Nike (NKE) stock has traded well over the past few months, but the past few days haven’t been a walk in the park.

When the company last reported earnings on Sept. 29, Nike stock fell 13% in the following session. It hit a 52-week low in the next session and then traded significantly higher, climbing to roughly $116.50 just last week.

Obviously, the bulls are hoping the stock can continue its recent run and not have a repeat of last quarter.

Retail earnings were mixed this quarter but for the most part were received pretty well by the market. That said, the S&P 500 was in the midst of a strong rally at that time vs. the selloff we’re seeing now.

It doesn’t help that investors did not react well to Lululemon’s (LULU) earnings report on Dec. 8. Those shares are down more than 17% since then.

Trading Nike Stock Ahead of Earnings

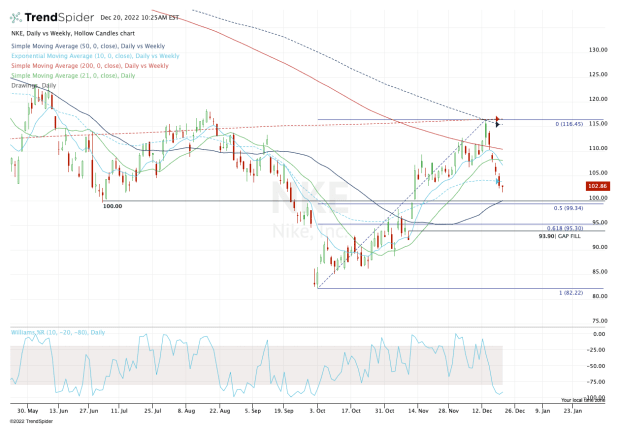

Chart courtesy of TrendSpider.com

When we looked at Nike ahead of its previous earnings report, I highlighted the $85 area as a potential dip-buy spot. The shares ultimately bottomed at $82.22, a bit lower than we expected, but the reaction out of this zone was robust.

Now that the stock has run so much, the approach is a bit different.

Notice how Nike stock ran right into the 50-week and 200-week moving averages. For traders who use only the daily charts, this might be a lesson in how a multi-timeframe approach can be advantageous.

As for the levels, the bulls would love to see the $100 area hold on a dip. Not only is that a key psychological level, but it’s also where the 50% retracement and 50-day moving average come into play.

While that is only a small dip from current levels, keep in mind that the shares are now down 12.5% from last week’s high.

A bit below this zone could put the $94 to $95 area in play, which gets us the gap-fill and 61.8% retracement.

On a bullish reaction, it’d be constructive to see a move north of $110.50. That is a big move, but will get Nike stock back above the 10-day, 10-week, 21-day and 200-day moving averages.

If we saw that type of reaction, it’d be important to see a close above $110.50, not just a rally to this level. A close above it puts the recent highs back in play.