It’s a real conundrum for management teams in oil and gas companies: In a world in which a much-boosted “energy transition” to renewables seems inevitable to take place at some point in the future, should you attempt to transition your company’s asset portfolio and strategic mission along with it? As things currently stand, it’s a question every company with a plan to still be in business a decade from now should be working to address.

On Monday, the folks who lead the oil, gas and chemicals practice inside Deloitte released a new report titled “Portfolio Transformation in Oil and Gas” which analyzes the various decision points that company executives must make as they attempt to guide their organizations through this looming transition. Questions like:

- Should we stick to optimizing our existing oil and gas portfolio or make a bet on one or more of an array of “green” business areas?

- If we decide to “go green,” which new enterprise is our company best suited to pursue?

- Once we decide on a strategic direction, how much of our capital budget should we allocate to the new venture? And,

- How do we make this new venture profitable for our investors and shareholders?

As I noted in a previous piece, many upstream oil and gas operators will never move beyond the first question, either due to the fact that their company business model envisions being sold to an acquiring company in the near future or because they’d rather make a bet that demand for oil and natural gas will remain stronger into the future than the boosters of a rapid energy transition believe.

As Deloitte notes, even the models assuming a transition accelerated by massive government subsidy and mandates in the coming years project oil demand to be no lower than 87 million barrels of oil per day by 2030. But the base case scenarios that firms cited by Deloitte, like Rystad Energy, consider far more likely to come about project crude demand to grow over the next decade and to remain very robust out to 2050. Such projections provide strong incentive for an industry that is far more engaged in short-term thinking than in strategizing over decades to continue to focus on maximizing their oil and gas portfolios.

