POWR Options employs a fusion approach to trade idea generation. It combines fundamental, technical and volatility analysis to identify potential trades that have the probabilities in their favor.

It all starts with the POWR Ratings. StockNews does the heavy-lifting for you by combining 118 different factors to find the stocks with the highest probability of success (A and B rated) for bullish call buys. It also identifies the stocks with the biggest chance of failure (D and F rated) for bearish put buys.

Let’s take a walk through the process using our most recent trade in Caterpillar call options.

Fundamental Analysis

Caterpillar (CAT) was a Strong Buy (A-Rated) stock in the POWR Ratings. Also ranked near the very top at number 8 out of 78 in the Strong Buy (A-Rated) Industrial Machinery Industry.

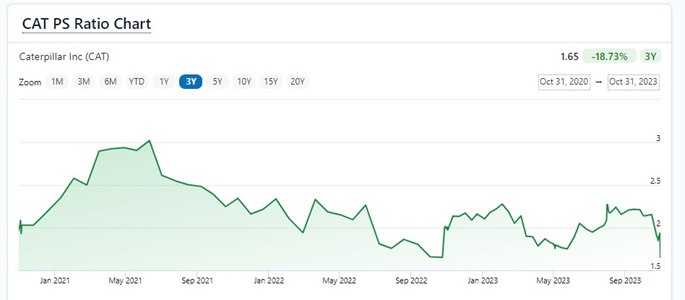

Current Price/Sales (P/S) ratio was also nearing a three-year low at just 1.65x. The last time it was at such an inexpensive multiple was October 2022-which preceded a strong rally in CAT stock price.

Technical Analysis

CAT stock reached oversold readings on a technical basis. 9-day RSI was under 20 and at the lowest levels of the past year. MACD at a similar negative extreme as well. Bollinger Percent B turned negative. Shares were trading at a big discount to the 20-day moving average. Previous times all these indicators aligned in a similar fashion marked significant lows in Caterpillar. CAT also held major support at the $225 area.

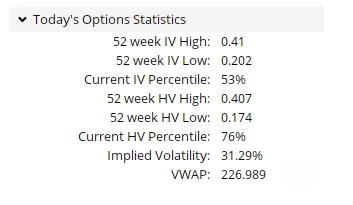

Implied Volatility Analysis

Implied volatility (IV) was trading at just the 53rd percentile post earnings, even after the sharp drop in CAT stock. This means option prices were pretty much average. Pricing was even cheaper, however, when compared to the historic volatility (HV) of 76%. Plus, it is important to remember that the VIX, an overall measure of implied volatility for S&P 500 stocks generally, was trading at just off the recent highs.

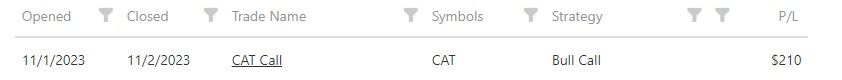

POWR Options bought the bullish CAT February $260 call options on 11/1 just after the market opened. Paid $4.10 to get in-or $410 per call.

Closed them out just a day later on 11/2 for a quick one-day gain of $210 as CAT stock rallied nicely. Shares did indeed bounce off the $225 support line. 9-day went back above 30. Bollinger Percent B regained positive territory and MACD improved as well.

This equates to just over a 50% gain in one day on the initial cost of the call of $410. Trade results shown below.

So, while CAT stock did rally 4.5% from $225 to $235, our February $260 calls gained more than 50%-or greater than 10x the amount the stock rose.

The cost of trading CAT stock versus CAT options would have been much greater, too. 100 shares of Caterpillar stock would require an initial outlay of about $22,500 (100 shares times $225 stock price). Even fully margined the stock would have tied up well over $10,000.

The purchase of the call option, which controls 100 shares of CAT stock, cost only $410 up front-or only about 2% of the stock purchase.

This highlights the power of options-and the power of the POWR Options approach.

Certainly, not all trades will work out this quickly or this well. Using the POWR ratings along with the POWR Options fusion approach can put the odds in your favor.

At the end of the day, trading is all about probabilities and not certainties.

POWR Options

What To Do Next?

If you're looking for the best options trades for today’s market, you should check out our latest presentation How to Trade Options with the POWR Ratings. Here we show you how to consistently find the top options trades, while minimizing risk.

If that appeals to you, and you want to learn more about this powerful new options strategy, then click below to get access to this timely investment presentation now:

How to Trade Options with the POWR Ratings

All the Best!

Tim Biggam

Editor, POWR Options Newsletter

CAT shares closed at $240.75 on Friday, up $1.63 (+0.68%). Year-to-date, CAT has gained 2.55%, versus a 14.93% rise in the benchmark S&P 500 index during the same period.

About the Author: Tim Biggam

Tim spent 13 years as Chief Options Strategist at Man Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 years as a Market Maker for First Options in Chicago. He makes regular appearances on Bloomberg TV and is a weekly contributor to the TD Ameritrade Network "Morning Trade Live". His overriding passion is to make the complex world of options more understandable and therefore more useful to the everyday trader. Tim is the editor of the POWR Options newsletter. Learn more about Tim's background, along with links to his most recent articles.

No Catcalls On These One Day Wonder CAT Calls StockNews.com