The automotive space was hit hard during the latest pullback, but the stock performances differed sharply.

Electric-vehicle leader Tesla (TSLA) held up pretty well, as did traditional automakers like Ford (F) and General Motors (GM). Others, like Lucid Motors (LCID) and Nio (NIO), have slumped.

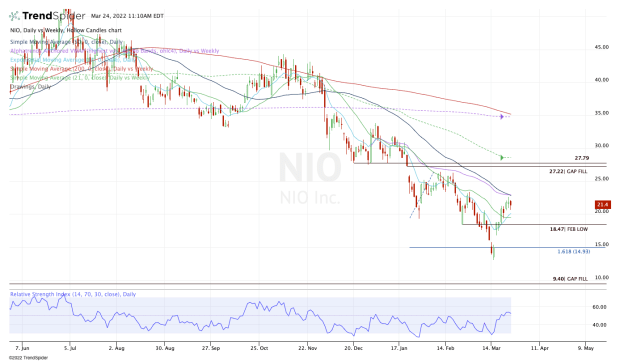

From its high more than a year ago to the recent low, Nio stock tumbled more than 80%. And even after Nio’s bounce from last week’s low — up about 65% in that stretch — the shares remain off 68% from the highs.

With Nio set to report earnings after the closing bell on Thursday, the bulls hope that the results will enable a larger relief rally.

Clearly volatility has been sharp here. Now the question is: Can the earnings report help out Nio stock, or will supply-chain issues disrupt the company’s business to the point thatinvestors are disappointed?

Trading Nio Stock

Chart courtesy of TrendSpider.com

While Nio stock has enjoyed a strong rally, it’s coming into a difficult area here as the 50-day moving average and daily VWAP measure loom overhead.

That said, it’s also above the 10-day and 21-day moving average. These two measures had been active resistance until the recent rally, but so far the 50-day has been a major hurdle.

Image source: Nio

That’s why the reaction to tonight’s earnings report will be key.

If Nio stock is able to rally above the 50-day and hold those gains on Friday, it will open up even more upside potential. Specifically, it could put last month’s high in play near $26.40.

If the shares gain momentum over that level — a monthly-up rotation — that would puts the $27 to $28 area in play. In that range, we’re looking at the gap-fill level from January, as well as prior support.

Above that puts the 21-week moving average in play.

On the downside, the bulls will want to see Nio close above $20, along with the 10-day and 21-day moving averages.

Should the stock fail to hold those levels, we must consider lower prices. Specifically, I’ll be watching last month’s low near $18.50, followed by $16.67 to $17.78 — the 61.8% and 50% retracements of the current rally.

Below all of those levels and the gap-fill level at $15.35 is in play, followed by the low near $13.