The High Court ruled last week that Victoria’s road-user charge for electric vehicle (EV) drivers is unconstitutional. Because the court decided it’s an excise, only the Commonwealth can now impose such a tax.

The Victorian government introduced the controversial distance-based charge in 2021. The court decision will likely derail similar plans by other states.

Current road taxes are blunt instruments that don’t reflect the true costs of driving to society. The fuel excise does not properly account for traffic congestion or emissions. It makes no allowance for people’s ability to pay. Car registration fees are also not related to the amount of travel, congestion or emissions produced by driving.

Hence the need for road-user charges. To understand public attitudes to such charges in Australia, we surveyed more than 900 people in Melbourne and Sydney. The results of this research showed a good appetite for road taxation reform in the nation’s two largest cities.

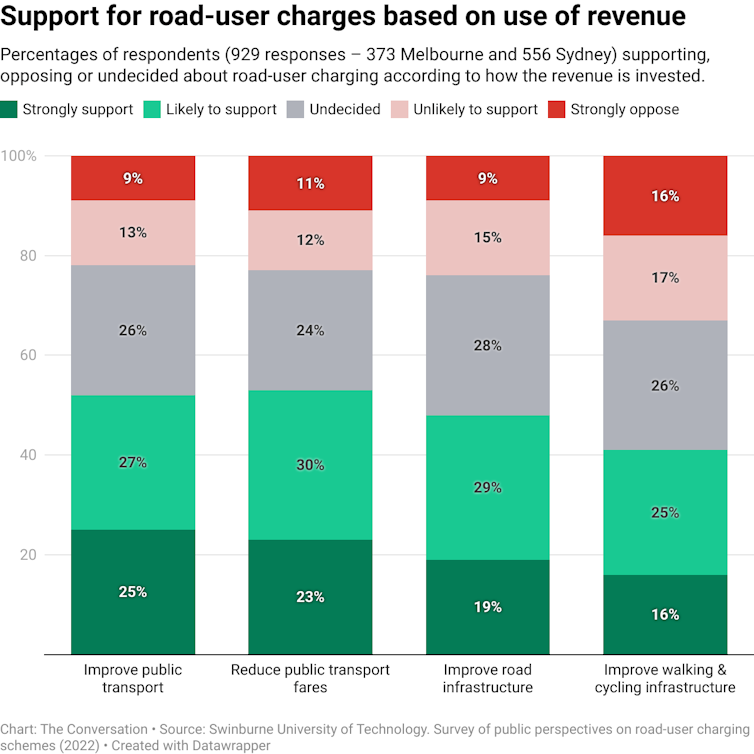

Only about a third of respondents opposed road-user charges to reduce traffic congestion in their cities. And support increased when they were told the revenue would be used to improve traffic infrastructure and public transport. The findings offer insights into how road-user charging could be rolled out successfully across the nation.

Read more: It's good the High Court overturned Victoria's questionable EV tax. But there's a sting in the tail

What do people think about road-user charges?

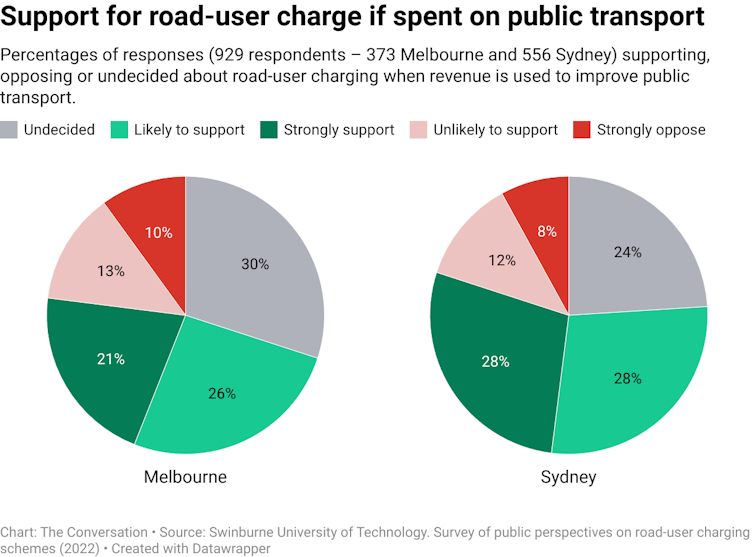

For our research, we surveyed a representative sample of 929 people (373 in Melbourne and 556 in Sydney) in April 2022 (Melbourne) and November 2022 (Sydney).

A majority of respondents (70% in Sydney and 65% in Melbourne) supported the introduction of measures to reduce traffic congestion in their respective cities.

When specifically asked if they would support road-user charges, only 32% of respondents in both cities opposed the idea. Around 29% of respondents in Sydney and 34% of respondents in Melbourne were undecided.

They were then told the revenue raised would be used to improve all forms of transport infrastructure and services. Levels of opposition and uncertainty fell.

In particular, respondents in both cities were most supportive of road-user charges if the revenue raised was used to improve public transport. Opposition fell to 20% in Sydney and to 23% in Melbourne. The percentage of undecided respondents fell to 24% in Sydney and to 30% in Melbourne.

