President Trump isn't done with his tariff-heavy agenda just yet.

Following a 10% levy on Chinese-made goods that went into effect on February 4, as well as 25% duties on virtually all imported Mexican and Canadian goods that were thwarted by last-minute deals that delayed their implementation, the President signed new orders that could American car buyers to cough up more of their hard-earned dollars at the dealership.

💰💸 Don't miss the move: Subscribe to TheStreet's free daily newsletter 💰💸

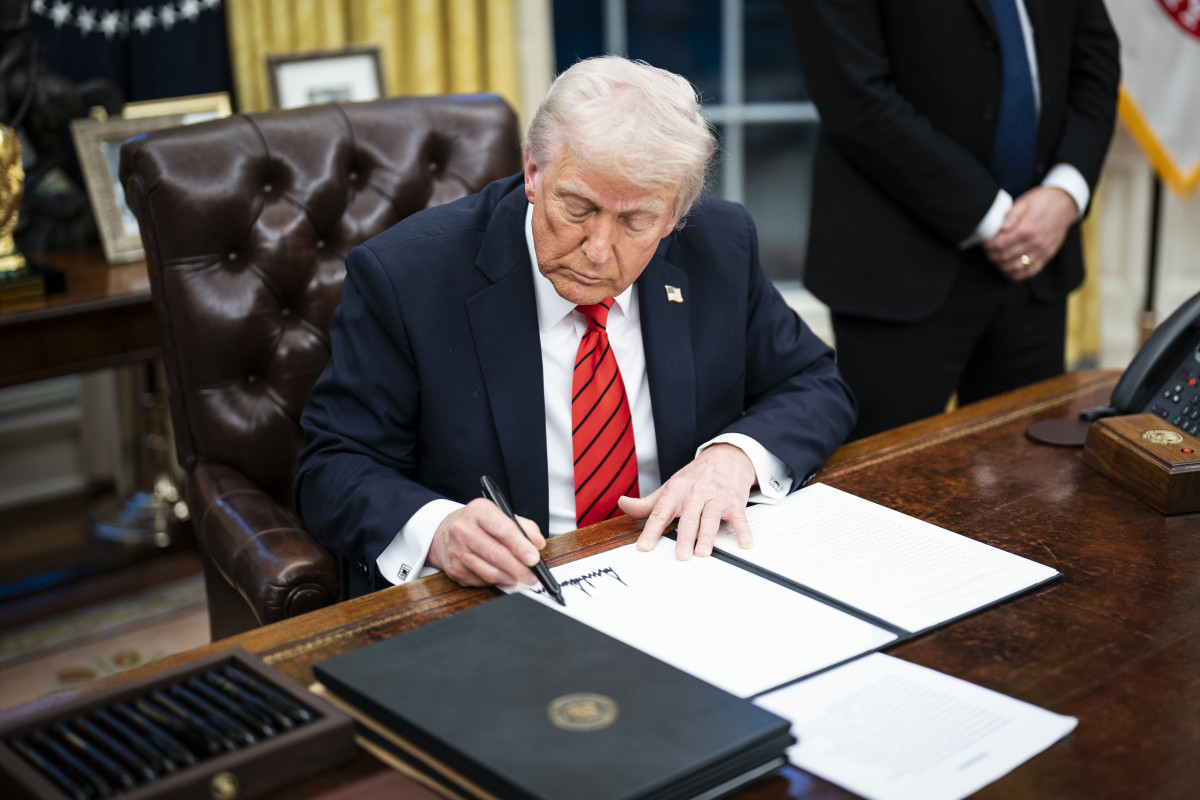

On Monday, February 10, President Trump signed two executive orders that would impose 25% tariffs on all steel and aluminum imports into the U.S., a move he intends to use to revitalize the country's industry and encourage companies to shy away from imports.

"Our nation requires steel and aluminum to be made in America, not in foreign lands we need to create in order to protect our country's future resurgence of U.S. manufacturing and production, the likes of which has not been seen for many decades," Trump said.

Not Trump's first rodeo with Steel, Aluminum tariffs.

