In the preceding three months, 4 analysts have released ratings for Myriad Genetics (NASDAQ:MYGN), presenting a wide array of perspectives from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 4 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

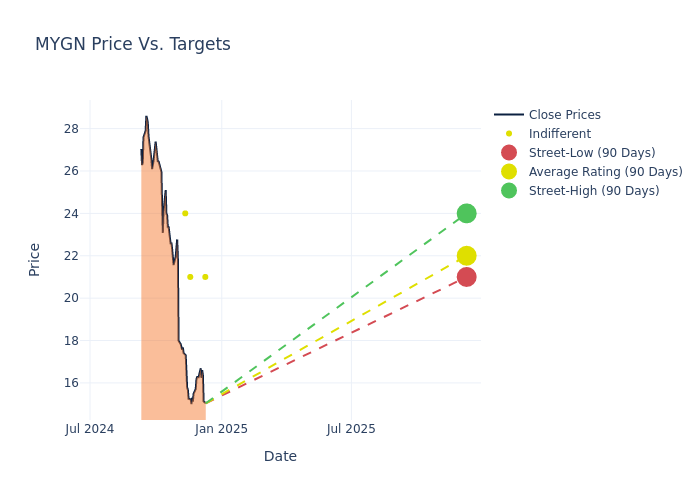

Analysts have set 12-month price targets for Myriad Genetics, revealing an average target of $24.5, a high estimate of $32.00, and a low estimate of $21.00. Highlighting a 20.12% decrease, the current average has fallen from the previous average price target of $30.67.

Decoding Analyst Ratings: A Detailed Look

A clear picture of Myriad Genetics's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Puneet Souda | Leerink Partners | Lowers | Market Perform | $21.00 | $30.00 |

| Tejas Savant | Morgan Stanley | Lowers | Equal-Weight | $21.00 | $32.00 |

| John Peterson | Piper Sandler | Lowers | Neutral | $24.00 | $30.00 |

| Tejas Savant | Morgan Stanley | Announces | Equal-Weight | $32.00 | - |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Myriad Genetics. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Myriad Genetics compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Myriad Genetics's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Myriad Genetics's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Myriad Genetics analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About Myriad Genetics

Myriad Genetics is a molecular diagnostics company that provides testing services designed to assess an individual's risk of developing a disease. The firm produces MyRisk, a 48-gene panel with the capability to identify the elevated risk of developing 11 types of cancer. Other diagnostic products include BRACAnalysis CDx, the FDA-approved companion diagnostic for PARP inhibitors; GeneSight, which helps improve responses to psychotropic drugs for patients suffering from depression; and Prequel, a noninvasive prenatal test. Precise Oncology Solutions, launched in 2022, combines Precise Tumor with companion diagnostic and prognostic tests such as MyChoice CDx, Prolaris, and EndoPredict. The firm offers biomarker discovery and companion diagnostic services to pharma and biotech companies.

Myriad Genetics: A Financial Overview

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining Myriad Genetics's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 11.15% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Health Care sector.

Net Margin: Myriad Genetics's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -10.36% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Myriad Genetics's ROE stands out, surpassing industry averages. With an impressive ROE of -3.0%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Myriad Genetics's ROA stands out, surpassing industry averages. With an impressive ROA of -2.04%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: With a below-average debt-to-equity ratio of 0.2, Myriad Genetics adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: Simplified

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.