Though rallying over the last few days, Netflix’s stock is still down more than 65% on the year, thanks to post-earnings plunges and broader market weakness.

Bulls are hoping the streaming giant’s numbers will be better than feared this time around, as it delivers its second-quarter earnings report on Tuesday. Also, many investors are hoping for more details about Netflix’s plans to cut costs, crack down on password-sharing and launch an ad-supported service.

Among analysts polled by FactSet, the consensus is for Netflix to report Q2 revenue of $8.03 billion (up 9% annually) and GAAP EPS of $2.95 (down 1%). However, the company’s subscriber figures tend to have a bigger impact on how its stock moves post-earnings.

Netflix guided in April for its paid streaming subscriber count to decline by 2 million sequentially in Q2 to 219.64 million, an outlook that roughly matches the FactSet consensus. For Q3, the consensus is for Netflix’s paid subs to grow by 1.41 million sequentially.

Eric Jhonsa, Real Money’s tech columnist, will be live-blogging Netflix’s report, which is due after Tuesday’s close, along with a “video interview” with management that’s scheduled to become available at 6 P.M. Eastern Time.

(Please refresh your browser for updates.)

7:11 PM ET: That's a wrap for Netflix's earnings interview. Shares are up 7.4% after-hours to $216.45 after Netflix reported it lost 970K paid streaming subs in Q2 (less than guidance and an analyst consensus of 2M) and guided for 1M Q3 paid net adds (below a 1.41M consensus, but perhaps better than feared).

The company also disclosed that it plans to launch ad-supported plans in partnership with Microsoft in early 2023, and that it expects $1 billion in free cash flow (plus or minus a few hundred million) this year, with "substantial growth" in FCF expected next year. And during the video interview, CFO Spence Neumann indicated Netflix's cash content spend (expected to be around $17B in 2022) will grow at a modest clip during the next few years.

Thanks for joining us.

7:04 PM ET: Sarandos with some closing comments. Says billions of people worldwide love streaming, and that Netflix only serves a few hundred million of them for now. "We're going to continue to lead this exciting and young industry," he says.

7:00 PM ET: A question about Netflix's 2022 FCF guide of ~$1B, and what kind of FCF growth it expects in 2023.

Neumann: We expect FCF will grow substantially next year. We're through a cash-intensive transition of our business. We expect roughly similar cash content spend in 2023 relative to 2022. That helps creates some leverage.

6:58 PM ET: A question about Netflix's 2022 op. margin guidance (19%-20% excluding $150M in restructuring costs).

Neumann: We're going to manage to a 19%-20% margin excluding any big forex changes, until we reignite revenue growth. The dollar's strengthening is a major outlier, and we have to work through that.

6:55 PM ET: Neumann notes COVID-related costs weighed on Netflix's spending efficiency the last couple of years, and that this headwind is lifting.

6:53 PM ET: A question about Netflix's content-spending plans.

Neumann: We're expecting to spend ~$17B on cash content spend this year. We're about in the right zip code for content spend over the next few years. We've had a big transition towards self-produced content that's now mostly finished. There was some pull-forward in content spend thanks to COVID. Our content spend will continue to grow, but the growth will be more moderate. And we think we've gotten smarter about directing content spend towards the highest-impact areas.

Sarandos says he agrees Netflix is "in the right zip code" for content spending.

6:49 PM ET: A question about balancing the scale of Netflix's content investments with creating quality content.

Sarandos: The focus on quality in streaming is always there. It starts with the creative talent. Our distributed decision-making approach allows our investments to scale. If everything relied on a small number of decision-makers in California, this wouldn't work.

6:45 PM ET: A question about how Netflix is approaching marketing for The Gray Man.

Sarandos: Our marketing spend can be lumpy based on the timing or major content launches. The Gray Man is the kind of original film that attracts a broad audience and drives conversation, and so we'll market it aggressively.

6:43 PM ET: A question about the reception for Season 4 of Stranger Things.

Sarandos: It's great that we can deliver such hits. Our biggest hits have come out in the last 12 months. 35 of our original shows have been nominated for Emmys this year. We're glad that our shows can be both crowd-pleasing and award-winning.

6:40 PM ET: A question about whether there are benefits to simultaneously launching ad-supported plans and dealing with password-sharing.

Peters: The efforts are independent of each other. But offering a cheaper plan to consumers who didn't see enough value in Netflix to sign up on their own should be helpful.

6:37 PM ET: A question about Netflix's efforts to deal with password-sharing.

