Local FinTechs are being called up to help the New South Wales government introduce innovative payment methods as part of a major refresh of its transactional banking contracts.

NSW Treasury issued an expression of interest to “expand the innovation capability within government banking and payments” earlier this month, alongside separate EoIs for core banking and platforms.

It is the first time in more than five years that the state government has market tested the contracts, which replaced a single contract held exclusively by Westpac for more than 15 years in 2018.

In that time, the government has been busy standing up the digital foundations to deliver faster, more efficient payments to citizens, businesses and suppliers.

Westpac and ANZ have delivered core banking services to the state government since March 2019 under multi-million-dollar contracts, with Citigroup securing the card payments component.

ANZ was also named innovation partner, allowing the government to “leverage the bank’s market-leading capability and experience in data analytics, agile ways of working, human-centred design, digital and payments”.

But with the contracts set to expire in March 2025, the government is looking beyond the big four banks for innovative capabilities and is “seeking to foster collaboration with a diverse range of suppliers, including nurturing smaller players”.

States like Victoria have also sought to split up their transactional banking contracts in recent years, but separating innovation from the core banking bundles is a further departure from tradition.

NSW Treasury plans to use pilot projects, hackathons and other mechanisms to solve a series of “targeted problem statements”, with growing the online services offered by Service NSW clearly front of mind for Treasury.

Making payments on someone else’s behalf, to avoid the beneficiary and the payee having to attend a service centre in person, and making payments to someone the government does not hold bank details for, are among the five use cases.

Fintechs and alternative payments providers will still need to “work with other government… providers for banking and payment services as may be required”, the EoI documents state.

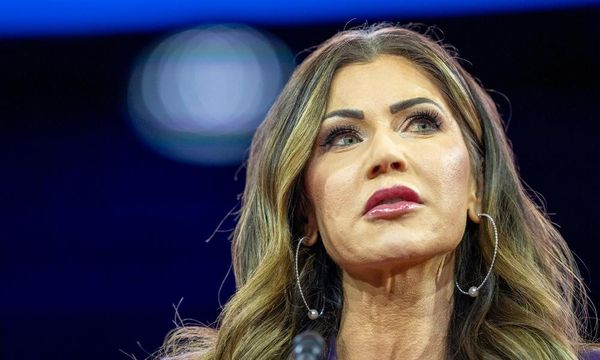

NSW Treasury’s executive director for banking and financial services, Lynne Cardwell, said the state’s “large-scale payment volume processing highlights the need for cutting-edge banking solutions”.

“With the FinTech sector booming in Australia, the state is eager to tap into the innovative talent pool to drive secure, inclusive and efficient payment solutions for the people and businesses of NSW,” she said.

“The tender process will support NSW government’s commitment to fostering innovation in the digital payments space and will ensure the State remains a leader in the early adoption of modern banking and payment technology.”

Last month, Ms Cardwell told InnovationAus.com that the state is moving to “standard ways of operating through common platforms, through greater focus on the right digital payment methods for the right use case”.

The payments reforms underway across government are also linked with the enterprise resource planning consolidation that the Department of Communities and Justice is leading, dubbed the Process and Technology Harmonisation program.

EoIs for core services – which has been broken up into six modules – and platforms – which consists of two modules: eInvoiving platform and payments platform – have also been issued by NSW Treasury.

All three EoIs will close on 8 May, with a request for proposal expected to follow. Core liquidity and banking services contracts are to commence from 1 April 2025.