA price targets

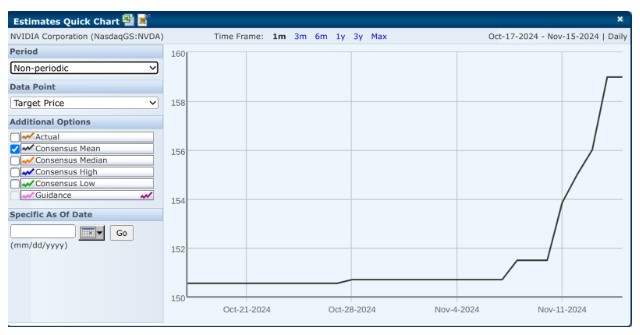

Wall Street analysts are busy updating their models ahead of Nvidia's bellwether earnings report. This isn't unusual. If there's something striking about these revisions, it's how fast analysts are hiking their price targets on the Magnificent 7 stock.

According to data from S&P Global Market Intelligence, as of November 15, analysts' average price target stood at $159 for NVDA stock. That gave shares implied upside of about 13% over the next 12 months or so.

If investors respond to the potential for 13% price upside over the next year with a "big wow," that's understandable. After all, NVDA stock has tripled in 2024 so far alone. The Street forecasts average annual earnings growth of 35% for the next three to five years, and yet NVDA shares change hands at just 42 times expected earnings.

Mind you, this does not begin to scratch the surface of the bull case. NVDA gets a rare consensus recommendation of Strong Buy, per S&P Global Market Intelligence. It's one of the Street's top S&P 500 stocks to buy.

Surely analysts who are so bullish on a stock see more than 13% upside in the next year or so.

Don't worry; they probably will soon enough.

Indeed, they're already updating their price targets at an accelerating rate. The Street's average target price jumped 5% over the past week. Just have a look at the below chart.

Investors can expect more upward revisions to NVDA's target price as we get closer to its earnings report. And we will certainly see a slew of updates once the NVDA print is in.

The bottom line: Take price targets with a grain of salt. Nvidia isn't as popular as it is because it's offering a 13% price return over the next year.

– Dan Burrows

Why are Nvidia earnings so important?

Nvidia is the most dominant stock in the equities market, driving 20% of the S&P 500's return over the past 12 months, says BofA Securities analyst Gonzalo Asis. He adds that the chipmaker "is expected to drive nearly 25% of the S&P 500's earnings per share growth in the third quarter."

The analyst says that clues in the options market show us just how important Nvidia earnings are for investors. Indeed, Asis notes that options contracts are currently pricing in more broad-market risk for NVDA earnings (implied move of 1.15%) than they are for the upcoming monthly jobs (implied move of roughly 1.05%) and Consumer Price Index (implied move of around 0.9%) reports.

- Karee Venema

Related content:

- When Is the Next Jobs Report?

- When Is the Next CPI Report?

