Shares of Netflix (NFLX) have performed well this year, up about 15%. But they've lagged all the streaming giant's FAANG peers.

A 15% return in less than five months in most cases is pretty good. But among the FAANG stocks, that’s about half the rate of return we’re seeing -- even from the second-worst performer.

With the latest breakout in Alphabet (GOOGL) (GOOG), those shares are now up about 33% on the year, while Amazon (AMZN) and Apple (AAPL) sport year-to-date gains of 31.5% and 32.5%, respectively.

Meta (META) (formerly Facebook) is crushing everyone, up more than 90% so far in 2023.

Don't Miss: Disney Stock: Here's When to Buy the Dip Off the Earnings Report

It’s not as if Netflix hasn’t had buyers lately either. While the stock is down about 1% on Friday, it has rallied in seven straight sessions coming into the day.

It even shook off the disappointing subscriber numbers from Disney (DIS) when the company reported earnings earlier this week.

That brings up the key question: Can Netflix stock play catchup to its FAANG peers?

Trading Netflix Stock

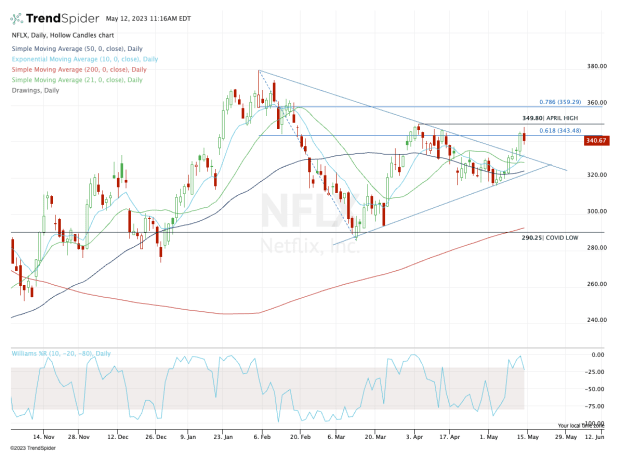

Chart courtesy of TrendSpider.com

While Netflix stock has underperformed its FAANG peers so far in 2023, it has bested the group over the past 12 months. NFLX shares have more than doubled in that span, while the next-best performer — Meta — is up 27%.

Recently, the stock has been putting in a series of higher lows and lower highs, as it consolidates into a wedge pattern.

The shares recently broke out over downtrend resistance, giving the bulls a bit of confidence that a larger upside move could be in the cards.

Don't Miss: Boeing Stock Must Clear One Level to Return to 2023 Highs

For that to happen, we’ll need to see a move over the 61.8% retracement near $343.50 and, ideally, a monthly-up rotation over the April high near $350.

If that happens, the bulls can look for a move higher, potentially up to the 78.6% retracement near $360, then into the $375 to $380 area where the shares previously topped out this year.

On the downside, the bulls would love to see the $330 to $332 area hold. Not only is that the 50% retracement of the current rally from the May low, but it’s also where the topside of prior downtrend resistance comes into play, as well as the 10-day and 21-day moving averages.

It’s not the end of the world if this area fails as support, but it would be the end of the current rally and deal a blow to the bull case in the short term.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.