The Takeaway: The median net worth of married couples in the U.S. is greater than the net worth of unmarried people at all age levels.

The comedian Henny Youngman once said that the secret to a happy marriage remains a secret.

But the king of one liners was happily married for 59 years. So he and his spouse Sadie were clearly in on the secret.

DON'T MISS: U.S. Net Worth: What Makes Up Household Wealth?

Here's something that is not a secret, just a fact: married couples tend to have a greater net worth than their unmarried counterparts.

The financial benefits of marriage have long been known, but they may be even greater than you think.

A recent report from the U.S. Census Bureau found a significant correlation between a person's marital status and their household wealth, based on an examination of the 2022 Survey of Income and Program Participation (SIPP).

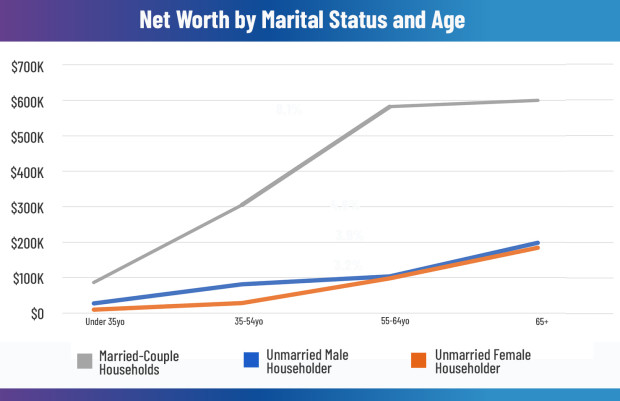

The median net worth of married-couple households, the researchers found, was greater at all age levels than that of households headed by unmarried people.

U.S. Census Bureau, 2022 Survey of Income and Program Participation, public-use data

Married householders under the age of 35 had a net worth 9.2 times more than unmarried female householders and 3.1 times more than unmarried male householders. Between the ages 35 and 54 -- a time of life when many people buy their largest asset: a home -- the median wealth of married couples surpassed that of unmarried people at an even greater clip.

“This pattern suggests that the gaps in median wealth cannot solely be attributed to the presence of an additional adult in the household,” the report said. “Otherwise, married households would have no more than twice the median wealth of unmarried households.”

Compare the Best Savings Rates

The Census defined net worth, or wealth, as the value of assets owned minus the debts owed. It included assets such as home equity, vehicles, investments, and bank accounts. The major assets not included were equity in pension plans and the value of home furnishings.

Millennials and Marriage

So what is causing this particular wealth gap, and could it get bigger?

A 2019 study by the Federal Reserve Bank of St. Louis points to a few explanations. As fewer young adults tie the knot in the 21st century, the Fed reported, marriage has become increasingly stratified.

“Shifting trends in family structure over three decades combined with an increasing concentration of assets contributed to a smaller share of young adult households, i.e. married couples, having a larger concentration of housing wealth,” the report said. In other words, marriage often leads to homeownership.

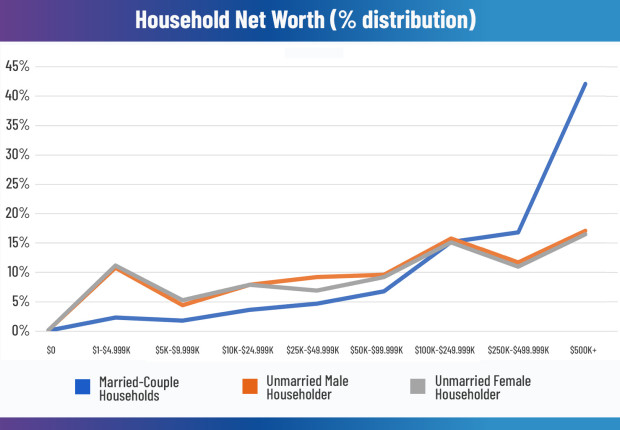

U.S. Census Bureau, 2022 Survey of Income and Program Participation, public-use data

At the same time, the Fed noted, “a growing proportion [of young adults] -- unmarried young adults -- have more financial vulnerability, specifically debt, during this transitional phase of the life course.”

The Fed also highlighted research indicating that growth in student debt levels is associated with delaying or avoiding marriage, suggesting “that young adults increasingly feel that their debt is an economic barrier to transitioning to adulthood and forming a family.”

Young households were particularly affected by the Great Recession of 2008, the Fed report noted, but unmarried young adults had balance sheets that “continue to look particularly vulnerable 10 years after the economic downturn.”

Gender and Net Worth

According to the Census report, household wealth was higher with age, regardless of marital status. But married couples continued to claim the highest net worth of all age groups -- and unmarried women the lowest. (The report didn't specify if same-sex married couples were included in the married householders group.)

Married couples aged 65 and older had a median net worth of $600,000. The median net worth for unmarried male householders and unmarried female householders of the same age was $197,900 and $184,000, respectively.

“Large gender wealth gaps indicate that many women-headed families have smaller financial cushions than those families headed by men,” The Fed wrote in 2021. "Savings and other assets blunt the impact of personal economic crises like losing incomes or being laid off, which occurred disproportionately for women during the COVID-19 recession."

Half of households were headed by women, yet they owned only 28% of total household wealth as of 2019, the Fed noted. When combined with race, the gender wealth gap was even wider, with Black and Hispanic women owning just pennies on the dollar compared with white men.