- What Is the VIX? This 'Fear Index' Is Used for Active Investing

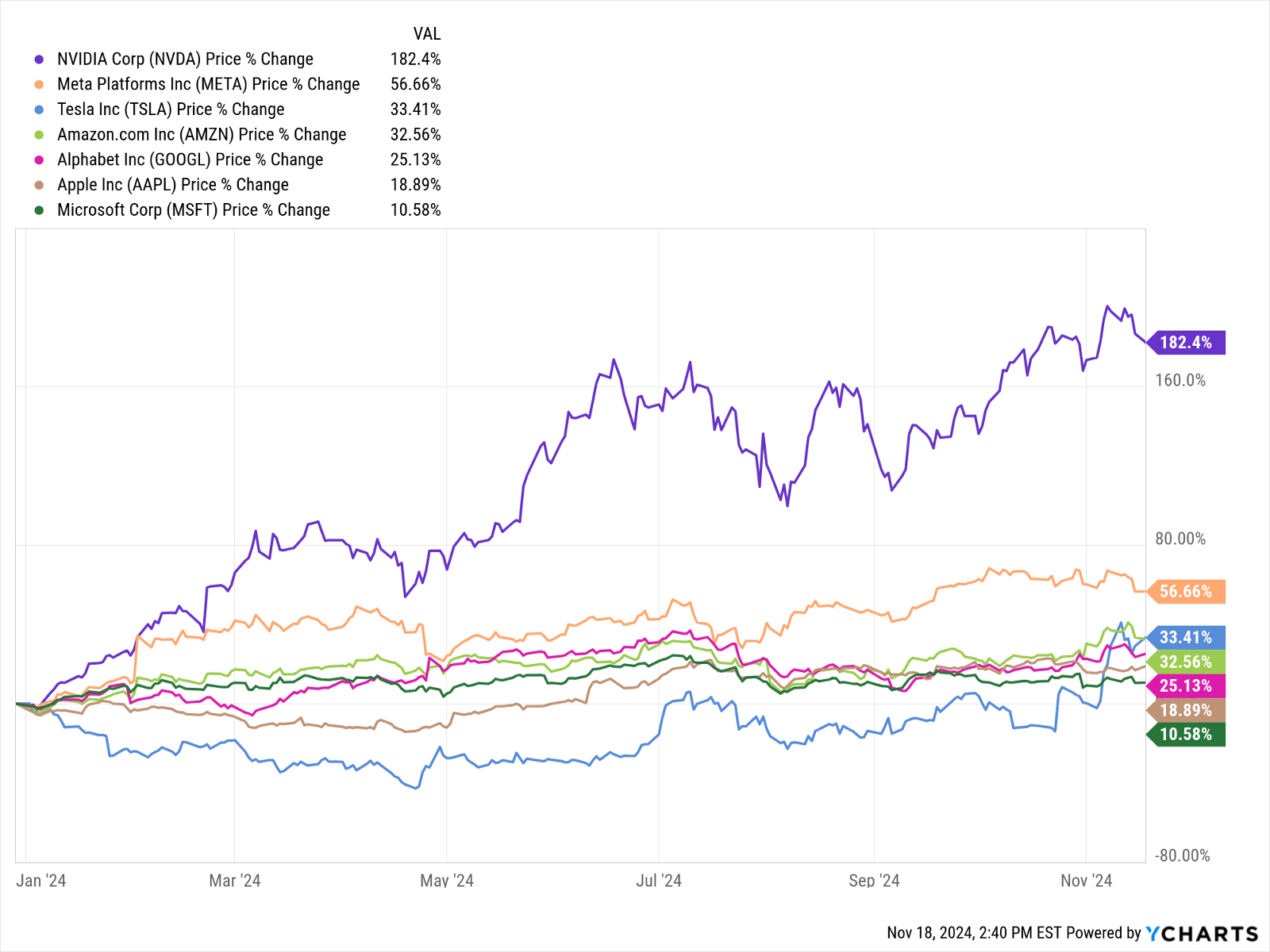

Nvidia smokes the rest of the Mag 7

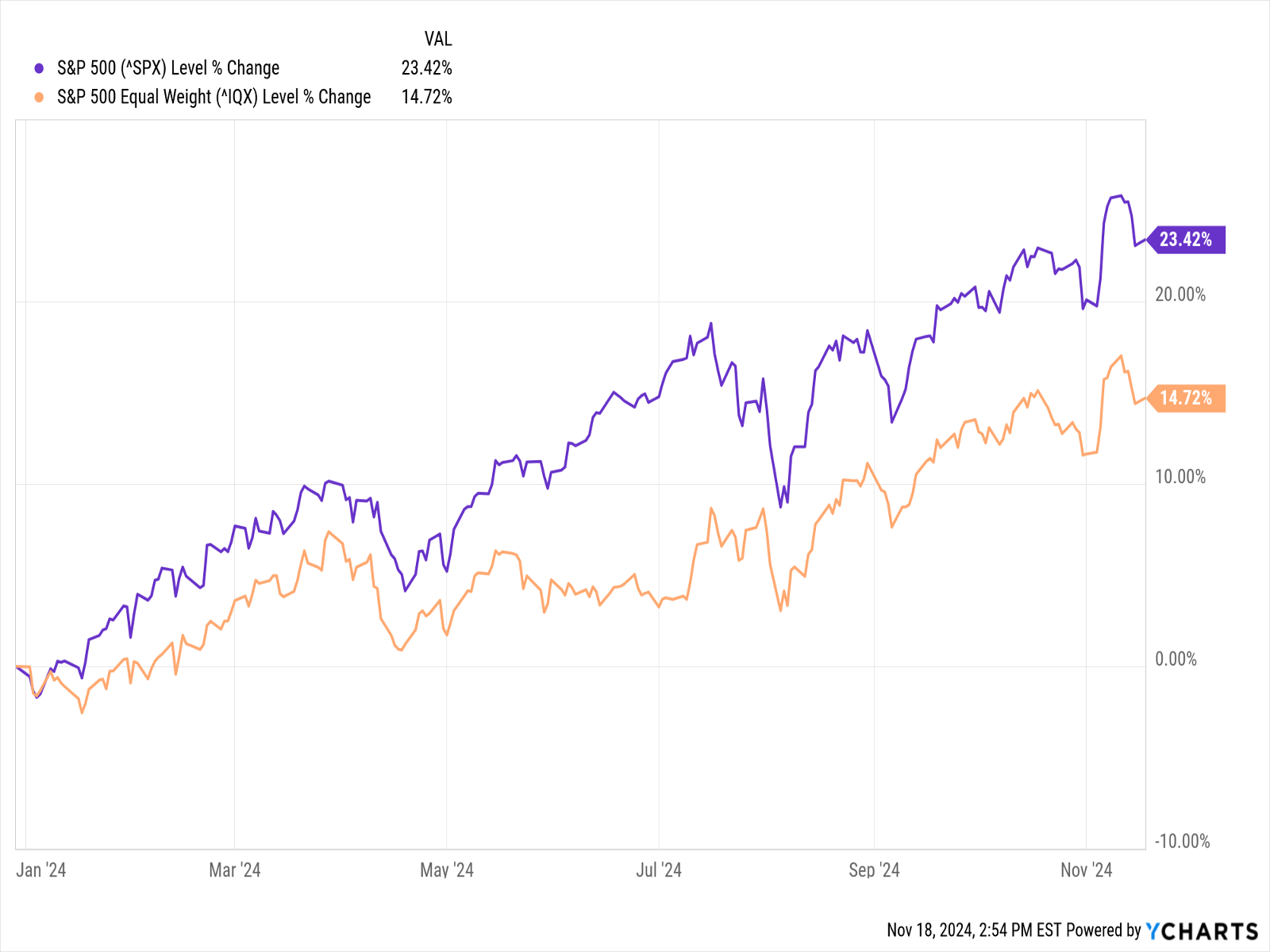

The most commonly used benchmark for U.S. equity performance is the S&P 500. It's up about 23% on a price basis so far this year. The riskier and growthier Nasdaq-100 – or the 100 largest non-financial companies in the Nasdaq Composite – has gained more than 25%, while the Nasdaq Composite itself is up almost 25%.

All of these indexes are weighted by market cap, which means the stocks with the largest market values have the greatest influence on the direction of the benchmark. As some of the largest companies in the world and monopolistic AI plays, the Magnificent 7 stocks are responsible for a good chunk of the bull market's gains, and much of its buoyant sentiment.

Just have a look at the divergence between the market-cap-weighted S&P 500 and the equal-weight version of the S&P 500 – which treats every stock, well, equally – so far this year.

Nvidia has done more than any other stock to help lift the cap-weighted gauges to record high after record high. Indeed, as of this writing, NVDA is the second most valuable publicly traded company in the world again, behind only Apple.

In order to visualize Nvidia's outperformance relative to the other Mag 7 names that it's so happy to call its customers, we thought it would help to put all of their stocks' YTD price performance on a single chart.

To that end, have a look below to get a sense of which Mag 7 stocks are helping the market the most this year.

– Dan Burrows

Robotics AI: Nvidia's next big market?

Quarterly earnings reports are backward-looking but the market is forward-looking. As much as market participants care about what a company has done for them lately, what they really want to know is how much cash the company is going to throw off over the long haul.

That's why corporate guidance is often more important than whatever a firm's income statement, balance sheet and cash flow statement tell investors about a three-month period that's already in the history books.

It's also why companies that post beat-and-raise quarters tend to see their share prices pop on the news.

Nvidia stock's meteoric rise has been driven in part by the way the most important company in the AI universe keeps delivering big top-line beats. Wall Street is already braced for another one, as well as the implications for forward sales, margins and profits.

This is standard stuff. But, believe it or not, industry analysts are also paid to think well beyond the next 12 months. Their clients want detail, color and granular information, not just updates to discounted cash flow models.

They also want their analysts to offer, well, analysis.

With that in mind, here's something NVDA bulls might want to consider as the Street dives into the post-print meeting with management.

"We believe there are two bullish factors that may not surface explicitly (or even implicitly) on the earnings call but are important to NVDA's position in compute generally and its revenue growth in the next few years," writes William Stein, managing director at Truist Securities, in a note to clients.

Although current demand and investor interest around all things AI is focused on various large language models (LLMs) such as ChatGPT, Stein notes that physical AI (robotics) and data processing are rapidly emerging. This has positive implications for demand for NVDA's parallel compute technology, which accelerates traditional compute workloads.

"Second, just as NVDA ramps delivery of Grace CPU in the data-center business, we anticipate the company will announce a client CPU during 2025, opening up significant additional total addressable market," Stein adds.

The analyst rates NVDA stock at Buy with a $167 target price, giving shares implied upside of about 17% in the next 12 months or so.

– Dan Burrows

Related content:

Nvidia earnings and Blackwell questions

The other big question around Nvidia's after-the-closing-bell event on Wednesday – other than the magnitude of its earnings beat and its guidance raise – is when the AI chipmaker will see a financial bounce from its new Blackwell platform.

Nvidia stock added 4.9% on Tuesday as already high expectations keep rising ahead of Wednesday night's print. Wall Street will also be looking to see what management has to say about Blackwell, particularly following a recent report in The Information that suggests the new chips are overheating when installed in high-capacity server racks.

"Supply chain data points, as well as discussions with industry participants, remain skewed positively," writes Stifel analyst Ruben Roy in a note on NVDA, "and we expect another beat/raise scenario." Roy says that "expectations are elevated" and that "our scenario appears to be widely anticipated" – adding that "our conversations suggest that a Blackwell-driven inflection to the upside is more likely an April quarter event than January."

