Top 10 rankings always make for interesting conversation – whether it’s a roster of the best presidents, colleges, athletes, etc.

Morningstar, a distinguished investment research firm, has put together a top 10 list that may be quite useful for investors.

The roster consists of 10 stocks recently purchased by 11 top mutual fund managers, as selected by Morningstar.

The funds are:

- Diamond Hill Large-Cap (DHLYX)

- Dodge & Cox Stock (DODGX)

- JPMorgan Equity Income (OIEJX)

- Loomis Sayles Growth (LSGRX)

- MFS Value (MEIJX)

- Morgan Stanley Growth (MSEQX)

- Oakmark (OAKMX)

- Parnassus Core Equity (PRBLX)

- Principal Blue Chip (PGBHX) . Rowe Price All-Cap

- Opportunities (PRWAX)

- Vanguard Dividend Growth (VDIGX) .

These are all actively managed, large-cap funds. At least one share class of each fund has earned Morningstar's top rating of gold. Oh, and all the funds hold 100 stocks or fewer.

To choose the stocks for its list, Morningstar compared the 11 funds' latest portfolios with their portfolios three months ago to learn which stocks the funds are buying.

Morningstar's top 10 list of stocks funds are buying

The 10 equities include:

No 1: Tesla (TSLA) , the electric vehicle king. Morningstar moat (durable competitive advantage) rating: narrow. Morningstar fair value estimate: $200. Thursday quote: $181.

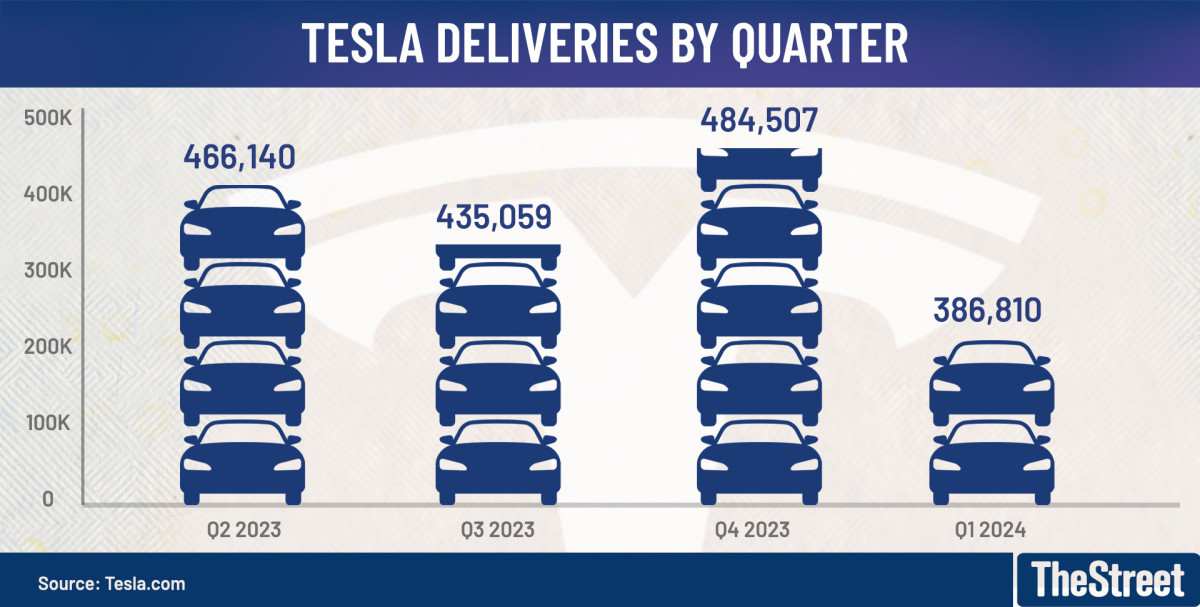

The company has suffered many woes this year, from falling revenue and deliveries To a judicial rejection of Chief Executive Elon Musk’s compensation package.

Related: Cathie Wood unveils surprising Tesla stock price target

But Morningstar analyst Steve Goldstein is bullish. “Tesla is aiming to adjust its capital expenditures investment and operating expenses to match a period of slower revenue, profit, and free cash flow growth over the next couple of years,” Goldstein wrote in a commentary.

Tesla.com

And he sees some good news ahead. “We think recent price cuts, the refreshed Model 3, and improved production at the Austin and Berlin factories should generate better sales through the rest of 2024.”

Cathie Wood’s Ark Investment Management is even more enthusiastic about Tesla. It forecast a $2,600 share price for 2029.

Ark analysts are excited about Tesla’s robo-taxi plans. Musk has focused the company on that segment amid slumping car sales and has said the robo-taxis will be unveiled in August.

“Nearly 90% of Tesla’s enterprise value and earnings will be attributed to the robo-taxi business in 2029,” the Ark analysts wrote in a commentary.

No. 2: Broadcom (AVGO) , the semiconductor giant. Morningstar moat rating: wide. Morningstar fair value estimate: $1,550. Thursday price quote: $1,736.

Related: Analysts overhaul Broadcom stock price targets after earnings

Artificial intelligence is taking center stage for this company. Morningstar analyst William Kerwin lifted his fair value estimate after Broadcom’s June 12 earnings report. That came as he raised his “medium-term” growth forecast for the company’s artificial intelligence revenue.

More Wall Street Analysts:

- Analyst updates Oracle stock price target after earnings

- Analyst reboots Trade Desk stock price target after Netflix deal

- Analysts adjust Micron stock price target ahead of earnings

“AI chip sales exceeded our expectations, and management raised its full-year guide for AI and total firm revenue,” Kerwin said. “Even so, we see the new fiscal 2024 AI guidance as conservative and model further upside.”

Fund managers like Boeing, Starbucks

No. 3: Boeing (BA) , the beleaguered airplane maker. Morningstar moat rating: wide. Morningstar fair value estimate: $221. Thursday quote: $176.

Crashes, in-air accidents, and deficient planes have bedeviled the company over the past few years, with problems constantly popping up.

Related: New Boeing whistleblower alleges company lost faulty plane parts

But, “Boeing can reestablish its footing, though some execution and supply risks remain,” wrote Morningstar analyst Nicolas Owens.

“Its narrow-bodied planes are ideal for high-frequency, short-haul routes, and its wide-bodied ones are used for long-haul and transcontinental flights.”

No 4: Starbucks (SBUX) , the giant coffee shop chain. Morningstar moat rating: wide. Morningstar fair value estimate: $96. Thursday price quote: $80.

Related: Ex-Starbucks exec delivers blunt advice to coffee giant

The stock has slumped 16% year to date amid labor conflict at the company, service issues at Starbucks stores, and inflation that has dampened customers' spending.

“Starbucks' immediate prospects look cloudy, but its longer-term trajectory is enviable,” wrote Morningstar analyst Sean Dunlop.

He said the company’s near-term priorities are “prudent.” They include investing in the in-store employee experience, fixing stores better to meet the needs of an increasingly off-premises consumer, and emphasizing a consistent customer experience across all platforms.

And the remaining stocks big funds are buying include:

No 5: Delta Air Lines (DAL) .

No. 6: Deere (DE) , the agricultural equipment company.

No. 7: Charter Communications (CHTR) , the cable TV carrier.

No. 8: Realty Income (O) , a retail real estate company (REIT).

No. 9: ServiceNow (NOW) , a software company.

No. 10: Kenvue KVUE, a health products company.

Related: Veteran fund manager picks favorite stocks for 2024

The author owns shares of Starbucks and Realty Income.