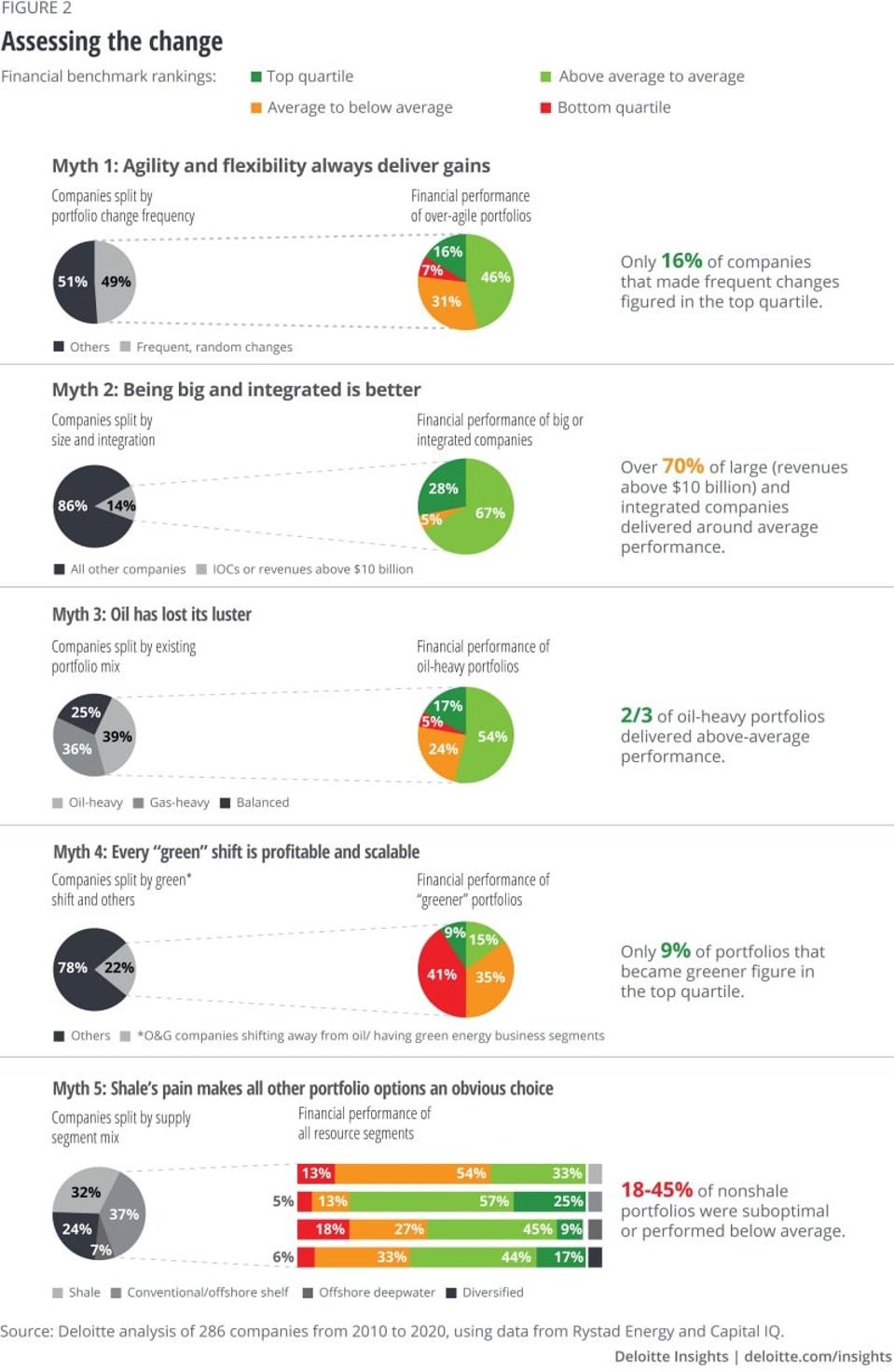

For companies who do move beyond the first question, Deloitte’s report provides insight on the remaining questions through a financial benchmarking process that looked at the financial performance of 286 companies over the past 10 years. As a result of that process, the firm debunks 5 major myths that have developed around the area of green transitioning. That process provides strong support for why some companies should consider moving into the green space while others will likely be better off focusing on repositioning and optimizing their oil and gas portfolios.

