This talk is titled "Should Wireless Networks Have a Crypto b¡Backbone?" Given that this is ETHBoston, the answer is obviously yes, for several inevitable reasons, as you'll see.

That said, little has changed in 3 decades. Wireless networks, 4G, Wifi, and Bluetooth, have been among the biggest catalysts for the last couple of decades of growth, and there's no sign of that trend slowing down. But when you think of wireless, you probably think of telco MNOs like AT&T or fiber providers like Comcast. And you'd be right to. Centrally scaled monopolies have defined the last century. But that's all about to change with the coming of age of Decentralized Wireless, or DeWi.

But what even is a decentralized wireless network? The DeWi movement is based on the idea that wireless networks make more sense for decentralized communities of motivated small businesses and people to deploy and maintain. What does that look like in practice today? Like putting a router the size of a mango in your window, providing the people around

you with solid internet connectivity, and getting paid instantly for doing so, usually in crypto. Pretty cool, right?

Here's the kicker: If you can get enough people to do it, you can create infrastructure that provides better service than incumbent telcos at a significantly lower cost. DeWi is a massive democratic movement that aims to give millions passive income by monetizing assets they already have access to, like real estate and internet connectivity.

Some protocols are already operating at scale. To highlight some:

● Helium reached a million nodes in their attempt to build a network for smart devices to communicate with each other. Why? Because nobody wants to buy an expensive phone plan for their smart Fridge – Helium is the first mover at scale, but there are others across a range of opportunities.

● Wifimaps has bootstrapped the creation of a Wi-Fi network with hundreds of millions of existing routers using a token model. They've created a community with over 4mm daily active users who are mapping and adding Wi-Fi hotspots globally to the network and offering Wi-Fi-powered phone plans on a pay-as-you-go basis.

● Finally, the trillion dollar prize, 5G: multiple players like Helium, Xnet, and others are in the race to use this decentralized model to create a 5G footprint and really challenge the TelCos at their own game. It's really early, but we are more confident they will win by the day.

At the highest level, three characteristics of DeWi define its usefulness, which helps us frame why this is important now. Networks are

- Open source and transparent

- Extremely resilient to physical attack

- Very powerful and cheap

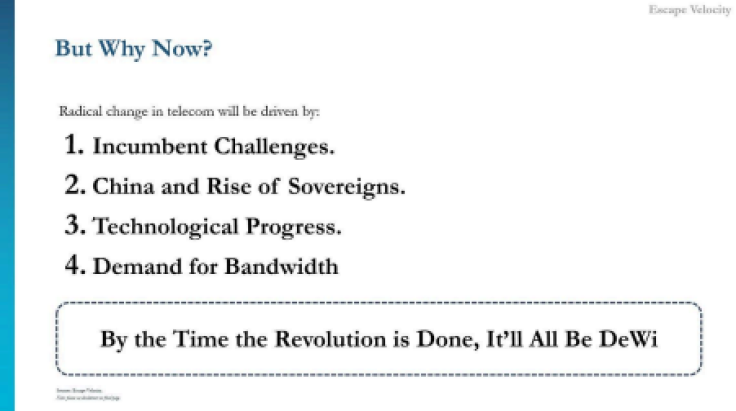

So the most significant question mark is around timing and resources - but there's never been a better way now for four different reasons:

● Incumbent Challenges: TelCos have unprecedented and fundamental issues with their business models and levels of borrowing

● Foreign Governments: Foreign sovereign countries (think China) are gaining hegemonic power and using telecom infra as a form of economic colonialism to control foreign countries

● Tech Progress: The move from a hardware-defined to a software-defined model requires a departure from the "tower" model that has dominated the industry for a century

● Demand: A continued exponential increase in global demand continues to accelerate and will only increase in scale as the internet grows

One:

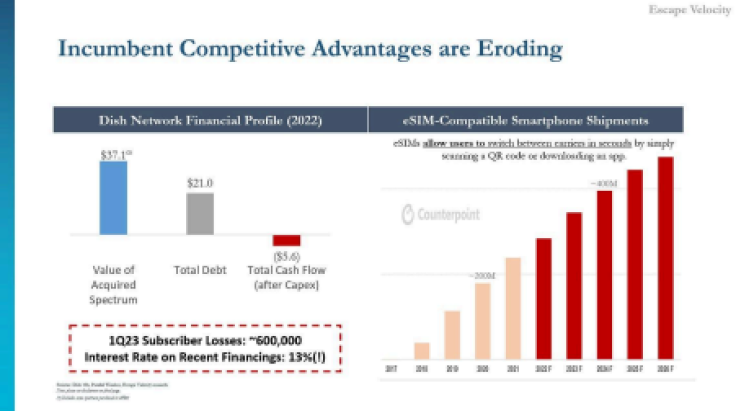

Let's start with the incumbent issues: COVID left incumbents in the US in a very tricky place because they borrowed—a lot! Against this backdrop, subscriber growth has vanished, and switching costs are disappearing, leading to far less revenue certainty than ever before.

These tedious old companies are as risky as ever, and their competitive advantages evaporate. Looking at history helps one understand why.

First, these incumbents have borrowed hundreds of billions on spectrum licenses in the last two years, the value of which they will never recoup unless they build out 5G capabilities. Dish alone borrowed 20bn for this.

Spectrum licenses help the government control the scarce availability of spectrum or radio bands that can be used to transmit signals. Decades ahead of building their network, Telcos are forced to buy these licenses to ensure that once their network is built, they will have the exclusive right to operate it. But till that network is built, the spectrum just sits idle on their balance sheet: there's nothing they can do with it - they can't finance against it, nor can they use it. They need 5G working to make it a productive asset.

Second, Telcos have seen switching costs disappear due to Apple's move to mobile ESIMs. You no longer have to go to a store, provide your passport, and wait for a person to activate your phone with a chip - you can just download an Esim, and you're good to go in 2 minutes,

and there are hundreds of options. The effects are starting to show up in subscriber losses, which imperils these companies' precarious position. Things will worsen for them before they improve, especially when you factor in the 300bn 5G buildout cost. And foreign governments aren't helping the US's cause.

Two:

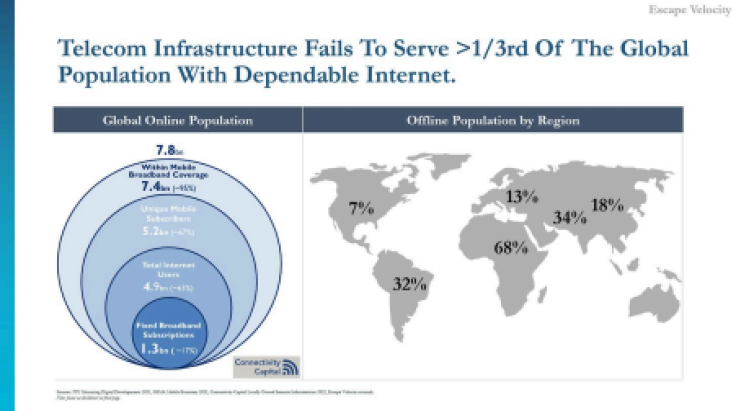

Global economic conflict is rising, and cyber security is ground zero. Emerging market Governments need more infrastructure to give citizens robust connectivity. Still, internet access is becoming a right, like food and water in developed and developing countries. India, for example, subsidizes [50]% of the total bandwidth cost for its citizens. This emergence of the internet haves and have-nots has led to opportunities for other countries (read China) to pursue economic colonialism. If you're an African country, China will subsidize your telco buildout today in return for control and information.

