NIB'S purchase of NDIS plan manager Maple Plan is the start of an expansion into the disability sector, says the managing director of Newcastle's stock exchange-listed private health insurer

In an interview with the Newcastle Herald on Friday in which he explained the company's thinking in buying the Melbourne-based firm, Mr Fitzgibbon said Maple Plan would continue to trade under its existing name for the time being, but the plan was for it - and the other planning companies NIB intended to buy - to be eventually rebranded under the moniker NIB Thrive.

He believed NIB was the first health insurer to move into NDIS plan management.

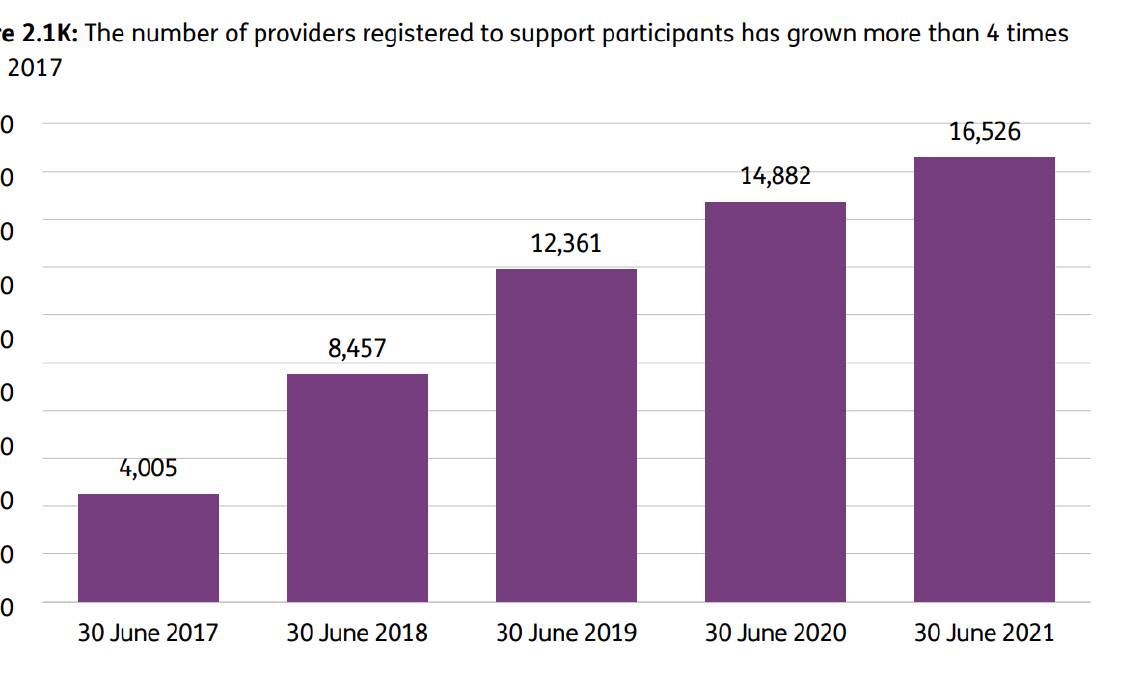

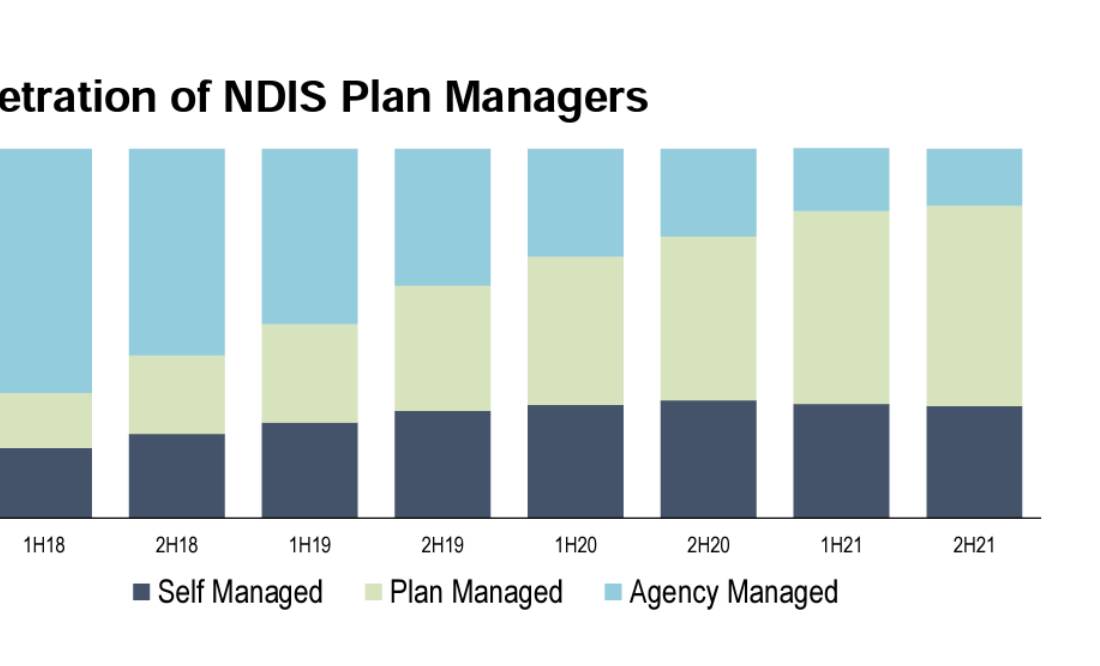

Plan managers have emerged in the National Disability Insurance Scheme as specialist organisations helping NDIS participants to deal with the funding and regulatory body, the National Disability Insurance Agency (NDIA) and more than 16,500 registered service providers - more than four times the 4000 that existed in 2017.