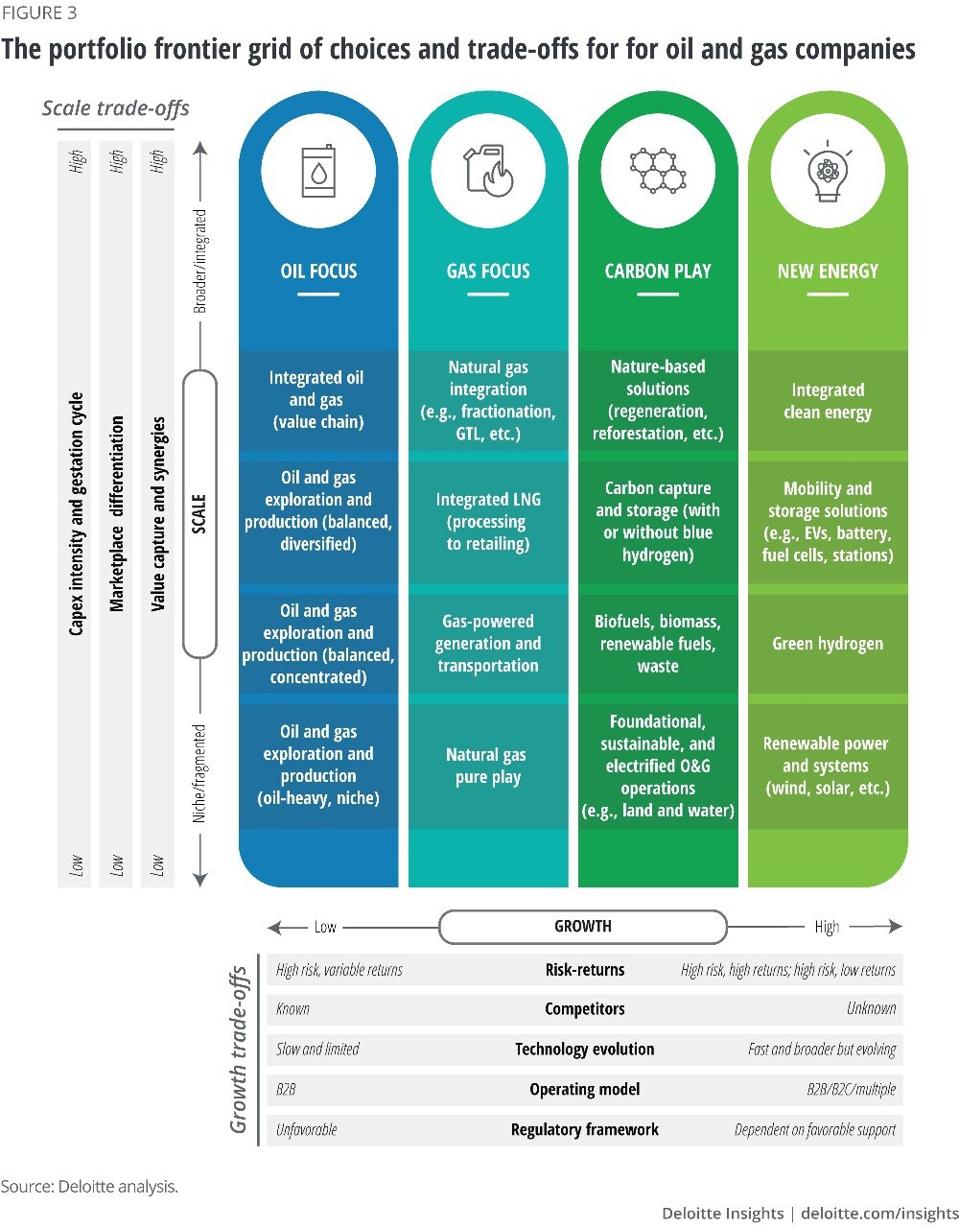

For companies that do decide to move into the green energy space, Deloitte finds strong investor sentiment favoring moves into wind and solar energy, moves that few independent producers are likely to pursue anytime soon. Potentially more relevant, though, is the growing sentiment Deloitte finds behind moves into carbon capture, usage and storage (CCUS) and green hydrogen projects, both of which require internal expertise more synergistic with that required in oil and gas-focused companies.

Overall, Deloitte estimates that, over the next 10 years, the global oil and gas industry will have the ability to deploy about $838 Billion of their future capex budgets to fund energy transition-related strategic investments. While that seems like a big number, it compares to the $525 billion annually Deloitte finds that the global industry will need to invest just to maintain static reserves levels needed to meet consumer demand for crude oil during that same decade.

Here’s how the firm summarizes the conundrum the industry faces: “Many new scalable and high-growth choices are available in the green energy space, from those adjacent to hydrocarbons (carbon plays, such as foundational sustainability measures, biofuels, and carbon capture) to those in the new energy spectrum (renewable power, green hydrogen, and mobility). The biggest portfolio conundrum (or the divide) for O&G companies, in fact, is now between these two green energy choices, with notable differences in the strategies of European and US companies. European majors, for example, have been aggressively buying in the “new energy” space through their acquisitions of renewable electricity (e.g., TOTAL’s recent $2.5 billion deal with the Indian renewable firm Adani Green Energy).18 US majors, however, seem to be prioritizing “low-carbon” choices with an aim to reduce GHG emissions and natural gas flaring from their core hydrocarbon operations.”

For any company’s management team, it’s a lot to consider, and risky even in times of comparatively high commodity prices. Those demanding that they all go green in lockstep with the prevailing societal narrative should also understand that these choices must be considered against the reality that, for more than 160 years, those who have projected the certain end of the oil industry to be just around the corner have always, without fail, ended up being surprised and disappointed by the reality to come.

None of this is easy. If it was, we’d all be doing it.