Banks could find themselves named and shamed for not providing enough support to customers facing financial difficulty amid cost-of-living pressures.

It comes after a number of the Big Four banks faced recent opprobrium for charging dead customers fees and suddenly closing branches.

The Australian Banking Association's updated code of practice takes effect on Friday with the aim of promoting trust and providing safeguards for customers.

Updates include tweaks to the definition of small businesses - which will cover 10,000 additional enterprises - and expanded support for people experiencing financial hardship.

Businesses will be permitted to carry an extra $2 million in debt before they no longer qualify as small under the updated code.

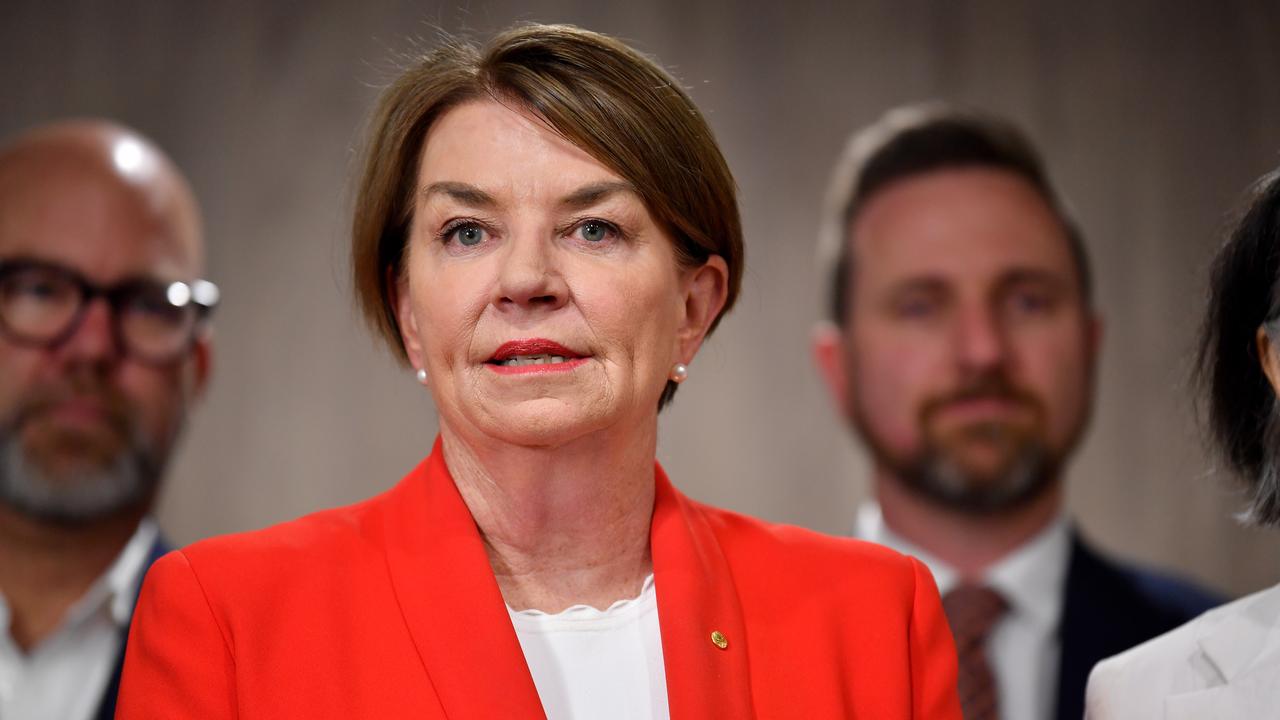

The association's chief executive Anna Bligh said the updated code sets new standards and simplifies others to make it clear what customers can expect from their bank.

"There is now greater clarity on how banks will support customers facing financial difficulty, including the hardship arrangements that can be put in place to help them get back on their feet.

"It strikes the right balance between creating new protections and simplifying parts to ensure it is easier to understand and apply - not only for bank staff but for customers and their representatives too," Ms Bligh said.

The code also contains new commitments on inclusivity and accessibility, such as organising external support like translators for people with limited English skills.

It also recommends training for staff to help them recognise when customers may be eligible for low or no fee accounts.

A public naming and shaming is the most serious sanction banks face for breaching the code, which is not legally enforced but designed to build trust and promote accountability.

ANZ was named and shamed in July for deeply concerning and significant deficiencies in its compliance frameworks after charging dead customers fees and failing to refund them quickly enough.

Westpac was called out for failing to provide adequate support to customers in the remote Northern Territory community Tennant Creek after closing a branch there in June.

The Banking Code Compliance Committee may also report serious or systemic ongoing breaches to the Australian Securities and Investments Commission.