Digital-video advertising spending is expected to rise 17% to $55.2 billion in 2023, according to a report from the Interactive Advertising Bureau released during the NewFronts.

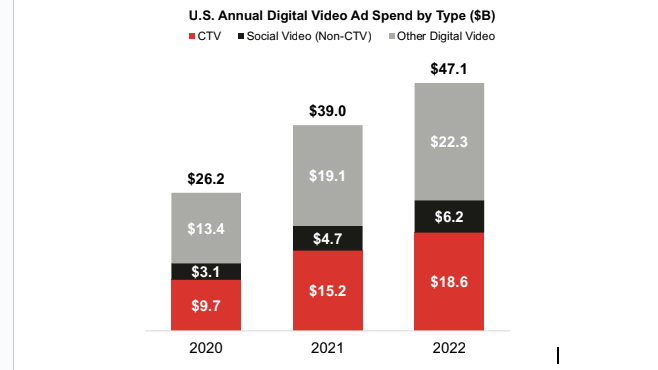

The growth would follow a 21% increase in spending on digital video advertising in 2022, according to the report from the IABm in conjunction with Standard Media Index and Advertiser Perceptions.

Connected TV spending increased 22% to $18.6 billion in 2022.

The report also sounded out buyers of TV and video about some of the key issues facing the market.

Traditional TV programmers have been tangling with YouTube and other streamers over what constitutes “premium video” and whether professionally produced video should be measured alongside user-created content.

In the study, 64% of buyers said creator-driven video can be considered premium. The percentage was higher — 69% — among the buyers with the biggest budgets.

A majority of buyers said they use the same measurement approaches for creator economy video as they do for professionally produced Hollywood-style video.

“Beauty has always been in the eye of the beholder,” Eric John, VP of the IAB’s Media Center, said. “That truism is playing out now in the world of video advertising as we see marketers and brands focusing and optimizing their spend not only in the traditional world of premium content, but also in the diverse, multiplatform world of creator content.”

A majority of buyers — 81% — said they want two or more unified currencies for impression measurement. Of those, 92% expect that will happen in the next two years.

There are disagreements over the details, with 52% saying they want viewable impressions defined by cumulative view time, while 48% what continuous view time. At the same time, 32% want a three-second minimum for viewability, 24% want five seconds and 19% said four seconds.

“As urgently as buyers want a multicurrency future, there’s no question that changing a market as large as video takes time; however, the clock is ticking,” IAB CEO David Cohen said. “To make significant progress, buyers need to come together and align on what they need, and sellers across the diverse video ecosystem need to be part of the conversation. We are optimistic about the conversations currently taking place and will continue to advocate for universal standards, transparency, interoperability, and collaboration across the industry.”

CTV is considered a must-buy by 65% of the buyers, while 64% considered social video a must-buy. The buyers said they were prioritizing addressable channels, like connected TV.

Buyers are also increasingly looking at attention as a metric, with 93% saying they use at least one way of measuring attention when planning or buying video. Half of the buyers are using biometric approaches to measuring attention, with eye-tracking leading the field at 34%.

“Buyers want to know if the audience is paying attention, and they’re making buying decisions accordingly,” added John. “Buyers want engaged audiences watching video content of all stripes, including premium and creator-driven video. They want currencies they can trust. That’s where the industry is going — the question now is how fast we will get there.”