Peters: We're finally at the point where the rubber meets the road. We have two models, one asking consumers to pay more to add an additional member, another to add an additional home. We'll see what works best. I'm increasingly confident we'll have something that we can deploy next year as we were planning.

Peters also says Netflix relies on network signals to figure out when a user isn't sharing his or her password, but simply logging into Netflix away from home.

6:33 PM ET: A question about whether the Microsoft partnership to expand to cover cloud services, gaming, etc.

Peters: We picked Microsoft because we think they'll be a great ad partner. We're super excited about our cloud partnership with AWS. We do have other partnerships with Microsoft. But this was about a great ad partnership.

6:31 PM ET: A question about why Netflix chose Microsoft over other potential ad partners.

Peters: Microsoft brought a lot of table-stakes features, including a strong commitment to privacy and data protection. Beyond those things, we saw a high degree of strategic alignment in terms of their willingness to innovate and create a new ecosystem around connected TV ads. There's also alignment in terms of caring about what brand advertisers are looking for.

6:29 PM ET: A question about whether content deals will need to be renegotiated to put them on the ad-supported service.

Sarandos: The vast majority of what's watched on Netflix today can already run on an ad-supported service. There are some things that can't and which we're talking with studios on.

Neumann: Adding more content via renegotiated deals would be nice to have, but not a must-have. We'll be disciplined in terms of what we do.

6:26 PM ET: A question about the impact of ad-supported plans on margins.

Neumann: We believe we can do this in both a revenue and profit-accretive way. We'll have some incremental costs related to the ad-supported business, but we think the unit economics will be good. Our focus is on returning to a more accelerated revenue trajectory in 2023 and 2024.

6:24 PM ET: A question about when ARM for ad-supported plans could match that for ad-free plans.

Peters: We're first launching ad-supported plans in countries with more mature ad markets. Then we'll explore other markets. The initial response we're getting from brand advertisers is quite strong. We think the unit economics will be quite good. The plans will initially be a small percentage of revenue, but will grow over time.

6:21 PM ET: A question about subscriber expectations and cannibalization risks for the ad-supported service.

Peters: Some consumers are price-sensitive. Some of them never signed up for Netflix, and some cancelled after a while. Hitting lower price points helps us better appeal to such consumers. We're confident the unit economics will be equal or perhaps even better than for ad-free plans.

6:17 PM ET: A question about the Microsoft ad partnership.

Peters: All of the ads that will be served through our ad-supported offering will be served by Microsoft. Their technical capacity complements ours. They're approaching this as an opportunity to evolve both the technical capacity and the user experience.

6:15 PM ET: A question about Netflix's plans for its ad-supported offerings.

Peters: We're taking an "innovation-oriented" approach to how we do this, as we have with past service launches. We'll take an iterative approach to how we develop this. At first, it might look like existing ad-supported services, but it'll evolve over time. Over a couple of years, we think we can deliver an ad experience that's fundamentally different from linear TV advertising.

6:11 PM ET: A question about macro effects on streaming demand.

Co-CEO/content chief Ted Sarandos: It's important that Netflix is seen as a tremendous value in tough economic times. We have a lot of great new content coming out.

Peters: Netflix is a great entertainment value. We support an array of price points. And our ad-supported service will further improves accessibility.

IR chief Spencer Wang: If you look at past economic cycles, entertainment services have generally been resilient. Home entertainment's value to consumers can grow as people go out less.

6:07 PM ET: A question about why Q3 paid net add guidance isn't higher.

Neumann: We're still seeing headwinds related to password-sharing, competition, Russia/Ukraine, etc. But as we get to a stronger seasonal period and address some of these challenges, performance will improve. But some things take time to address.

6:05 PM ET: A question about the impact of recent price hikes.

COO Greg Peters: What we've seen is generally similar to what's happened following past price hikes. We saw a slight increase in churn, but it eventually returns to normal. And the additional revenue allows us to invest more in the service to drive future growth.

Neumann: The Q3 paid net add guide reflects how churn is returning to normal.

6:04 PM ET: First question is about Q2 paid net adds.

Reed Hastings: We're executing really well in terms of content. We're also improving our merchandising, marketing, etc. Our enthusiasm is tempered by the fact that we still lost subs. But streaming continues growing. We're set up very well for the next year.

CFO Spence Neumann: The quarter largely played out as expected. Outside of forex swings, our revenue was in-line with guidance. EPS was above.

6:01 PM ET: The Q2 interview is up. JPMorgan's Doug Anmuth is this quarter's interviewer.

5:57 PM ET: Netflix is up 8% AH ahead of the video interview's release. Shares are at levels last seen in April.