Roy emphasizes that "the timing of expected Blackwell-based configurations has not changed in recent weeks. In aggregate, estimates have been moving higher for fiscal 2026 and fiscal 2027 and we believe that a diverse set of data points support the positive revisions."

Concluding this morning's note, Roy reiterated his Buy rating on NVDA and raised his price target from $165 to $180. That new target suggests implied upside of about 22% to the stock's November 19 close.

- David Dittman

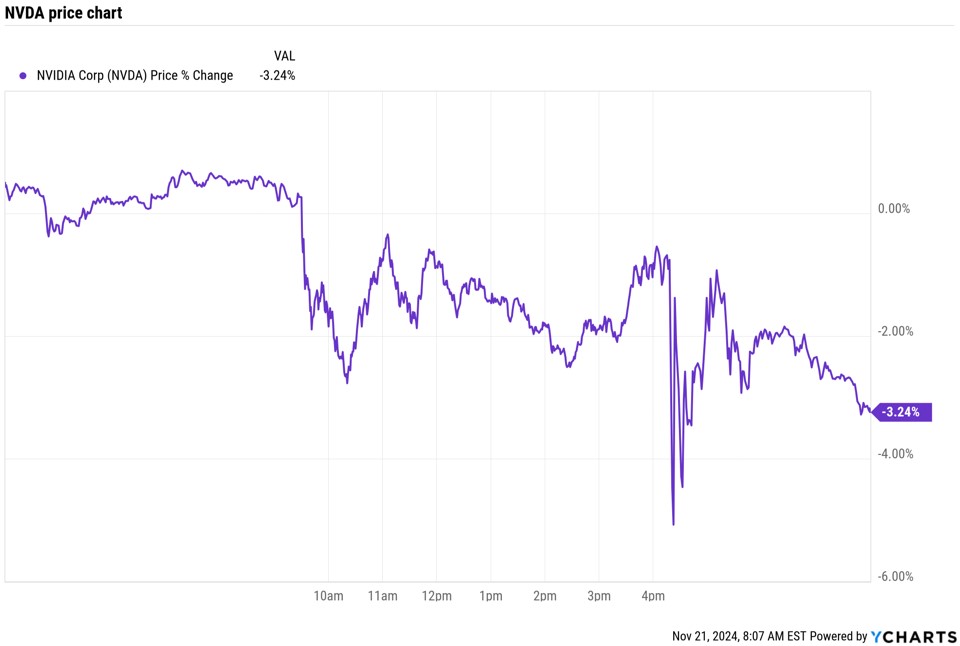

Nvidia stock trades lower ahead of earnings

Nvidia opened Wednesday's session lower as investors take some profits ahead of this evening's earnings announcement. Shares were down 1.2% at last check, putting pressure on all three main benchmarks.

About 15 minutes into the trading day, the Dow is down 0.1%, the S&P 500 is off 0.4% and the Nasdaq Composite is 0.5% lower.

- Karee Venema

Is Nvidia the best stock of all time?

Nvidia was already one of the best long-term holdings of all time before the stock went on an epic run this year. Indeed, NVDA's share price had essentially tripled for the year to date on the eve of its Q3 post-market earnings release.

But then longtime shareholders should be used to such returns by now.

After all, from its initial public offering at $12 a share in January 1999 through December 2020, NVDA stock created $309.4 billion in shareholder wealth, according to an analysis by Hendrik Bessembinder, a finance professor at the W.P. Carey School of Business at Arizona State University.

Indeed, per Bessembinder's findings, which account for a stock's increase in market value adjusted for cash flows in and out of the business and other factors, Nvidia was one of the best stocks of that 30-year period.

At this point readers may have noticed that it is now the year 2024 – or many years since the original study's cutoff date.

Happily, Bessembinder updated the results. And even after missing NVDA's epic 2024 rally, this is a name that truly stands out.

After studying the return outcomes of the 29,078 publicly listed common stocks contained in the Center for Research in Security Prices database from December 1925 to December 2023, "the highest annualized compound return for any stock with at least 20 years of return data was 33.38%, earned by Nvidia shareholders," Bessembinder writes.

True, Nvidia did not generate the greatest cumulative return. That honor belongs to tobacco titan Altria (MO), which is currently one of the stocks with the highest dividend yields in the S&P 500. But when it comes to the historical record, no name beats Nvidia for generating lots of wealth really fast.

– Dan Burrows

Are expectations for Nvidia "insane"?

As LPL Financial Chief Global Strategist Quincy Krosby observes in a note on the company's fiscal third-quarter earnings announcement, there's a lot riding on Nvidia stock right now.

"With markets concerned about the latest phase of the Russia/Ukraine conflict – and with European leaders worried over Moscow's next move – Walmart's positive guidance helped support U.S. markets yesterday," Krosby writes. "But it was a parade of enthusiastic comments regarding NVDA's Q3 earnings call following [yesterday's] market close, that seemingly had the market exceptionally excited."

Krosby notes that "options markets have been pricing in a move of nearly 10% in either direction" for NVDA's share price, "underscoring uncertainty going into this afternoon's earnings report (the average has been around 9%)."

NVDA has moved up from its intraday lows but is still down about 1.9% at $144.28 a little more than two hours before management reports results.

Krosby highlights "a wide-reaching narrative over whether NVDA can once again surpass analyst expectations" as valuations – NVDA's as well as the broader market's – continue to climb. The strategist would also like to know more from Nvidia management about "a conspiracy theory making the rounds that a story was planted to shed doubt on the long-awaited Blackwell chip, suggesting that it overheats within the servers." We discussed yesterday that this story may or may not have been "planted" in The Information.

The bottom line here is "the options market is reflecting swings in the stock price following release of the numbers and during the conference call with the CEO." As Krosby concludes, "The market is hoping for not just strong guidance but 'insane' guidance that's not yet priced in."

Stay tuned.

- David Dittman

Nvidia's third-quarter results are out

For the three months ended October 27, the chipmaker reported earnings of 81 cents per share – up 19% quarter over quarter and more than doubling on a year-over-year basis. Revenue arrived at $35.1 billion, a 17% increase over Q2 and 94% over the year prior.

Data center revenue, which houses the company's AI segment, came in at $30.8 billion, marking a 17% improvement over the second quarter and rising 112% YoY. Automotive revenue also saw a notable year-over-year increase, jumping 72% to $449 million.

Analysts tracked by S&P Global Market Intelligence expected earnings of 75 cents per share on revenue of $33.1 billion.

The company also said it initiated $11 billion in stock buybacks in Q3 and paid out $245 million in dividends.

At last check, NVDA shares are down 3.4% in after-hours trading.

- Karee Venema

Nvidia gives strong fiscal Q4 guidance, talks Blackwell shipmets

For its fiscal fourth quarter, Nvidia is calling for revenue of $37.5 billion, plus or minus 2%. This compares to Wall Street's forecast for Q4 revenue of $37.0 billion.

The company had the following to say about its highly anticipated Blackwell chips:

We completed a successful mask change for Blackwell, our next Data Center architecture, that improved production yields. Blackwell production shipments are scheduled to begin in the fourth quarter of fiscal 2025 and will continue to ramp into fiscal 2026. We will be shipping both Hopper and Blackwell systems in the fourth quarter of fiscal 2025 and beyond. Both Hopper and Blackwell systems have certain supply constraints, and the demand for Blackwell is expected to exceed supply for several quarters in fiscal 2026.