The president's latest move is similar to one he made during his first term in office. Back in 2018, he announced tariffs of 25% on steel and 15% on aluminum, specifically targeting specific regions like the European Union, Canada, Mexico, and China, the largest steel smelter and exporter.

However, he eventually negotiated carve-outs. Tariffs against Canadian and Mexican steel were dropped in 2019 before their respective leaders negotiated and signed the United States-Mexico-Canada Agreement.

In October 2021, then-President Biden negotiated an agreement to lift the tariffs on steel and aluminum from the EU. However, in July 2024, the administration sought to close a gaping trade loophole, which Chinese steel companies took advantage of.

The former administration imposed 25% tariffs on imports of Mexican steel melted or poured outside North America and 10% tariffs on Mexican aluminum containing metal smelted or cast in China, Belarus, Iran, or Russia.

Americans import a lot of steel and aluminum

These barriers are significant because our industries import a lot of steel.

According to data from the U.S. International Trade Administration (USITA), the U.S. of A is the second-largest importer of steel, importing 25 million metric tons of the stuff in 2023.

Imported steel accounts for 25% of all steel used in the States; the most coming from just three countries: Canada, Brazil, and Mexico.

Meanwhile, about half of all aluminum used stateside was imported, the large majority from Canada. USITA data shows that aluminum imports from the Great White North reached roughly 3.2 million tons last year.

Related: Tariffs could make these popular cars more expensive

Experts warn of 'Triple Whammy' penalties for automakers

Economic and auto industry experts warn that the tariffs could have a negative effect that could translate to higher sticker prices at dealerships.

Dean Baker, a senior economist at the Center For Economic and Policy Research, told CBS MoneyWatch that he estimates that a 25% tariff on steel would translate to a price increase of $1,000 to $1,500 on the typical car; which may be boosted by domestic steel manufacturers boosting prices to take advantage of the increased cost of foreign-made steel.

Additionally, Patrick Anderson, the CEO of Anderson Economic Group, warned that if the new metal tariffs are added to the delayed 25% tariffs on Canadian and Mexican goods, automakers will face a "triple whammy" if negotiations break down.

He told Automotive News that if negotiations break down, cars could become $4,000 to $10,000 more expensive, and the figure will rise if steel and aluminum are subject to levies in addition to the import tariffs.

"It’s a two-alarm fire for the industry before we even get to additional tariffs on steel and aluminum," Anderson said.

More Automotive:

- Dodge confirms gas-powered Charger Sixpack coming this summer

- Jeep parent makes executive overhaul as it searches for new CEO

- Honda faces a massive recall over dangerous software glitch

Ford CEO: Trump is causing 'cost and chaos' to U.S. auto industry.

Though the tariffs were meant to "protect our country's future resurgence of U.S. manufacturing and production," as per Trump, auto industry leaders feel he is shaking up a very weakened and fragile industry.

In an appearance at the Wolfe Research Auto, Auto Tech and Semiconductor Conference on February 11, Ford CEO Jim Farley noted that Trump's recent moves, including deflected tariffs on Mexican and Canadian imports, have given his company much more to overthink.

"President Trump has talked a lot about making our U.S. auto industry stronger, bringing more production here, more innovation to the U.S., and if this administration can achieve that, it would be, I think, one of the most signature accomplishments," Farley said. "So far, what we’re seeing is a lot of cost and a lot of chaos."

Additionally, new steel and aluminum import tariffs can uniquely affect Ford. Ford's best-selling vehicle and the best-selling vehicle in the United States, the F-Series pickup truck, has had an aluminum body for nearly 10 model years, which helped it shed 700 pounds and be free from corrosion.

Ford CFO Sherry House said that Ford only has about 10% of its steel from Canada, and the rest from Canada, while the aluminum it sources is "not that impacted" by tariffs; however, Farley warns that some suppliers have international sources for their steel and aluminum and may likely pass on the cost to Ford.

"That’s what I’m talking about — cost and chaos," Farley said. "It’s like, a little here, a little there. Couple weeks or a couple months of vehicles and components crossing the border, that’s going to be a tariff. This is what we’re dealing with right now."

Related: Veteran fund manager issues dire S&P 500 warning for 2025

.png?w=600)