5:55 PM ET: Hi, I'm back to cover Netflix's video interview. It should go up on Netflix IR's YouTube page in a few minutes.

5:01 PM ET: I'm taking a break, but will be back to cover Netflix's video interview, which is expected to go up at 6 PM ET.

Shares are currently up 7.1% after-hours to $216.10 after Netflix posted a smaller-than-expected Q2 paid subscriber decline, with Asia-Pac subscriber growth partly offsetting declines in North America and EMEA, and guided for 1M paid net adds in Q3.

4:57 PM ET: Netflix on its mobile gaming efforts:

"Since our launch of a small selection of licensed mobile games last November, we’ve released new games every few weeks, with the portfolio growing to the current total of 24. The games are all intended to be accessible to broad audiences, and span several genres and categories, including racing with Asphalt Xtreme, the digital version of the irreverent card game Exploding Kittens, zombies in Into the Dead 2 and the knitting for cats in Knittens. We’ve had millions of our members play games through the service and we are learning about what games work for different audiences."

4:53 PM ET: Netflix's cash content spend totaled $4.5B in Q2, bringing its YTD total to $8.4B. That compares with $8B in cash content spend during the first 6 months of 2021.

Total streaming content obligations amounted to $22.77B at the end of Q2, up ~$400M Q/Q. Netflix notes that 60% of the net content assets on its balance sheet now consist of internally-produced content.

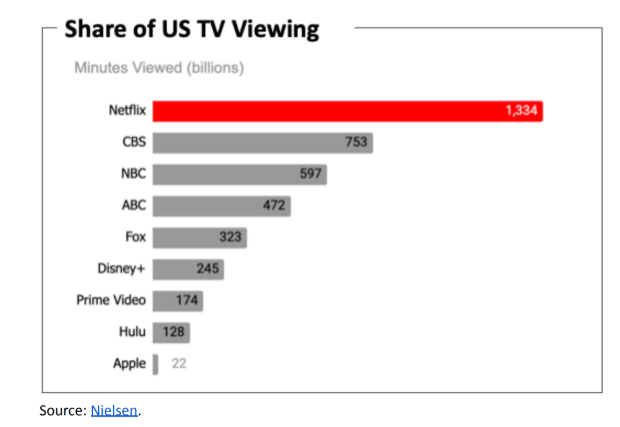

4:49 PM ET: A graph shared by Netflix comparing its share of U.S. TV viewing (per Nielsen) with that of major TV networks and rival subscription streaming services. The size of Netflix's lead over Prime Video is noteworthy.

4:42 PM ET: As always, Netflix's letter includes some viewing stats about popular originals. One notable disclosure: Season 4 of Stranger Things saw 1.3B hours of viewing during its first 28 days, the largest figure Netflix has seen to date for an English-language TV show.

"Season four also re-ignited interest in past episodes with season one through three experiencing a greater than five-fold increase in viewing in the month after the release of season four (vs. the prior month)," Netflix adds.

4:37 PM ET: With Netflix starting to pare its spending, marketing spend fell 5% Y/Y in Q2 to $575M. However, tech and development (R&D) spend rose 33% to $716.8M, and G&A spend rose 22% to $409.3M.

4:33 PM ET: Netflix ended Q2 with $5.8B in cash and $14.2B in debt.

"Our capital structure policy remains unchanged. The first priority for our cash is to reinvest in our core business and to fund new growth opportunities like gaming, followed by selective acquisitions. We target maintaining minimum cash equivalent to roughly two months of revenue (eg, about $5.3 billion based on Q2 revenue). After meeting those needs, our intent is to return excess cash to stockholders through share repurchases," the company says.

4:30 PM ET: Also: Netflix says it expects "substantial growth" in FCF in 2023 relative to 2022. That suggests 2023 FCF could be meaningfully above the FactSet consensus of $1.69B.

4:27 PM ET: Of note: Netflix says it's looking to launch ad-supported services in partnership with Microsoft in early 2023.

"They are investing heavily to expand their multi-billion advertising business into premium television video, and we are thrilled to be working with such a strong global partner," says Netflix about Microsoft.

4:25 PM ET: Netflix on its efforts to deal with password-sharing:

"We’re in the early stages of working to monetize the 100m+ households that are currently enjoying, but not directly paying for, Netflix. We know this will be a change for our members. As such, we have launched two different approaches in Latin America to learn more. Our goal is to find an easy-to-use paid sharing offering that we believe works for our members and our business that we can roll out in 2023. We’re encouraged by our early learnings and ability to convert consumers to paid sharing in Latin America."