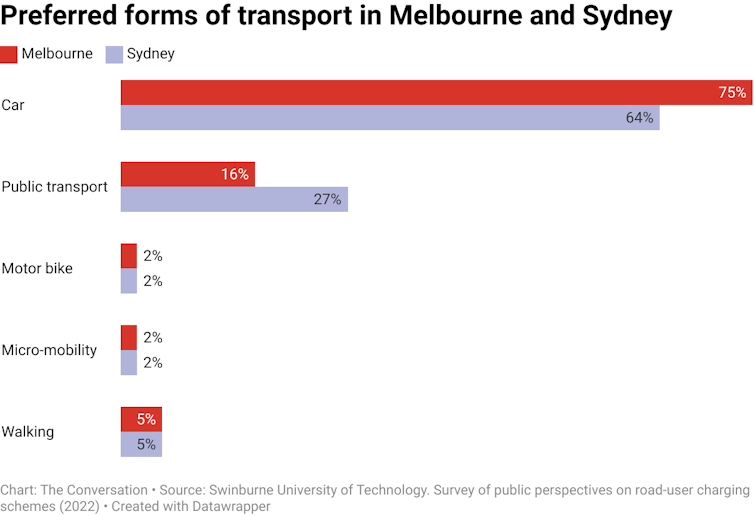

Around 96% of respondents in Melbourne owned a private car, compared to 90% in Sydney. These cars were the main means of transport for most respondents (75% Melbourne, 64% Sydney). Average vehicle occupancy was 1.25 people per vehicle in Melbourne and 1.27 in Sydney.

Sydney had a higher proportion of public transport users (27% Sydney, 16% Melbourne). Around 7% of respondents in both cities preferred walking and micro-mobility, such as bikes and scooters, as their main means of getting around.

Read more: The High Court decision on electric vehicles will make charging for road use very difficult

Savings affect willingness to pay road-user charges

We found willingness to pay a road-user charge varies with the level of expected savings.

Around 66% of respondents in both cities were willing to pay a road-user charge if it saved them up to $800 a year on registration fees and fuel taxes. Another 13% of respondents in Sydney and 11% in Melbourne were willing to pay the charge if savings exceeded $800 a year.

Around 55% of respondents in Sydney and 46% in Melbourne would be willing to pay a congestion charge if it cut their total daily travel times by 10 to 30 minutes. Another 18% of respondents in both cities would pay the charge if it cut travel times by more than 30 minutes.

Read more: Will drivers who paid Victoria's electric vehicle tax be able to get their money back?

Why oppose road-user charges?

Many factors influence public opposition to road-user charging. These include distrust in governments, uncertainty about benefits, and concerns over equity. Other barriers include understanding how the scheme works, complexity of implementation, and uncertainty about how revenues will be used.

In our survey, the undecided respondents said they needed more information to better understand the user-pays approach and its benefits. International studies have reported the same response.

Information campaigns to demystify road-user charging and highlight its benefits can win over undecided people.

Road tax system is broken

The road taxes in place today – which include fuel excise and motor vehicle ownership taxes – are near breaking point, according to political, policy and business leaders. Soaring electric vehicle sales will hasten the decline in fuel excise revenues.

Victoria’s levy of 2.8 cents for each kilometre travelled (2.3 cents for plug-in hybrids) was intended to raise revenue from drivers who don’t pay fuel excise. The High Court decision has prompted warnings of major hits to state coffers.

Tax reviews, peak bodies such as Infrastructure Victoria and experts have long called for road-user charges to replace current road taxes.

Aside from the decline in revenue, another problem with fuel excise is that drivers with different travel patterns pay the same tax. There will be drivers who travel in regional Victoria or in an outer suburb of Sydney for local shopping or school drop-offs who pay the same excise as a driver who travels into the city centre or other congested areas. This means fuel excise is less effective for reducing traffic congestion and emissions than road-user charges.

But to be effective and fair, these must be applied to all vehicles as part of a holistic national approach. It will help to manage travel demand, cut emissions and raise revenue to maintain transport infrastructure.

The road ahead

The High Court decision has placed road taxation reform squarely on the national agenda. But any road-user charging scheme that targets only electric vehicles would be a missed opportunity for meaningful reform.

Our survey findings show Australia is ready for a rational and transparent discussion about road-user charging on all vehicles, not only electric vehicles.

The findings show a majority of people would support such charges if they are transparent, equitable and replace or reduce other road taxes. Support would increase if the public is assured the revenue will be used to improve all transport infrastructure, not only roads.

If well planned and implemented, a national approach to road-user charges can raise enough revenue to replace the fuel excise tax. It will also ease congestion, promote sustainable transport and help achieve Australia’s targets for cutting transport emissions.

Hussein Dia receives funding from the Australian Research Council, the iMOVE Cooperative Research Centre, Transport for New South Wales, Queensland Department of Transport and Main Roads, Victorian Department of Transport and Planning, Department of Infrastructure, Transport, Regional Development, Communications and the Arts, and Beam Mobility Holdings.

Hadi Ghaderi receives funding from the iMOVE Cooperative Research Centre, Transport for New South Wales, Queensland Department of Transport and Main Roads, Victorian Department of Transport and Planning, Department of Infrastructure, Transport, Regional Development, Communications and the Arts, IVECO Trucks Australia limited, Innovative Manufacturing Cooperative Research Centre, Victoria Department of Education and Training, Bondi Laboratories, Australian Meat Processor Corporation, 460degrees and Passel.

Tariq Munir acknowledges the financial support received in the form of a PhD scholarship from Swinburne University and the government of Pakistan. He also acknowledges the PhD top-up scholarship received from the iMOVE CRC and supported by the Cooperative Research Centres program, an Australian government initiative.

This article was originally published on The Conversation. Read the original article.