- Karee Venema

Nvidia earnings call highlights

On Blackwell: Nvidia Chief Financial Officer Colette Kress said production is in "full swing," and underscored "staggering demand" for the new AI chips. She also said margins will likely rise as Blackwell production accelerates to meet demand.

Nvidia CEO Jensen Huang said the company will deliver more Blackwell chips in the fourth quarter than previously anticipated and that execution is "going well."

Kress added that fourth-quarter revenue from Blackwell chips could top prior estimates of "several billion dollars."

On Trump: Huang said that the company will take things one quarter at a time, but will "fully" comply with regulations. "Whatever the new administration decides we will of course support the administration."

On AI and robotics: Huang said AI has created "a new industrial revolution" that is currently underway. "There are more foundation model makers now than there were a year ago. The computing scale of pre-training and post-training continues to grow exponentially. There are more AI native startups than ever, and the number of successful inference services is rising."

He added that "the age of robotics is coming" and that "Nvidia's expertise, scale, and ability to deliver full stack and full infrastructure let us serve the entire multi-trillion-dollar AI and robotics opportunities ahead, from every hyperscale cloud, enterprise private cloud, to sovereign regional AI clouds, on (premise) to industrial edge, and robotics."

- Karee Venema

Data center revenue growth is sustainable, says Third Bridge

Third Bridge analyst Lucas Keh thinks the quarter-to-quarter revenue growth rate in Nvidia's data center segment is sustainable over the next several quarters amid growing demand for AI chips from cloud providers.

Keh points to an increasing concentration in revenue from public cloud companies – now half of total revenue – as a positive sign of hyperscaler adoption for Blackwell, despite the delays.

He also says that the company attributed a decline in data center GPU margins "to a shift from customers from H100-based systems to more complex solutions like B200 and H200." This could suggest that Nvidia will not price Blackwell as aggressively "initially to spur adoption against competitive threats in the market like Advanced Micro Devices (AMD)."

- Karee Venema

NVDA stock is lower in Thursday's pre-market trading

Nvidia stock fell by more than 5% in Wednesday's extended trading in reaction to the chipmaker's fiscal Q3 results. In Thursday's pre-market session, shares were off a more modest 0.8%.

- Karee Venema

Nvidia stock swings higher

I spoke too soon. With about 20 minutes to go until Thursday's opening bell, Nvidia stock has swung higher, now set to start the day up nearly 2%. As a result, the Dow, S&P 500 and Nasdaq Composite are all poised to open in the green.

"There is nothing wrong with NVDA," says Eric Clark, portfolio manager of the Rational Dynamic Brands Fund. Clark suggests "investors use any weakness to buy the stock" because demand for Blackwell chips will eventually be satisfied and any slight misses in the company's financial results will turn into big beats yet again."

- Karee Venema

Nvidia drops back into the red in mid-morning trading

Nvidia's brief pop higher at the open didn't last long, with shares quickly sinking back into negative territory. At last check, NVDA stock was down 2.8%.

- Karee Venema

Downside for Nvidia

Nvidia stock can go down, of course, and it's happening today. NVDA gapped up at the open and reached $152.89, a new all-time high, but slipped to an intraday low of $140.70 by 10:30 am Eastern time.

NVDA is trading toward $144 around the noon hour, down a little over 1%. Still, strength elsewhere, notably in Salesforce (CRM), has the Dow Jones Industrial Average, as well as the S&P 500, in positive territory, even as the Nasdaq Composite lags.

Both analysts and investors are still reacting to Nvidia's fiscal third-quarter results and management's fourth-quarter guidance. Wall Street appears generally pleased with reported numbers while perhaps only "whelmed" by management's forecast.

CEO Jensen Huang, addressing directly one of the major questions about Nvidia's immediate future during management's earnings conference call, said that Blackwell production "is in full steam."

During the earnings call, Huang said the company will deliver more Blackwells than previously estimated this quarter.

The Information reported last weekend that the new chips were overheating when installed in high-capacity server racks, requiring design changes. They may not be as excited about what's to come as they have been in the past, but even skeptics see limited downside from here for Nvidia stock.

Consider D.A. Davidson Head of Technology Research Gil Luria. "Despite demand in the near term continuing to be strong, we still believe a decline in demand for Nvidia compute is inevitable as customers begin to scrutinize their return on investment on AI compute," Luria wrote in a research note this morning. He reiterated his Neutral (Hold) rating on NVDA stock but raised his price target from $90 to $135. That's not a bad floor given the stock’s new all-time high.

- David Dittman

Is Nvidia stock on sale?

Analysts are busy updating their discounted cash flow models and price targets for Nvidia after the most important AI company in the world failed to give the sort of blow-out revenue guidance Wall Street has come to expect.

Indeed, shares in NVDA, the world's most valuable publicly traded company with a market cap in excess of $3 trillion, actually stumbled after posting Q3 results.

But then these sorts of things can happen when a stock is said to be priced for perfection.

Either way, it seemed like a good time to take a look at a couple of ways in which analysts' expectations have changed for NVDA stock in light of the company's latest guidance.

First, let's have a look at NVDA's price target. Although these targets are of limited utility, they do form the basis for declaring whether a stock is a Buy, Hold or Sell.

As of now, NVDA's average price target stands at $170, up roughly 6% from the pre-earnings release target of $161. NVDA's new average price target gives shares implied upside of about 17% over the next 12 months. The old price target – based off NVDA's previous level – gave the stock implied upside of about 13%.

It's hard to believe Nvidia has become a $3 trillion company because of its potential for 13% or 17% price upside over the next year or so.

Price targets. Go figure.

Perhaps relative valuation can be more helpful.

NVDA's relative valuation does indeed look more attractive by some measures. Please note, however, that NVDA stock often looks expensive and yet it keeps going up.

Valuation, while critical, plays out on its own time frame. These time frames can be much longer than investors expect.

But getting back to Nvidia. After updating their models, analysts now forecast NVDA to generate average annual earnings growth of about 38% over the next three to five years, up from 35% a day ago.

This, in turn, makes NVDA look much cheaper when you look at how fast the stock is rising relative to its growth prospects. Indeed, Nvidia stock changes hands at about 38 times estimated next-12-months earnings.

What does this mean? By at least one metric – the price/earnings-to-growth (PEG) ratio – Nvidia stock looks very cheap on a relative valuation basis.

Here's why: since NVDA stock is trading at 38 times expected earnings and has a LTG forecast of 38, its PEG is 1.0. To put that in perspective, the S&P 500 trades at a PEG of more than 2.0.

By this measure, NVDA trades at more than a 50% discount to the broader market. That's not bad, but then Nvidia and the broader market are sort of apples and oranges.

That's why we want to look at Nvidia's PEG relative to itself. This gives us an idea of what sort of premiums the market has been willing to pay for Nvidia's growth prospects in the past.

And what do we find? Bulls will be happy to know that with a PEG ratio of about 1.0, Nvidia stock trades at a steep discount to its own five-year average. Indeed, per LSEG Stock Reports Plus, if Nvidia's PEG "returned to historical form," the stock would trade at $349.04.

That's not a price target, mind you, it's just some modeling. But it does give NVDA stock implied price upside of more than 140% from current levels.

