9 analysts have expressed a variety of opinions on Veracyte (NASDAQ:VCYT) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 2 | 1 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 3 | 1 | 0 | 1 | 0 |

| 2M Ago | 2 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

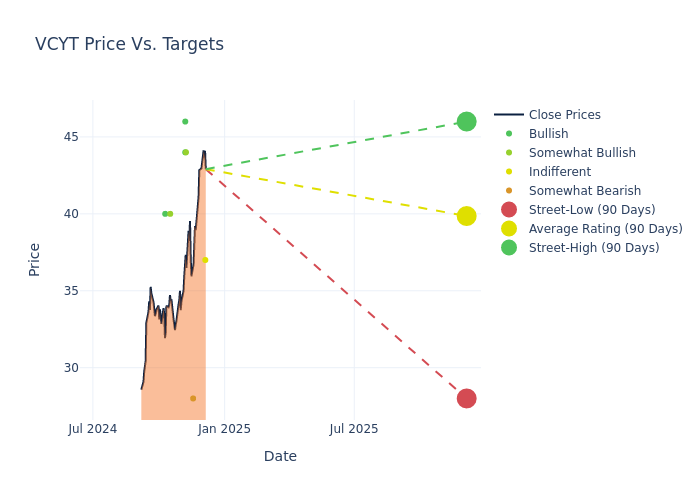

In the assessment of 12-month price targets, analysts unveil insights for Veracyte, presenting an average target of $40.0, a high estimate of $46.00, and a low estimate of $28.00. Marking an increase of 10.68%, the current average surpasses the previous average price target of $36.14.

Decoding Analyst Ratings: A Detailed Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive Veracyte. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Matthew Sykes | Goldman Sachs | Lowers | Neutral | $37.00 | $38.00 |

| Tejas Savant | Morgan Stanley | Raises | Underweight | $28.00 | $26.00 |

| Sung Ji Nam | Scotiabank | Raises | Sector Outperform | $44.00 | $40.00 |

| Matthew Sykes | Goldman Sachs | Raises | Buy | $38.00 | $34.00 |

| Lu Li | UBS | Raises | Buy | $46.00 | $43.00 |

| Mike Matson | Needham | Raises | Buy | $44.00 | $37.00 |

| Puneet Souda | Leerink Partners | Raises | Outperform | $40.00 | $35.00 |

| Lu Li | UBS | Announces | Buy | $43.00 | - |

| Subbu Nambi | Guggenheim | Announces | Buy | $40.00 | - |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Veracyte. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Veracyte compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Veracyte's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Veracyte's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Veracyte analyst ratings.

All You Need to Know About Veracyte

Veracyte Inc is a genomic diagnostics company. It provides genomic diagnostic products and services to improve patient care against diseases such as thyroid cancer, lung cancer, and idiopathic pulmonary fibrosis. The firm's product portfolio consists of products such as Afirma analysis, Percepta, Envisia, and others.

Understanding the Numbers: Veracyte's Finances

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Veracyte's remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 28.58%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Health Care sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 13.08%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 1.31%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Veracyte's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 1.21%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Veracyte's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.02.

What Are Analyst Ratings?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.