Nvidia (NVDA) -) posted much better-than-expected third quarter earnings Tuesday, while forecasting sales that smashed Wall Street forecasts, as the world's most-valuable chipmaker continues to benefit from surging AI demand.

A warning that China sales will slow as a result of U.S. export restrictions, however, kept a lid on after-hours gains for the shares, which hit a record high earlier this week.

Nvidia said adjusted earnings for the three months ending in October came in at $4.02 per share, up more than threefold from the same period last year and well ahead of the Wall Street consensus forecast of $3.37 per share.

Group revenues, Nvidia said, soared 205% from last year to $18.12 billion, a figure that also smashed analysts' estimates of an $16.2 billion tally. Data-center revenue was a record $14.5 billion, Nvidia said, a 41% increase from last year, while gaming revenue rose 15% to $2.86 billion. Overall profit margins were pegged at 74%, topping estimates of around 72.5%.

Looking into the current quarter, Nvidia sees revenue of around $20 billion, plus or minus 2%, a tally that was firmly ahead of the Wall Street consensus of around $17.2 billion.

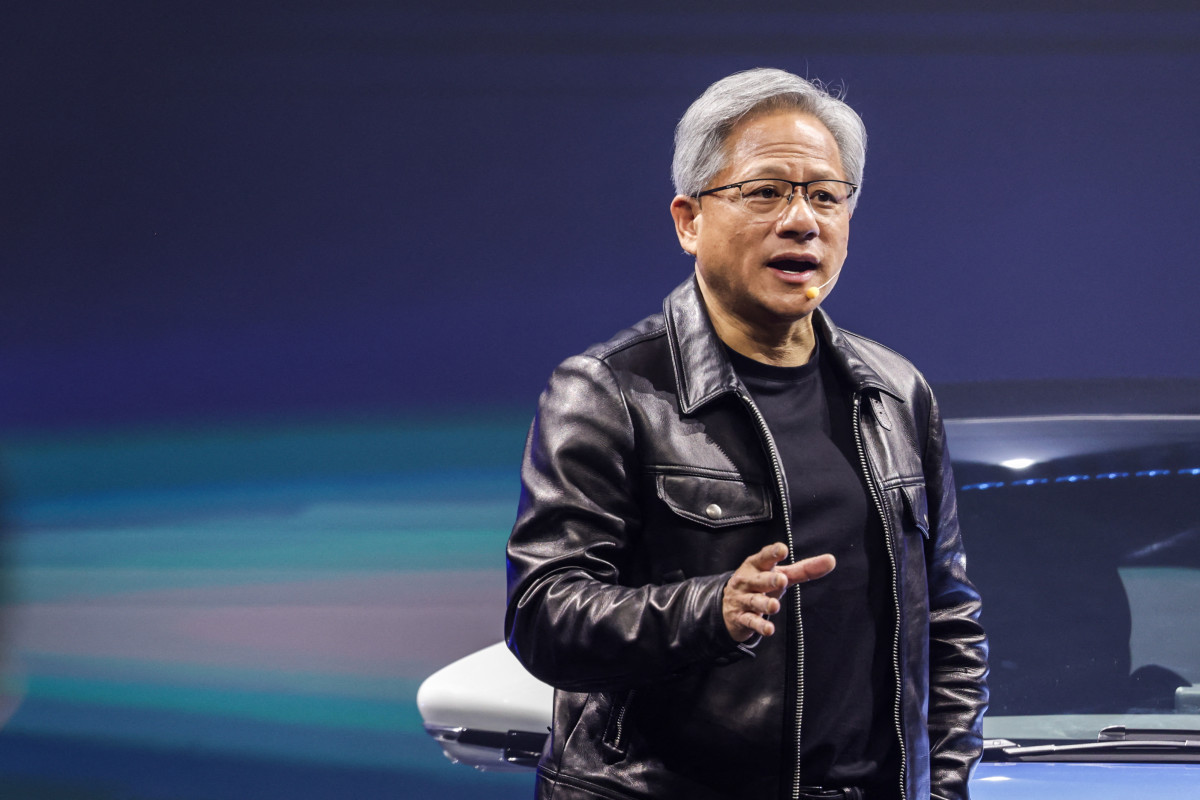

“Our strong growth reflects the broad industry platform transition from general-purpose to accelerated computing and generative AI,” said CEO Jensen Huang. “Large language model startups, consumer internet companies and global cloud service providers were the first movers, and the next waves are starting to build. Nations and regional CSPs are investing in AI clouds to serve local demand, enterprise software companies are adding AI copilots and assistants to their platforms, and enterprises are creating custom AI to automate the world’s largest industries.

“NVIDIA GPUs, CPUs, networking, AI foundry services and NVIDIA AI Enterprise software are all growth engines in full throttle. The era of generative AI is taking off,” he added.

Nvidia shares, which hit an all-time high of $505.48 each earlier this week, were marked 1.03% lower in after-hours trading immediately following the earnings release to indicate a Wednesday opening bell price of $494.708 each.

Nvidia CFO Colette Kress noted that China sales, which comprise around 20% to 25% of total revenues, would likely slow over the current quarter as a result of new export restrictions put in place by the U.S. government.

"We expect that our sales to these destinations will decline significantly in the fourth quarter of fiscal 2024, though we believe the decline will be more than offset by strong growth in other regions," Kress said.

- Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.

.png?w=600)