In early June, the Energy Information Administration (EIA) released its latest outlook on U.S. oil production – revising up the outlook for U.S. supplies and surpassing 2019 highs by Q3 of 2023. This contrasts with the recent focus on headwinds faced by producers: weather-related disruptions, lack of investor appetite, supply chain disruptions, rising costs, and labor shortages have all been cited.

The tone on disappointing production levels belies the longer-term trend: North American crude output is expected to keep climbing. With growing production, the expansion of midstream infrastructure since 2018, and a shrinking North American refining system, export volumes of WTI from the U.S. Gulf Coast are poised to set new records.

Slope of Production Growth Uncertain

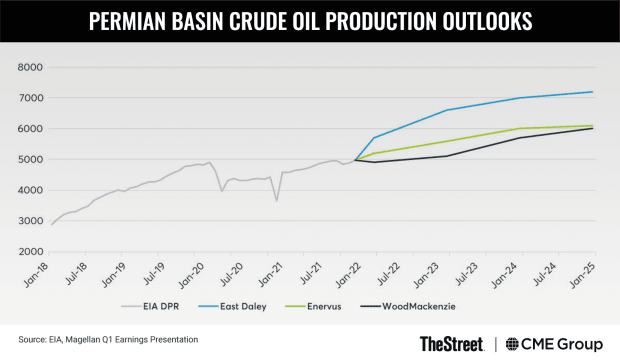

The debate on production growth is about how much and when key factors when global crude and refined product deficits are contributing to record pump prices. 2022 U.S. growth estimates range from 800,000 barrels per day (BPD) to 1.8 million BPD, much of which comes in the second half of the year. An additional 500,000 to 1 million BPD is expected by the end of 2024. Western Canadian crude and condensate production has already exceeded pre-COVID levels and could grow over 500,000 barrels per day from its 2019 peak by 2024. Though output is increasing in most major basins, the Permian leads with nearly 5 million barrels per day of supply, adding another 1 to 2 million BPD through 2024.

Ample Pipeline Capacity

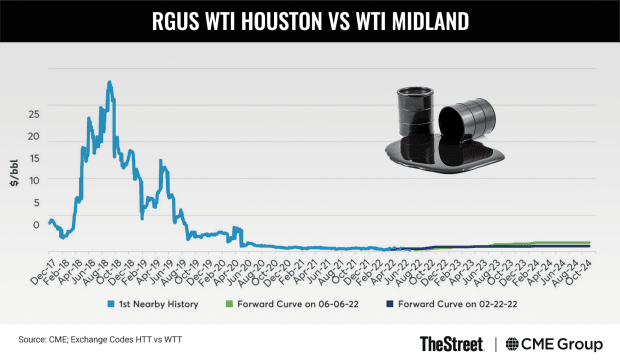

Major pipeline operators from the Permian, including Plains All American, Magellan Midstream, and Enterprise Products, pointed to rising system utilization in their latest investor materials, with forecasts through 2025 still highlighting spare crude oil pipeline capacity from the area. The regional prices for light sweet crude also reflect ample space for production growth, with the futures curves for Argus WTI Midland and Argus WTI Houston trading at narrow spreads to NYMEX WTI and to each other. In 2018, shale production outpaced the construction of pipelines, filling regional storage tanks to capacity and causing the nearby price for Argus WTI Midland to hit a low of -17.43 dollars per barrel on Aug. 30.

Spreads narrowed as pipelines expanded. Over 5 million barrels per day of pipeline space was added since then, much of which connects production directly to the Gulf Coast. Western Canadian production delivery capabilities to the Gulf Coast have also been expanded.

Oil Exports Poised to Rise

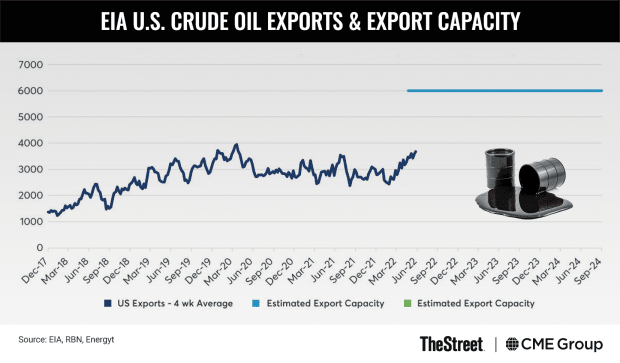

While there are ample pipelines to deliver growing oil production to the Gulf Coast, there is little room for refiners to consume more volume there. Gulf Coast refining capacity has shrunk since the prior oil production peak. Two major refineries in Louisiana closed in 2021, and a shutdown of a third in Houston is planned for 2023, representing a combined loss of approximately 750,000 BPD.

Without local demand, much of the Permian Basin and Western Canadian growth will need to make its way to the export docks along the Gulf Coast. RBN Energy estimates the effective capacity of area export terminals at 6 million barrels per day, leaving room to grow from the current levels. Exports averaged 3.7 million barrels per day over the four weeks ending May 27, up from 2.7 million in the first quarter and in line with prior highs. While seasonal refinery maintenance and withdrawals from the Strategic Petroleum Reserve (SPR) may be temporarily inflating exports, production forecasts imply that North America may have another 2 to 2.5 million barrels per day to offer the global refining market over the next 24 months.

WTI a Leader in Waterborne Export Growth

With export volumes expected to climb toward 5 million BPD in the coming years, the U.S. Gulf Coast is poised to be the second-largest origin for waterborne crude oil, behind only Saudi Arabia. While exports of heavier Western Canadian grades will also rise, most of the increase will be in Permian Basin light sweet crude.

The Texas-area benchmarks for this crude – WTI Midland and Midland-spec WTI at Houston – are already the most active U.S. markets beyond the global WTI benchmark, with futures contracts that traded over 7 million barrels per day in May. WTI is of growing interest to European and Asian refiners who will see WTI Midland become an increasing share of their refinery slate, particularly as Russian exports and light sweet volumes from the North Sea are forecast to decline. The announced inclusion of WTI Midland grade in Dated Brent, Platts’ assessment of the North Sea benchmark, for Europe underscores the importance of the WTI price abroad.

Uncertainty in the rate and timing of the increase in North American production is unsettling when inventories are tight and prices are high, but an increase is coming. Unlike in 2018, there is little uncertainty about the midstream sector’s ability to transport the production to where it is needed. As production grows, WTI will be increasingly available on the U.S. Gulf Coast to assuage shortages, and will inevitably account for a larger share of the global refinery slate.