4:22 PM ET: With the help of price hikes, Netflix's average revenue per member (ARM) rose 2% Y/Y in dollars and 7% in constant currency. That compares with 2% and 6% growth, respectively, in Q1.

4:19 PM ET: Roku is up 2.9% after-hours following Netflix's report, and Disney is up 1.6%.

4:18 PM ET: Netflix notes forex had a $339M impact on its top line in Q2, and that its Q3 revenue guide of $7.84B (below an $8.09B consensus) implies 5% Y/Y growth in dollars and 12% growth in constant currency.

Look for a lot of other U.S. multinationals to report similar forex pressures this earnings season.

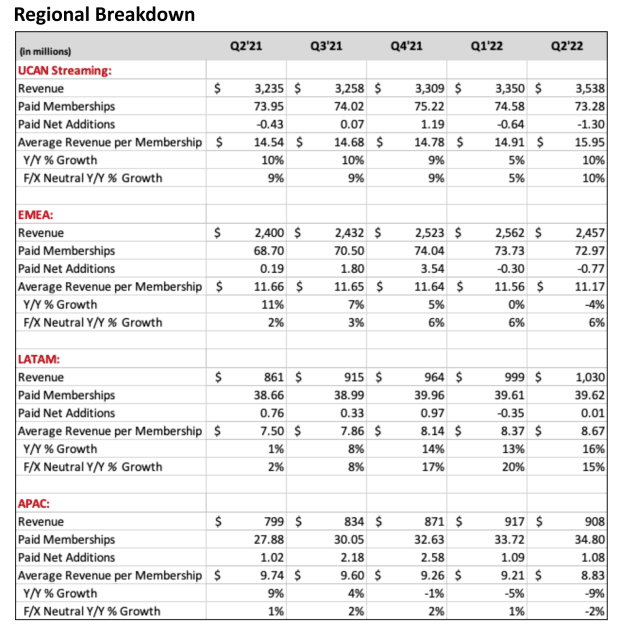

4:14 PM ET: Netflix's Q2 performance by region. Paid net adds were a little below consensus in North America and EMEA, but above consensus in Latin America and Asia-Pac. A strong dollar was a revenue headwind in EMEA and Asia-Pac.

4:10 PM ET: Netflix is now up 6.9% after-hours to $215.80. While the Q3 paid net add guide was below consensus, the better-than-expected Q2 figure is being well-received, and (as the YTD drop in Netflix's stock drives home) pre-earnings expectations were low.

4:08 PM ET: Netflix on its plans for ad-supported services:

"We’ll likely start in a handful of markets where advertising spend is significant. Like most of our new initiatives, our intention is to roll it out, listen and learn, and iterate quickly to improve the offering. So, our advertising business in a few years will likely look quite different than what it looks like on day one. Over time, our hope is to create a better-than-linear-TV advertisement model that’s more seamless and relevant for consumers, and more effective for our advertising partners."

4:06 PM ET: Netflix says it still expects a full-year GAAP op. margin of 19%-20%, excluding $150M worth of restructuring costs recorded in Q2.

Also, the company says it now expects full-year free cash flow of $1B, plus or minus a few hundred million (assuming no more big forex swings). In April, Netflix only said it expects to be FCF positive in 2022 and beyond.

4:03 PM ET: Q2 revenue of $7.97B (+8.6% Y/Y) is a little blow an $8.03B consensus (forex was a headwind). GAAP EPS of $3.20 beats a $2.95 consensus.

4:02 PM ET: The Q2 letter is out. Netflix reports Q2 paid net adds of negative 0.97M, better than guidance and a FactSet consensus of negative 2M. And it guides for 1M Q3 paid net adds, below a consensus of 1.41M.

Shares are up 8.6% after-hours.

4:00 PM ET: Netflix closed up 5.7% to $201.80. The Q2 letter should be out shortly.

3:57 PM ET: Along with its subscriber numbers, any new details shared by Netflix about its planned launch of ad-supported services will be closely watched. An ad partnership with Microsoft was announced last week.

3:54 PM ET: Netflix's stock is up 5.2% today, amid a 3% gain for the Nasdaq. But (thanks to disappointing Q4/Q1 reports and broader market declines) shares are still down 66% YTD and at levels first touched in 2017.

3:49 PM ET: The FactSet consensus is for Netflix to report Q2 revenue of $8.03B, GAAP EPS of $2.95 and paid streaming net adds of negative 2 million.

The Q3 paid net add consensus (Netflix issues subscriber guidance in its shareholder letters) is for a gain of 1.41 million.

3:46 PM ET: Hi, this is Eric Jhonsa. I'll be live-blogging Netflix's Q2 report and video interview.