You've probably read something about this in the news recently, which extensively covered bans for Huawei and ZTE – Chinese mobile connectivity companies. Why? Under a program called the Belt and Road Initiative, China went to most of Africa and offered them entirely subsidized hardware – and many countries took it. In the last few years, these countries have realized China has back doors into all their wireless infra because the Chinese software operating the network is closed source, and the hardware isn't modular. Some of the stories are horrifying, and if you're curious, I highly recommend Wireless Wars by Pelson.

The battle for wireless supremacy is public—you probably saw the story about the Chinese spy balloon looking for vulnerabilities in our telecom infrastructure. The threat of network downtime is real. The first thing Russia did when it invaded Ukraine was take out key towers and their internet access.

But these problems of national security and safety are solvable: open-source software, combined with a decentralized footprint, makes it impossible to take down or surreptitiously steal information from our telecom systems. So, incumbents are in trouble, and foreign competition is rising. How do we fight back? Innovation.

Third:

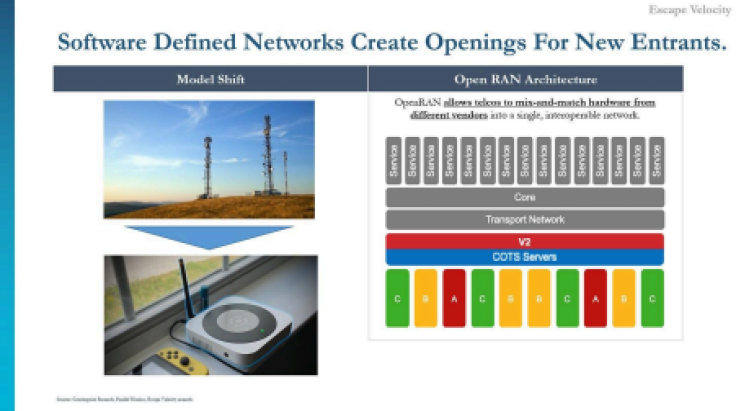

Technological progress genuinely necessitates a different model for 5G that no longer relies on specialized hardware. Like almost every industry, telecom is moving from a hardware-defined model to a software-defined one. We saw it at scale for Media and FinTech in the last decade, and sleepier industries like telecom are in for a reckoning.

Moats for telecom businesses used to relate to the specialized hardware required for the network. In that world, towers were everything, and their complexity was a massive Barrier to entry.

Historically, a cell tower has a different box for switching, routing, and receiving calls and requires specialized hardware to enable each function. Hundreds of thousands of employees are required to diagnose and fix hardware-related issues. Importantly, the tower needs to be perfectly positioned to maximize the signal, which required TelCos and tower companies to spend a lot of money on real estate that they locked up long term.

But today, All those functions - receiving, switching, etc. are done by software - which means these networks need 90% fewer people and don't need specialized hardware anymore. This is a massive headache for incumbents.

Even if Verizon builds 5G, it will still have to run its LTE and 3G networks, which have entirely different cost footprints and require significant additional resources. This diverts those resources away from growth. Verizon will continue to be on the hook for redundant land and employees, making its cost structure completely untenable. Under this framework, telcos will put off hardware build-out.

We've talked a lot about transformation, but what do these new 5G networks look like? The next generation of telecom is called open ran (radio access networks), which use commoditized, closely distributed radios to provide connectivity.

For 5G to provide the quality of bandwidth that it promises, towers are just too far apart to make the math work - you need consumer radios and antennas to achieve high speeds consistently and have probably started seeing these antennas pop up in your neighborhood already. Building 5G will require going into people's homes and convincing them to host these. We are confident a token-incentivized, blockchain-based permissionless model is more powerful than AT&T hiring 100k people to go door-to-door.