Mr Fitzgibbon declined to say how much NIB paid for Maple Plan, saying that it did not want to set "a floor price" for the other businesses it was intent on acquiring.

It was not "materially" significant and so did not need to be publicly disclosed at this time.

NIB documents describe Maple Plan as the seventh biggest of 1200 plan managers in the NDIS. It had abou 60 employees and 6800 clients, or about 2 per cent of the market, up from 5700 in 2020-21.

In the year to June 30, Maple Plan earned $4.8 million before income tax and depreciation on revenues of $10.4 million. Its previous year's results were earnings of $4.1 million on revenues of $7.9 million.

Maple Plan co-founder Vincent Lay said yesterday that he and partner Adrian Putra had not been thinking of selling, but that "NIB came along", was "a good fit" and would help them expand more quickly than they had been.

Mr Fitzgibbon said NIB had been thinking about moving into the National Disability Insurance Scheme for more than three years but its intentions were delayed by the COVID pandemic.

RELATED READING: Kurt Fearnley appointed chair of the NDIA

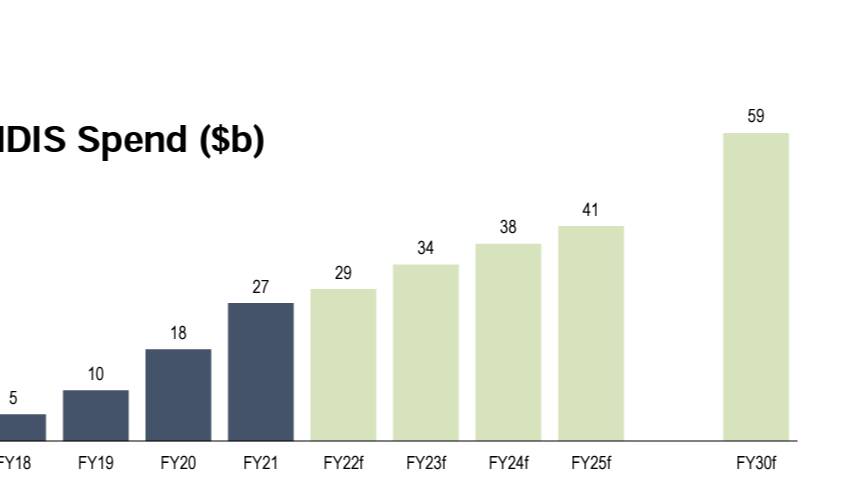

As was well known, the NDIS was expanding rapidly, with expenditure forecast to grow from $29 billion on 530,000 participants this year to $59 billion and more than 800,000 participants in 2030, and NIB believed it could bring its private health experience into the management of NDIS plans.

NIB's move into the disability sector began formally on Wednesday when it announced a halt in the trade of its shares on the stock exchange to allow for a capital raising announced that day as "approximately $150 million".

On Thursday NIB said it had raised $135 million at $6.90 a share, a 7.9 per cent discount to the $7.49 average price for NIB before the trading halt.

The capital raising created 19.6 million of new NIB shares - about 4.3 per cent of its share base - and existing shareholders will be able to buy up to $30,000 of new shares in a share purchase plan scheduled to open this week with the aim of raising the final $15 million.

In its statement to the stock exchange, NIB said the share take-up reflected support for the company's "strategic direction, its longer-term vision to move from payer to healthcare partner, and its entry into the NDIS as a plan manager".

Since converting from a mutual fund to list on the stock exchange in 2007, NIB has looked at various means to expand and diversify its business, with the move into the NDIS the latest of these.

Although its main business remains private health insurance (PHI), it told investors last year that it had "entered, differentiated and grown our NDIS plan management".

"NDIS plan management has been identified as an opportunity," the NIB document said, noting that "NDIS spend now exceeds private health insurance spend".

RELATED READING: Australian of the Year Dylan Alcott on the NDIS

The "revenue pool" was 350 million a year and estimated to more than double by 2026. NIB hoped to have 50,000 customers in its NDIS plan management by 2025.

Mr Fitzgibbon acknowledged that NIB would not be moving into the sector if it did not believe it could make money.

He questioned any assumption its earnings were guaranteed by Canberra, pointing to the pressure to cut NDIS costs, and the federal government's ultimate ability to set payment levels.

He said NIB would apply the high-tech data approach it used in private health insurance to NDIS plan management, connecting participants with high-quality providers, simplifying the process and maximising the value of their plans.

WHAT DO YOU THINK? We've made it a whole lot easier for you to have your say. Our new comment platform requires only one log-in to access articles and to join the discussion on the Newcastle Herald website. Find out how to register so you can enjoy civil, friendly and engaging discussions. Sign up for a subscription here.