– Dan Burrows

Nvidia ekes out modest gain after earnings

In Wednesday's intraday session, Nvidia was down by as much as 3.4% and up by nearly 2%. Shares eventually settled with a modest 0.5% gain.

Read more: Stock Market Today: Stocks End Higher in Whipsaw Session

Huang talks DeepSeek

Nvidia CEO Jensen Huang last week commented on DeepSeek, a cheap AI model from a Chinese startup that sparked a massive selloff in tech stocks last month. Speaking with DDN CEO Alex Bouzari, Huang suggested the market's reaction to DeepSeek's R1 model was a bit of an overreaction.

"Reasoning is a fairly compute-intensive part. The market responded to R1 as in 'Oh my gosh, AI is finished. It dropped out of the sky, we don't need to do any computing anymore.' It's exactly the opposite," Huang said, noting that the release of the new open-source AI model is "incredibly exciting."

"It's making everybody take notice that, okay, there are opportunities to have the models be far more efficient than what we thought was possible," the CEO added. "And so it's expanding, and it's accelerating the adoption of AI."

Still, expectations for Nvidia's fiscal fourth-quarter results have been lowered heading into the print as a result of DeepSeek jitters, which means we're unlikely to see a major upside reaction in the shares, says Stifel analyst Ruben Roy (Buy).

However, Roy notes that the near-term impact from DeepSeek will be minimal given the massive spending levels many large-cap companies announced this earnings season. "Rather, we continue to anticipate potential impacts of DeepSeek playing out over the next several years as AI players re-evaluate model development practices," he adds.

Roy remains Buy-rated on the blue chip stock, saying that "the underlying trends in AI infrastructure spend continue to bode well for NVDA."

- Karee Venema

Fireworks alert

Wedbush analyst Daniel Ives is known for being bold in both attire and opinion, and his often stunning sartorial choices match well the performance of a stock he's touted just about all the way during a historic climb up the market-cap ladder.

"This is a massive week ahead for tech stocks and the global markets as the Godfather of AI Jensen and Nvidia are on deck reporting earnings Wednesday after the bell," Ives writes in a Monday note. "With market jitters abounding for macro, Trump policy worries, Fed/inflation, DeepSeek, and a myriad of other issues … the most important company for the tech sector and AI Revolution continues to be Nvidia."

And the analyst expects Nvidia to deliver "another robust performance and 'clear beat and raise special'" that "should calm the nerves of investors."

Ives says CEO Jensen Huang will talk about "massive demand drivers from Blackwell and AI capex" amid "this fourth Industrial Revolution." He notes that the Magnificent 7 have committed to $325 billion of capex in 2025, a year-over-year increase of approximately $100 billion – "and enterprise-driven demand is accelerating as more companies and governments head down the AI yellow brick road."

The analyst includes this nugget: "After speaking with many enterprise AI customers we have seen NOT ONE AI enterprise deployment slow down or change due to the DeepSeek situation. No customer wants to 'lose their place in line' as it is described to us for Nvidia's next-gen chips."

Huang will host a conference call to discuss Nvidia's fiscal 2025 fourth-quarter results on Wednesday at 5 pm Eastern Time, during which Ives says "the Blackwell ramp will be front and center." Like Ives, we'll be "very closely watching the fireworks" and live-blogging the Nvidia conference call on Wednesday."

The bedrock of this bull market in 2025 is built around the AI Revolution spreading to the second and third derivatives across software, consumer tech, and infrastructure," Ives concludes, "but it all starts with Nvidia."

- David Dittman

Will Nvidia earnings be the next market catalyst?

The stock market's next move may very well be determined by the reaction to Nvidia's earnings report, says Clark Bellin, president and chief investment officer at Bellwether Wealth. This is because earnings and artificial intelligence are two of the "most important factors for markets right now." (Inflation, he adds, is the third.)

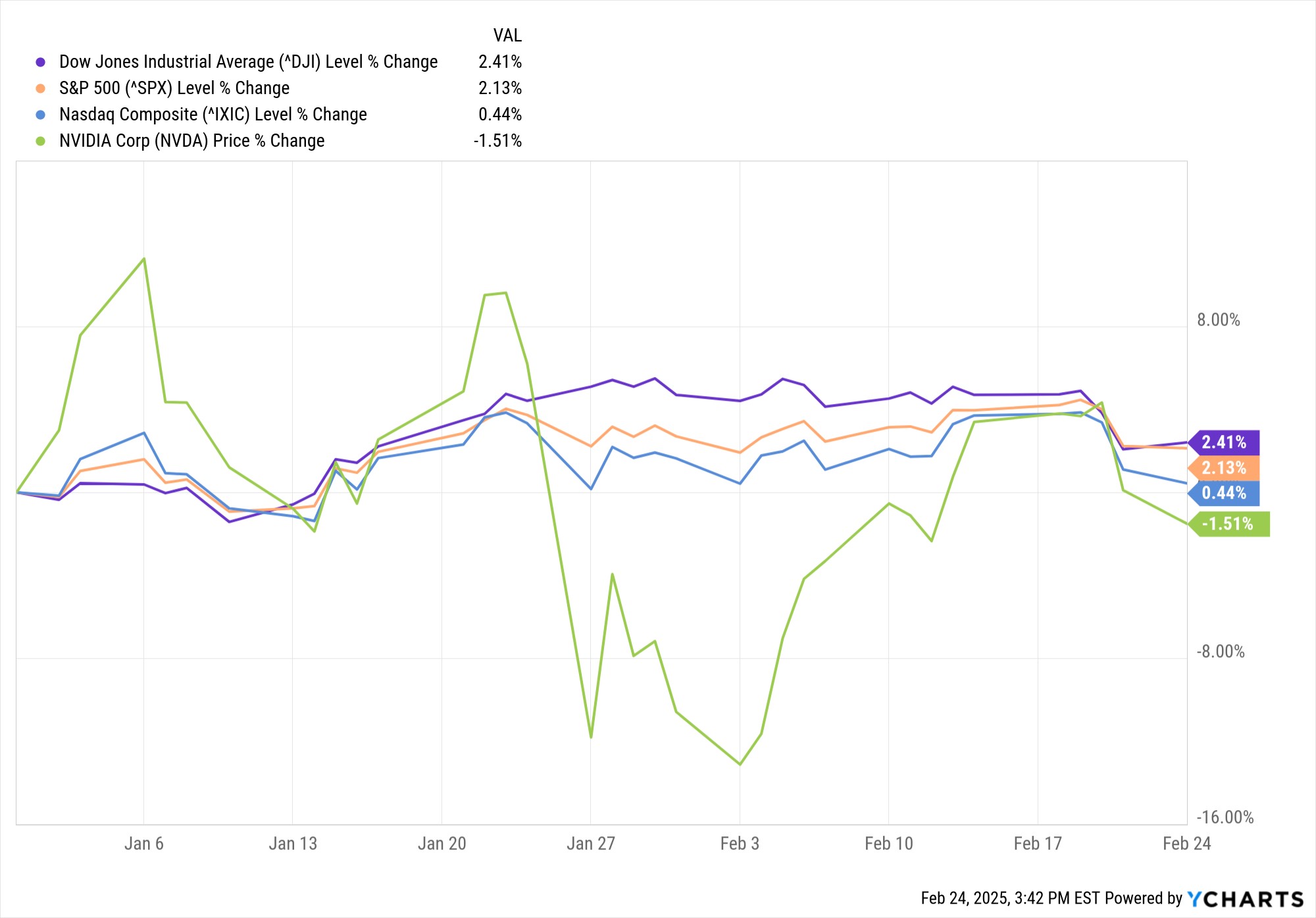

So far for the year to date, Nvidia shares have lagged the broader market – and are currently down compared to their December 31 close vs positive returns for the Dow Jones Industrial Average, S&P 500 Index and the Nasdaq Composite.

