Nio (NIO) investors were hoping for a better reaction to the electric-vehicle company’s earnings report, which it issued before the open.

The reaction so far? Mixed.

The shares fell just over 3% near the open, flipped positive, sported a 7.5% gain for a moment, and are now up 2.5% on the day.

Covid-related shutdowns — which also hampered rival Tesla (TSLA) — created headaches for Nio in the quarter. The automaker lost 20 cents a share in the second quarter, slightly missing expectations, while revenue grew about 22% year over year to $1.54 billion and slightly topped expectations.

But revenue guidance for next quarter was a little light.

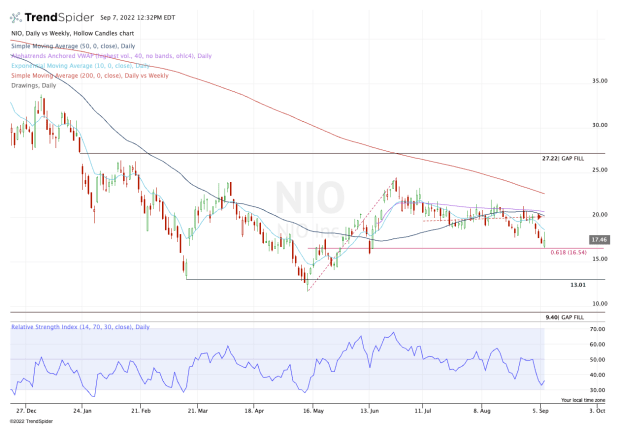

When we look at the charts, today’s post-earnings rally from the lows shows that Nio stock is trying to rally.

That said, the stock is stuck below all its major moving averages, while it faces a major hurdle at $20.

Can Nio stock get back on track?

Trading Nio Stock

Chart courtesy of TrendSpider.com

Notice how Nio stock opened at the 61.8% retracement of the recent rally, then bounced. Also notice how it’s being rejected from the 10-day moving average and the $17.75 level, which is the August low.

In that sense, the stock is stuck between a rock and hard place.

Traders without a bias don’t care which way the range breaks, but they need something to give. Specifically, they need Nio stock to either break below the 61.8% retracement (and now the post-earnings low) or to reclaim $17.75 and the 10-day moving average. Mainly the latter.

If Nio can rotate higher and clear the 10-day, it opens the door to the aforementioned $20 level.

At this level, though, investors must be aware of a number of measures. Specifically, we find the 50-day and 200-week moving averages, as well as the daily VWAP measure. Above that opens the door to the 200-day moving average.

On the downside, a break of the $16.50 level could usher in a test of the $14.50 zone, then a retest of the vital $12.50 to $13 zone. Twice now, the latter has been significant support.

Going forward, the two levels to keep in mind are the 10-day moving average on the upside and $16.50 on the downside. A break of either one can create a continuation trade in that direction.