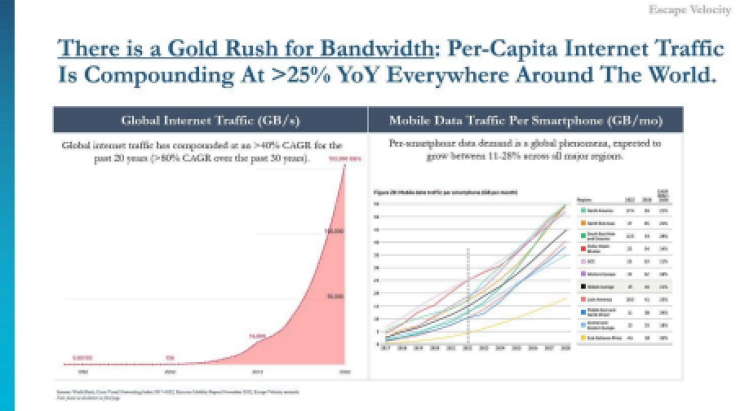

That's a lot of doom and gloom for the incumbent industry, but this brings us to the most crucial point. We are in a new gold rush, and the prize size is 1000x that of gold. No, I'm not talking about Bitcoin - this isn't even a crypto point.

As you've heard numerous examples of today, the internet continues to will power exponentially increasing economic productivity, including:

- Internet-driven financial system

- Ai powered work

- Virtual reality-powered experiences

These can potentially drive exponential increases in labor force productivity because they make it easier for humans to do basic things. So why aren't we growing faster? Venture capitalists may tell you that capital is constrained, but we've never been able to do so much with so little. The anarchists may tell you the government conflict is stopping progress, but despite all the Chinese noise, we're in a period of relative global détente.

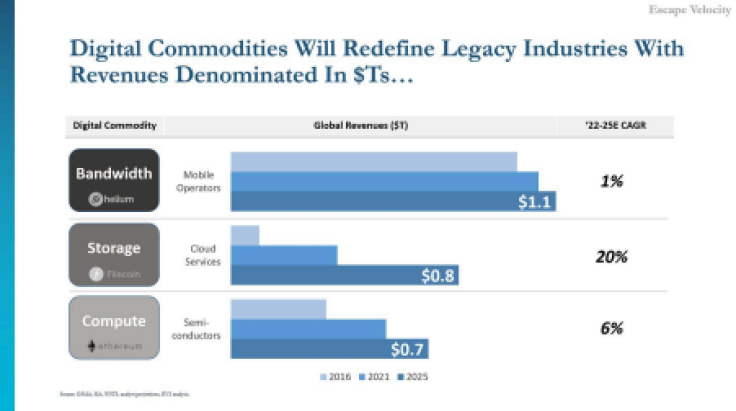

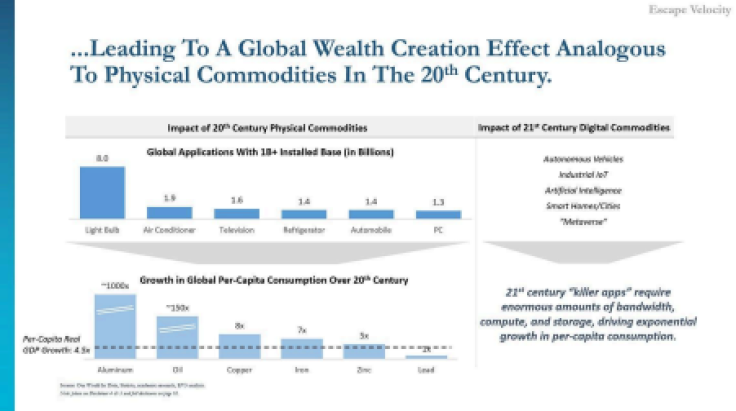

The correct answer is that the Internet is constrained by the computing, storage, and bandwidth supply - the three digital commodities that power the Internet. These will be the building blocks on which the new economy will be built, and a gold rush is underway to lock up access.

Commodities-driven growth is nothing new: one fitting analogy is to Coal in the mid-19th century, which powered the growth of railroads. Economically, the headline was cheap transportation for goods. Still, the effect was supercharging cross-national trade, which set off growth and created our capital markets and broader financial system.