"Blowout earnings from Nvidia … could add upward momentum to stocks," Bellin adds.

- Karee Venema, senior investing editor

Should you buy Nvidia before earnings?

Nvidia stock shed more than 10% in January in reaction to DeepSeek. While shares have recovered most of their early 2025 losses, they are down roughly 6% this week at last check after Bloomberg reported the Trump administration is preparing to broaden restrictions on the type of chips the company can export to China without a license. The administration is also considering "tightening existing curbs on the quantity of AI chips that can be exported globally without a license," according to Bloomberg.

Should investors be worried about more selling or is now the time to buy the dip on the chipmaker?

Only time will tell, but Mary Ann Bartels, chief investment strategist at Sanctuary Wealth, thinks that Nvidia is in a consolidation phase that could last six to 12 months. Still, the strategist believes the stock remains in a bull trend.

And for investors wanting to gain exposure to longer-term AI growth – the market is expected to grow at a 27.7% compound annual growth rate through 2030, according to Statista – now could be the time to strike on NVDA given its current valuation. Specifically, the stock is trading at 30.4 times forward earnings, well below its five-year average of 40.7, per Morningstar.

- Karee Venema, senior investing editor

Nvidia and the AI monetization phase

Wedbush analyst Daniel Ives reiterated his optimism for NVDA on Tuesday morning, adding a new introduction and restating the data resulting from his channel checks ahead of Nvidia Day.

"Tomorrow is a massive day for the global markets," Ives writes, "as the Street awaits Nvidia earnings to gauge the demand trajectory of the AI Revolution." Investors, traders and speculators on and off Wall Street are wondering "if another '$2 billion beat and $2 billion raise' is in the cards for the Godfather of AI Jensen and Nvidia."

Nvidia stock was down more than 3% Tuesday morning, jockeying with Amazon.com (AMZN) in and out of the Nos. 29 and 30 spots in the Dow Jones Industrial Average.

"The market is heavily skewed negative right now around tech sentiment with any whisper of worries/concern from DeepSeek to Microsoft (MSFT) CapEx causing a brutal ripple impact across the tech ecosystem," Ives observes.

He has an Outperform rating on NVDA and a 12-month target price of $550 for the AI stock. "We have been monitoring dozens of large companies/CIOs that have embarked down the AI path in 2025 to gauge enterprise AI spending, use cases, and which vendors are separating from the pack in the AI Revolution," the analyst explains in his twin notes.

Ives estimates that AI now accounts for "roughly 10% of many IT budgets for 2025 … and in some cases up to 15%," noting that "many CIOs have accelerated their AI strategies" over the next six to nine months. "Monetization of this key theme is starting to become a reality across many industries," he concludes.

- David Dittman

Will Nvidia's guidance be conservative?

Morgan Stanley analyst Joseph Moore thinks fundamentals have improved in recent weeks as Hopper demand has firmed and expects Nvidia to report full-year earnings of $2.94 per share – roughly in line with Street estimates.

However, Moore believes Nvidia's guidance for fiscal 2026 will be conservative due to uncertainty around potential export controls. "Export controls have been a challenge since last year's restriction on processing power to China," he says.

While Moore initially believed these restrictions would have a limited impact, the success of DeepSeek suggests "the government is likely to be more restrictive, but we don't know what that looks like." He feels these export controls could create "a meaningful headwind to second-half results."

Still, Nvidia remains a top stock pick for Moore on expectations the Blackwell cycle will drive notable upside for the chipmaker.

- Karee Venema

The whole market Is watching

Welcome to Nvidia Day. Equity futures are indicating a positive open a little less than two hours before the opening bell rings to start what promises to be a fascinating trading session ahead of perhaps the most consequential after-market earnings announcement of the 21st century. That sounds like a lot, but Nvidia is literally everywhere.

"In case you're not keeping up with the index weightings," writes All Star Charts founder and chief market strategist J.C. Parets in a note previewing the event, "here's the cheat sheet…" Parets explains that Nvidia equals 17.9% of the Semiconductors Index Fund (SMH), 7.4% of the Nasdaq100 Index Fund (QQQ), 12% of the S&P Technology Index Fund (XLK), 9.3% of the Russell 1000 Growth Index Fund (IWF), "and a lot more ... This is a very big deal."

Parets implores his readers to "look at the Semiconductors Index relative to the S&P 500 potentially completing a massive top."

A technical analyst, Parets will be watching the reaction and how Nvidia's conference call impacts the broader market. "If we lose semis," Parets concludes, "then bull market canceled. It's that simple."

Note that we'll be live-blogging here beginning right after the closing bell and continuing through the conclusion of Nvidia's conference call.

- David Dittman, investing editor

Experts weigh in on Nvidia ahead of earnings

All eyes are on Nvidia today as the chipmaker prepares to report earnings after the close. Many of Wall Street's top minds are chiming in ahead of the print. Here's some of what they're saying:

"We expect a narrower earnings beat from Nvidia, but a beat nonetheless, and that comes even with the recent DeepSeek fears, which we believe are already priced into Nvidia's current stock price and will have little influence on Wednesday's earnings report. We expect the stock to rally post-earnings, as it's been some time since Nvidia has made a new record high, and its earnings and guidance justify continued momentum in the stock." - Chris Brigati, Chief Investment Officer at SWBC

"Nvidia's earnings will be a defining moment, not just for itself but for the entire tech sector. Given the sky-high expectations, the AI giant must deliver exceptional results to keep the bulls alive. But mounting competition and supply constraints could complicate the narrative." - Lukman Otunuga, Senior Market Analyst at FXTM

"Nvidia is likely to post strong earnings again, but the stakes are lower than they have been in previous quarters. The company is now selling at a valuation much lower than the broad semis index, which gives them some room for error." - Scott Helfstein, Head of Investment Strategy, Global X

"This week, all eyes will be on Nvidia as investors expect to see another quarter of strong earnings. Major tech companies have recently pledged to increase spending on AI, but breakthroughs in AI like DeepSeek may disrupt how that spending is divided, potentially at the expense of the hardware suppliers." - Jason Pride, Chief of Investment Strategy & Research, and Michael Reynolds, Vice President of Investment Strategy at Glenmede

"All eyes will be on Blackwell momentum and the ramp of its most premium GB200 configuration, with the NVL72 GPU rack likely to see orders push into April/July quarters due to well-known delays/overheating issues. Higher spend by hyperscalers and gross margin expansion as Blackwell ramps are positives, with Blackwell revenue to cross Hopper in Apr-Q. We will be closely watching NVDA's commentary on market concerns tied to compute demand post-DeepSeek, potential excess capacity by the second half, and possibly more aggressive China export restrictions." - Angelo Zino, Senior Equity Analyst at CFRA Research

- Karee Venema, senior investing editor

NVDA gaps up at the open

It's one of those days that brings together investors, traders and speculators of every stripe, with different and even competing interests, like a Super Bowl for financial markets, only every quarter.

