Persistence really does pay off after all.

Women's health drug specialist Myovant Sciences (MYOV) rejected a $2.5 billion acquisition from its largest shareholder, Japanese drugmaker Sumitomo Pharma, in early October. The finer details suggested shareholders might have been subjected to a roller coaster ride, or at the very least shouldn't have expected a much higher offer.

Shareholders were luckily spared the roller-coaster ride part. Unfortunately, the other half of my forecast proved true. Myovant Sciences accepted a slightly higher acquisition price of $2.9 billion.

The outcome wasn't quite the best-case scenario should Pfizer (PFE) have started a bidding war, but that was always a long shot. The board of directors deserves credit for wrestling out more favorable terms for shareholders. The final offer price of $27 per share is 18% higher than the initial offer price of $22.75 per share.

A Case Study of Successful Drug Development

Most drug developers never earn FDA approval for a single drug candidate. Myovant Sciences has earned regulatory approvals for two different drug products: Orgovyx in prostate cancer and Myfembree in uterine fibroids. Both products share an active pharmaceutical ingredient (API) called relugolix, although the latter has multiple APIs.

It's not very common for companies to enjoy developmental, regulatory, and commercial success when going all-in on a single API. Myovant Sciences was one of the lucky exceptions.

The company landed a lucrative collaboration with Pfizer for relugolix that provided an upfront cash payment of $650 million and up to $3.8 billion in future milestone payments. Most of that bounty remains unearned. The partnership importantly provided Myovant Sciences access to world-class commercial access to support the launch and ramp of both its products.

In fiscal 2022, or the period ended March 2022, the business generated $94.3 million in net product revenue and $231 million in total revenue including milestone payments. Wall Street expects the company to generate $518 million in total fiscal 2023 revenue.

Following the science for an API, developing drug candidates in indications with severe unmet need, and attracting the attention of a pharma titan are a pretty great combination. The confluence of those factors no doubt led to the acquisition of the business.

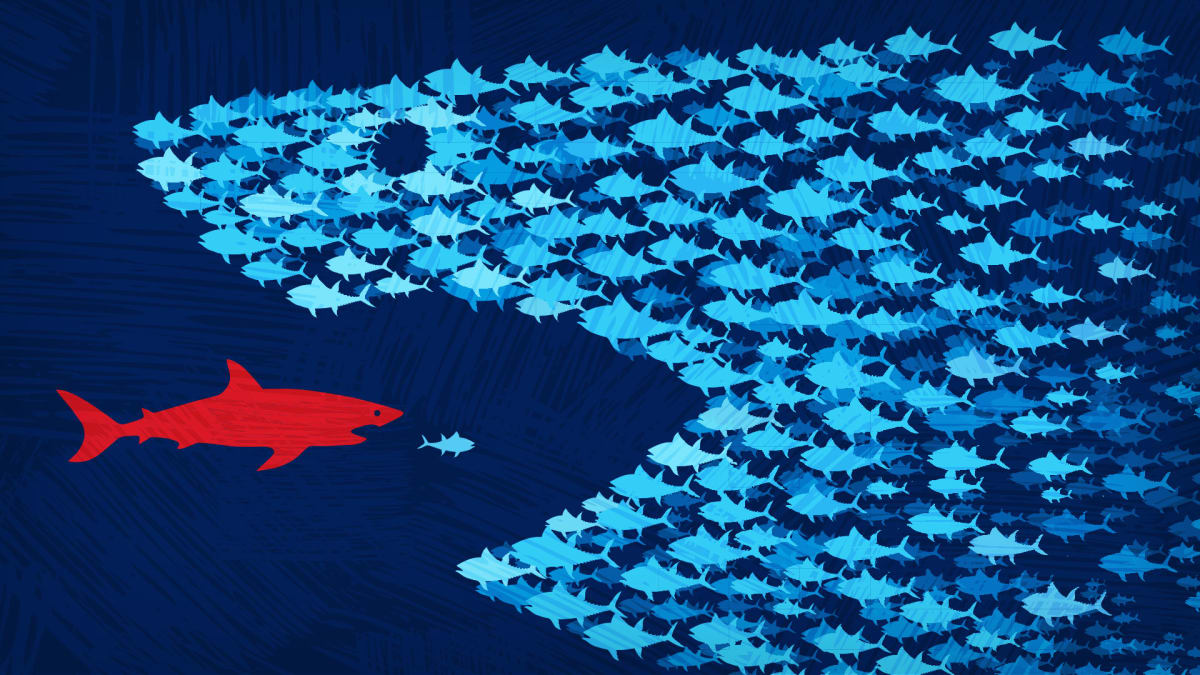

The takeover will work out handsomely for Sumitomo Pharma, which will likely tuck the operations of Myovant Sciences into its Sumitovant Biopharma subsidiary. It owned roughly 52% of the women's health specialist before the acquisition.

- The Japanese drug developer is only valued at $2.75 billion itself, so the acquisition will nearly double its valuation. Kind of. Japanese companies trade at different valuation premiums than American companies.

- However, the U.S. operations of Myovant Sciences address any concerns about a strong U.S. dollar suffocating companies doing business in Japanese yen. That will lift the market cap and fortunes of Sumitomo Pharma.

- The suitor picks up a business with over $500 million in annual revenue including milestone payments, all transacted in U.S. dollars. Myovant Sciences also ended June 2022 with $359 million in cash – also counted in greenbacks.

There are other lessons for investors. Myovant Sciences focused on a single API and had a single shareholder own over half of its shares. While that led to an acquisition, it also limited the company's pre- and post-takeover valuation.

A drug developer with a promising and de-risked technology platform may have earned a much richer premium. A technology platform could be applied to multiple drug candidates across multiple therapeutic indications.

In other words, had Myovant Sciences focused on developing a broader portfolio focused on women's health, then it may have attracted suitors for more than twice the acquisition price paid by Sumitomo Pharma. But it also would've been riskier to develop such a pipeline without the financial backing of the Japanese drug developer.

This isn't to say the acquisition is a failure. Shareholders should be thrilled with the buyout and the board of directors for wrestling out a sharper premium. The agreed-to takeover price of $27 per share represents a 55% premium to the 60-day average trading price before the initial offer. A win is a win.

Nonetheless, it does have implications for other biotech and genomics stocks, including many that are much more popular among retail investors. Multiple CRISPR gene editing companies or protein degradation pioneers with concentrated shareholders might not enjoy rich takeover premiums either, especially in the current environment. Then again, given the rough year for biotech stocks and the likely brutal slog through 2023, investors might not complain too much should one of their investments be acquired.