In the last three months, 7 analysts have published ratings on Brixmor Property Group (NYSE:BRX), offering a diverse range of perspectives from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 3 | 2 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 2 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 1 | 0 | 1 | 0 | 0 |

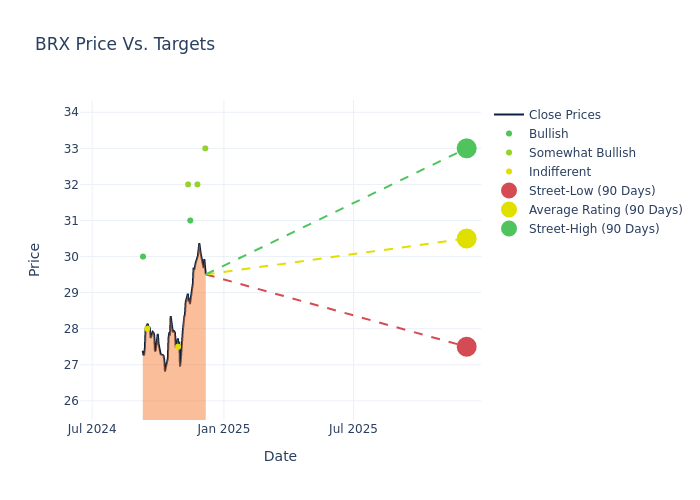

Insights from analysts' 12-month price targets are revealed, presenting an average target of $30.5, a high estimate of $33.00, and a low estimate of $27.50. This upward trend is evident, with the current average reflecting a 9.2% increase from the previous average price target of $27.93.

Investigating Analyst Ratings: An Elaborate Study

In examining recent analyst actions, we gain insights into how financial experts perceive Brixmor Property Group. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Juan Sanabria | BMO Capital | Raises | Outperform | $33.00 | $30.00 |

| Greg McGinniss | Scotiabank | Raises | Sector Outperform | $32.00 | $29.00 |

| Ki Bin Kim | Truist Securities | Raises | Buy | $31.00 | $28.00 |

| Todd Thomas | Keybanc | Raises | Overweight | $32.00 | $28.00 |

| Simon Yarmak | Stifel | Raises | Hold | $27.50 | $25.50 |

| Samir Khanal | Evercore ISI Group | Raises | In-Line | $28.00 | $27.00 |

| Floris Van Dijkum | Compass Point | Raises | Buy | $30.00 | $28.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Brixmor Property Group. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Brixmor Property Group compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Brixmor Property Group's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Brixmor Property Group analyst ratings.

Discovering Brixmor Property Group: A Closer Look

Brixmor Property Group Inc is a real estate investment trust based in the United States. The company owns and operates a portfolio of grocery-anchored community and neighborhood shopping centers across the United States. It leases its rentable areas to retailers, restaurants, theatres, entertainment venues, and fitness centers, with the company's tenants consisting of large department stores, discount retailers, and grocery stores. The company is an internally managed REIT. The company operates in Florida, Texas, California, New York, Pennsylvania, Illinois, New Jersey, Georgia, North Carolina, Michigan, Ohio and other states.

Brixmor Property Group: Delving into Financials

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Brixmor Property Group's remarkable performance in 3 months is evident. As of 30 September, 2024, the company achieved an impressive revenue growth rate of 4.35%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Real Estate sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 30.15%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Brixmor Property Group's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 3.37% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Brixmor Property Group's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.11%, the company showcases efficient use of assets and strong financial health.

Debt Management: Brixmor Property Group's debt-to-equity ratio is below the industry average. With a ratio of 1.85, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyst Ratings: What Are They?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.