For the record, Nvidia opened at $129.99 on Wednesday, up 2.7% from its closing price on Tuesday and continuing the short-term trend established in pre-market trading.

NVDA was down 3.1% on Monday and lost another 2.8% yesterday. It's traded as high as $132.15 early Tuesday and as low as $129.05. That range is likely to broaden – upside, downside, perhaps both – during regular hours and then in the after-market session once the numbers come out.

Investors are concerned today about Nvidia's growth trajectory. Traders and speculators are focused on price action, pure and simple.

Over the long, long term, what they all have done and continue to do in terms of price discovery, etc., has driven that ultra-comforting up-and-to-the-right trend. That big move is made up of many days like today – maybe not many days like today, but things like this do happen.

At the same time, the way the market is right now – still poised near all-time highs basically on the strength of the AI trade but with more and more questions about the stability of the earnings landscape – Nvidia merits additional scrutiny.

Nvidia Day is exciting. It's important to appreciate that the market has been pricing in since ChatGPT's release in 2022 what Wedbush analyst Daniel Ives describes as a "4th Industrial Revolution."

That seems like a long-term thing. Nevertheless, this is an expectations game, and expectations for Nvidia are really high.

My Nvidia scorecard

Having completed a semi-comprehensive cross-check of financial media and publicly available Wall Street analysis, here are five things the market will tune in to this evening when Nvidia reveals its results and Jensen Huang opens up the conference call for questions and answers…

Expectations: Analysts expect Nvidia to report revenue growth of 72% to $38.1 billion and adjusted earnings per share of 85 cents. Wall Street wants to see fiscal 2026 first-quarter guidance of $42.1 billion for revenue and 91 cents for adjusted EPS.

Blackwell: A – perhaps "the" – major question is how quickly Nvidia can ramp up production of its GB200 NVL72 Blackwell Server system. That sounds like a good problem for a business to have, all else equal. NVDA stock will be sensitive to commentary on both sides of the equation: supply and demand.

Moat: This is a word more commonly associated with mature businesses as opposed to those building the infrastructure for a "4th Industrial Revolution." It could be, however, that Nvidia's technology stack already makes its semiconductor leadership defensible for the long term.

DeepSeek: Huang has already offered his take on the "cheap" large language model from a Chinese startup that catalyzed a broad market sell-off in late January: He expects DeepSeek will accelerate adoption of AI and drive demand for the kind of computing power only Nvidia supports.

Trump: According to Bloomberg, "Donald Trump's administration is sketching out tougher versions of U.S. semiconductor curbs and pressuring key allies to escalate their restrictions on China's chip industry." China's share of Nvidia's total revenue has already declined from about 25% to below 15%.

With about two hours to go until Nvidia reports its fiscal 2025 fourth-quarter results, NVDA stock is up about 4%, having traded as high as $133.73.

- David Dittman, investing editor

What time will Nvidia earnings be released?

Nvidia earnings will be released after the stock market closes on Wednesday. While some companies release their quarterly report right at 4 pm Eastern Standard Time, the typical time frame is between 4:00 and 4:30 pm. According to NVDA, its results will come through "at approximately" at 4:20 pm.

The conference call is scheduled to begin at 5 pm Eastern Standard Time.

Nvidia's numbers are in

For the three months ending January 26, Nvidia reported earnings of 89 cents per share, up 71% year over year, on revenue of $39.3 billion (+78% YoY).

Data center revenue surged 93% year over year to $35.6 billion, while automotive revenue jumped 27% to $570 million. Gaming revenue, on the other hand, slumped 11% to $11.4 billion.

For its full fiscal year, Nvidia said earnings more than doubled from the year prior, to $2.99 per share. Revenue jumped 114% to $130.5 billion.

For its fiscal first quarter, the company expects revenue of $43.0 billion.

- Karee Venema, senior investing editor

Did Nvidia do enough?

Nvidia beat expectations on the top line by $1.2 billion, and guidance for fiscal 2026 first-quarter revenue exceeded the Wall Street forecast by $900 million.

That's a little shy of the ambitious "$2 billion and $2 billion" benchmark set down by Wedbush analyst Daniel Ives in pre-earnings notes over the last couple of days.

NVDA stock popped up from a $131.28 closing price to $136.60 in the after-market right after the release before settling in the $130s about 10 minutes ahead of the company's conference call.

"Demand for Blackwell is amazing," said Nvidia CEO Jensen Huang in a statement announcing results and offering guidance, "as reasoning AI adds another scaling law."

The "Godfather of AI," as Ives has dubbed Huang, said Nvidia has "successfully ramped up the massive-scale production of Blackwell AI supercomputers, achieving billions of dollars in sales in its first quarter."

Huang added that "AI is advancing at light speed as agentic AI and physical AI set the stage for the next wave of AI to revolutionize the largest industries."

Nvidia's Blackwell deployment is going well

CFO Colette Kress said Nvidia's Blackwell deployment is "the fastest ramp in the company's history," adding that "Blackwell is in full gear." NVDA stock is rising in after-market trading.

Nvidia is expanding supply quickly, and customers are "racing to train… the scale of training and post-training is massive… inference demand is expanding."

Kress explained that the "growing complexity of inference at scale" as well as the desire to "boost performance and slash costs" supports rising demand. "Blackwell addresses the entire AI market," Kress said, "and accelerates every AI model, ensuring large investments across market environments."

Nvidia's AI moat

"Moats" are things investors like Warren Buffett enjoy: Strong businesses with solid protections against potential competitors.

It's early in the AI Revolution. But the on-the-ground environment CFO Colette Kress described during the company's conference call sounds like one Nvidia itself made and that it's well positioned to defend.

"Blackwell is a customizable AI architecture," Kress said, and Nvidia "exceeded expectations in ramping up during the fourth quarter, "delivering several architectures."

Customers are "racing to build out" Blackwell infrastructure.

Millions of times more compute

"Hundreds of thousands – millions of times – more compute" is in our future. The question is how do you design such architecture?" asked Jensen Huang during his answer to the first question in the Q-and-A session.

Huang said "Blackwell was designed with reasoning models in mind," adding that "our architecture is fungible."

The CEO added that he sees "much more concentration on a unified architecture than ever before."

CFO Colette Kress reiterated that Blackwell's ramp-up will result in a margin expansion during the fiscal year.

Huang said he's "more enthusiastic about the ramp-up" than he was at CES in January. "We've shipped a lot more," he said. "And we have customers who are anxious and impatient to get their Blackwell systems."

That's another good problem to have.

"We're everywhere"

"Nvidia's architecture is general," said Jensen Huang during Nvidia's fiscal 2025 fourth-quarter conference call. "And we're great at all of it.

"We're really good from end to end – from data processing to reinforcement learning in post-training all the way to inference.

"We're general, we're end to end, and we're everywhere." Huang said Nvidia's performance and its rhythm are "so incredibly fast. Data centers are fixed in size or fixed in power, so our speed translates directly to better revenue.

"That's incredibly valuable to companies building these things – fast ROIs."

Nvidia, DeepSeek and tariffs

It wasn't until the very last minutes of Nvidia's conference call that DeepSeek and tariffs turned up, and the former was first mentioned by Jensen Huang in terms of what the cheaper model will do for the proliferation of AI and "igniting excellent innovation."