The second commodity-powered boom in recent memory was Oil, which unlocked the automotive revolution. A third and arguably more ground-breaking revolution is the one powered by silicon and cobalt in the last 40 years, which led to the creation of extremely powerful hardware like supercomputers. With that came the emergence of the digital world and a whole world of possibilities outside the physical realms of time and space.

The growth of this internet-native digital world is powered by new commodities, most fundamentally compute power, storage, and bandwidth.

But the potential of the internet is nothing new, and a generation of super-innovative big-tech behemoths continue to drive rapid increases in access to these scarce resources.

Amazon and Microsoft have created monstrous cloud services businesses focusing on computing and storage. Even Google has seriously entered the fray and is pouring billions into these capabilities. Then, you have the crypto newcomers, using blockchain-based infrastructure to create and provide these commodities using distributed computing frameworks.

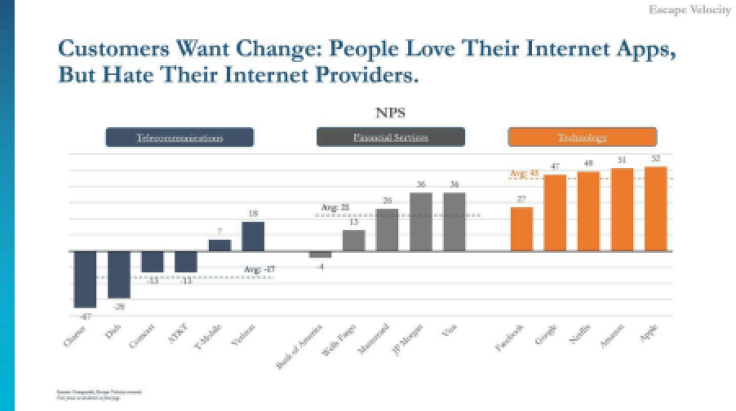

But what about bandwidth? The truth is people hate their TelCo—they consistently have the lowest NPS of any company—and they hate AT&T more than they hate rent collectors. But

to date, new approaches pioneered by Big Tech have been largely unsuccessful, driven by a key fact—these businesses always required specialized hardware... until today.

Clearly, there are infinite reasons why the world needs faster, more secure, and more resilient telecom systems. But just to hit a last, extremely important one—they are night and day cheaper than TelCos. Helium /Xnet are thinking about pricing 1GB of data transfer between 50c and $1. How? Because they have structurally lower costs. A telco's three most enormous cost buckets are spectrum licenses, rent, and salaries. DeWi reduces each by a factor.

● Spectrum these radio networks operate on a band of spectrum called CbRS, which was privatized for use by the public in 2020, so they avoid the massive upfront spectrum cost

● On Salaries, as previously discussed, the software-defined nature of the networks significantly reduces the need for maintenance and support staff; you need 100 people vs. 100k

● Finally, on rent, because people are deploying these in their homes and offices where they already pay rent, DeWi networks altogether avoid rental costs vs. telcos that pay tower companies tens of billions a year for hosting their hardware.

The result of all of this is a pricing model that is structurally 80% lower than incumbents', who, let's not forget, still have to maintain their old networks and have debt-laden balance sheets. Make no mistake: winter is here for the legacy MNOs.

There you have it: for national security, cost, innovation, and capital structure-related reasons, the next generation of telcos will be built and distributed, and the crypto model of instant payments seamlessly distributed is the perfect complementary product. We are incredibly bullish on bandwidth and the new approaches to create access to it. We suspect that if these networks work, they will quickly become some of the most valuable companies worldwide. The revolution is underway, and by the time this is all over, we will see market structures change on par with the original emergence of big tech.

Building infra is complex, and decentralized infra can be even more challenging. We're here to support anyone trying to achieve escape velocity for their network.