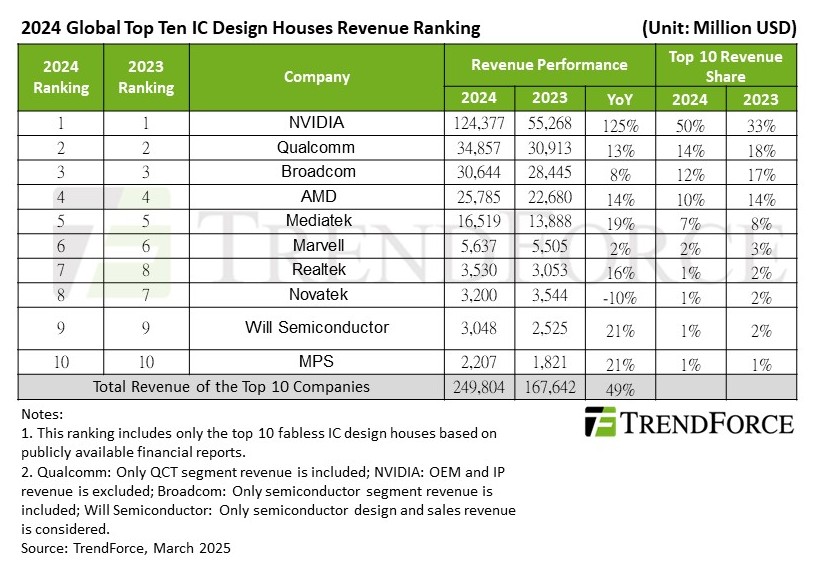

The global semiconductor industry saw explosive growth in 2024, mainly driven by sales of processors for AI applications, according to TrendForce. The Top 10 largest fabless chip developers earned nearly a quarter of a trillion dollars last year; roughly half of that sum came from Nvidia.

The largest fabless chip designers generated $249.8 billion in revenue, up 49% from the previous year. The growth boomed due to skyrocketing demand for AI GPUs, ASICs, adjacent chips (e.g., network processors, DPUs), datacenter CPUs, and recovered demand for client PCs. Market consolidation also intensified, with the Top 5 firms now accounting for over 90% of the revenue among the Top 10.

Nvidia was at the forefront of the industry and extended its dominance, posting $124.3 billion in revenue (a 125% increase from 2023) and capturing 50% of the revenue share. Hopper-based H100, H20, and H200 GPUs drove the company’s revenue increase, as Blackwell-based B200/GB200/B100 only emerged in the fourth quarter. As demand for Blackwell parts — which are believed to be more expensive than Hopper GPUs — increases this year, they will likely enable an even higher revenue for the green company this year.

Qualcomm ranked second, earning $34.86 billion, a 13% year-over-year increase. The company’s growth came from smartphones, the automotive sector, and PCs, a new source of the company’s revenue. The company secured a legal victory against Arm, and there are no risks that the latter will withdraw its licenses. The company also confirmed its interest in datacenter CPUs, though its entry into this market is likely a few years down the road.

Broadcom held third place, with its semiconductor unit bringing in $30.64 billion, up 8% from the previous year. AI-related products accounted for more than 30% of its semiconductor revenue. Despite a mid-year slump, demand for wireless communication, broadband, and server storage will drive the company’s growth in 2025.

AMD followed in fourth, increasing revenue by 14% to $25.79 billion. Its server business surged by 94%, boosting its position in datacenters and the cloud. Strategic partnerships with Dell, Google, and Microsoft are expected to help sustain its momentum, according to TrendForce.

MediaTek secured the fifth spot, with $16.52 billion in revenue, marking a 19% annual increase. The company’s success was driven by mainstream 5G smartphones, power management chips, and AI-related products. Its collaboration with Nvidia on Project Digits positions it for further expansion in 2025 as AI integration in mobile devices increases.

Marvell was the sixth largest fabless chip designer, with 5.637 billion in revenue, up 2% from the previous year. Realtek moved to seventh place with $3.53 billion (16% YoY growth), benefiting from a recovery in PC and automotive-related sales. Meanwhile, Novatek dropped to eighth, with revenue declining 10% to $3.2 billion.

Will Semiconductor and MPS closed the top ten, each showing 21% revenue growth, reaching $3.05 billion and $2.2 billion, respectively. Will Semiconductor benefited from high-end CMOS image sensors in Android phones and autonomous vehicles, while MPS saw success as its power management chips entered the AI server supply chain.

TrendForce expects AI to drive growth in various sectors, from datacenters to personal devices, in 2025.