"It's a world-class open-source model," Huang said.

And CFO Colette Kress said tariffs are "at this point a little bit of an unknown until we understand" the Trump administration's plan, including timing and magnitude.

"We will always follow export controls and tariffs," Kress said.

We've only just begun the AI revolution

"Demand for Blackwell is extraordinary," CEO Jensen Huang said at the top of his closing remarks at the end of Nvidia's conference call, "and AI is evolving beyond perception."

Despite Huang's persistent optimism, NVDA stock slipped to $130.74 by the conclusion of the conference call from as high as $136.60 right after the earnings announcement.

"It is fairly safe to say AI has gone mainstream," he said during his remarks. "It's being integrated into every application. We're at the beginning of this new transition, and all software is going to be infused with AI."

According to Huang, "No software tool has been able to meet as much of the world's GDP as AI has. That's the context. And we're really just in the beginning."

Now let's see what happens with NVDA stock on Thursday…

Nvidia to $180?

Nvidia earnings were "outstanding," but were released during "an extremely jittery stock market," says James Demmert, chief investment officer at Main Street Research. As such, he is taking the chipmaker's relatively modest post-earnings move with "a grain of salt."

Indeed, NVDA is set to open Thursday with a less than 2% gain – a far cry from the massive post-earnings moves the market is accustomed to.

According to Market Chameleon, Nvidia has averaged a 5.8% gain in the session immediately following its past 12 earnings releases (not including last night's print).

Demmert remains bullish on Nvidia and says that when the stock's price-to-earnings ratio has hovered near 31 – as it is now – this has historically preceded big pops in the share price. "We have a price target of $180 on the shares for the end of 2025," he adds, which implies expected upside of 44% to NVDA's February 26 close at $131.28.

- Karee Venema, senior investing editor

What the experts are saying about Nvidia earnings

Several of Wall Street's top minds were quick to weigh in after Nvidia's earnings report. Here's some of what they're saying:

"In a transitional quarter, where Hopper was two-thirds of data center revenue and they were wrestling with 'unprecedented complexity' of new Blackwell form factors, the company still grew 18% quarter over quarter, beat guidance by almost $2 billion – which has become routine, but worth repeating that no semiconductor company ever did that before Nvidia started doing it – guided for strong growth again, and returned to very positive language around 'amazing' levels of Blackwell demand." – Joseph Moore, equity analyst at Morgan Stanley

"There were maybe a couple things to pick at, but we see the results/guidance/commentary as good enough to keep the debate moving in a positive direction – especially ahead of [the company's] GTC [conference] in a few weeks. The most important thing is that Blackwell is ramping ahead of plan (even better than our $9 billion preview which was high-on-Street) and we also like that the company was willing to put a stake in the ground on opex growth this year – historically a strong indicator of confidence in growth headroom." – Timothy Arcuri, analyst at UBS Global Research

"We saw few (if any) blemishes in NVDA's quarter or outlook, with both our fiscal year 2026 and fiscal year 2027 estimates lifting following the call. And with seemingly only good news ahead: the March GTC conference, ramping Blackwell projects → accelerating revenue growth, and large sovereign investments that could/should boost the intermediate-term outlook; we see numerous catalysts that should bolster the stock." – Matt Bryson, analyst at Wedbush

- Karee Venema, senior investing editor

Nvidia turns lower on gross margin concerns

After opening Thursday's session up nearly 3%, Nvidia stock has since turned lower – down 3.4% at last check – on concerns around the company's gross margins. Specifically, the chipmaker forecast fiscal first-quarter gross margins of 71% – lower than the 73.5% reported in fiscal Q4 and the 72.1% analysts are calling for.

Bernstein analyst Stacy Rasgon says this is a result of the company's focus "on the ramp of Blackwell and putting it into the hands of customers rather than optimizing gross margins in this phase." He calls this a "nitpick" concern and adds that management expects margins to move back into the mid-70s by the end of the current fiscal year.

- Karee Venema, senior investing editor

Nvidia bumps Salesforce from the No. 30 Dow position

Nvidia's early morning reversal quickly had the blue chip replacing Salesforce (CRM) as the worst Dow Jones stock on Thursday. Still, CRM remains in second-to-last place on the 30-stock index following its own earnings report.

While the cloud-based software company reported higher-than-expected fiscal fourth-quarter earnings of $2.78 per share, its $9.99 billion in sales missed analysts' estimates. Additionally, Salesforce's fiscal first-quarter and full-year guidance came up short of Wall Street's forecasts.

Similar to Nvidia, most analysts remain bullish on CRM. The quarterly results "saw Salesforce put up solid results against core investor KPIs," says Morgan Stanley analyst Keith Weiss, but forex headwinds took "a bit out of headline numbers and consensus estimates."

And the company's guidance creates "an 'appropriately conservative' baseline for growth and margins," with significant room for upside to free cash flow and the share price thanks to growth in Agentforce, its AI platform, Weiss adds.

"With almost 40% upside to our unchanged $405 price target, we would be strong buyers of Salesforce ahead of these potentially improving numbers and investor sentiment," the analyst concludes.

- Karee Venema, senior investing editor

Read more about Saleforce's earnings report.

Nvidia takes one on the chip

Nvidia stock closed just above its intraday low at $120.15, down 8.5%. It's the worst one-day decline since the January 27 DeepSeek sell-off, when NVDA was down 17%.

And it's the worst post-earnings announcement performance since February 17, 2022, when the AI stock shed 7.6%.

Nvidia gapped up at the open to $135 – it got as low as $120.01 late in the day for a top-to-bottom slide of 11% – but that was as high as it got during a volatile session.

It's a fragile market right now, with rising uncertainty about inflation and growth exacerbated by the effects of a new Trump administration in Washington, D.C.

As Karsihma Vanjani of Barron's reports, "Uncertainty is at an almost unprecedented level." Vanjani cites the 30-day moving average for the Economic Policy Uncertainty Index, which "hit 334 on Wednesday, after reaching 325 on Tuesday and 327 on Monday."

During the pandemic the index – which aggregates newspaper headlines, disagreements among economic forecasters, and the number of expiring federal tax provisions – soared above 500.

Other than that, Vanjani notes, "These levels are the highest on record, dating back to 1985."

As mesmerizing as Jensen Huang can be, his certainty about the trajectory of the AI revolution and his company's tip-of-the-spear position wasn't enough to captivate investors as well as traders and speculators looking to lock in gains on existing positions.

Both the CEO and CFO Colette Kress sound convinced Nvidia's business is optimized for an AI revolution that is still in its earliest stages. And their financial numbers – including early Blackwell results – provide substantial supporting evidence.

"We still believe that the chips, boards, and systems ramp wasn't as smooth as might have been hoped," writes Wedbush analyst Daniel Ives in a post-Nvidia Day note. "But it's hard to argue these issues had a discernible impact on NVDA's trajectory other than perhaps moving some revenue between quarters."

Ives reiterated his Outperform rating (which means Buy) and his 12-month price target of $175.

"Given the quarter's strength, a lack of any meaningful concerns and what looks to be extremely clear sailing ahead," the analyst explains, "we see no reason to shift our positive outlook on NVDA."

Thank you for joining us for another Nvidia Day. That's it for us this time around. We'll see you again in May.

- David Dittman, investing editor