The Bank of England increased its base rate yet again in May 2023 to 4.5%, pushing borrowing costs to the highest level in almost 15 years. More than 6 million UK households will now see their mortgage payments increase by the end of 2025, with more than 4 million experiencing this in 2023.

For an average household this would mean an increase from £750 to £1,000 in monthly payments – or around 17% of average pre-tax income compared to 12% in June 2022. As the pressure of increasing interest costs, as well as rising house prices, weighs on households, mortgage lenders are developing and offering borrowers different kinds of products in response.

UK lender Skipton Building Society recently launched a 100% or no-deposit mortgage as “a lifeline to tenants across the country, to help them break out of their trapped rental cycles and onto the property ladder for the first time”. Alternatively, home loans that last as long as 40 years – so-called marathon mortgages – are on the rise. They can make it easier for some people to get on the property ladder by stretching out payments over a longer period.

But mortgage lending criteria were tightened for good reason after the 2008 global financial crisis. And while these recent relaxations may be designed to help struggling would-be borrowers trapped in rising interest rate, rent and house price hell, hopeful homeowners should be very cautious about the risks involved.

Long-term loans

Prior to 2007, mortgage terms were rarely longer than 25 years. Only about 21% of first-time borrowers and 8% of remortgages opted for such a long term in December 2007. While one lender started offering a 40-year fixed rate product at the end of 2021, marathon mortgages are long-term loans but don’t typically offer a fixed rate for the length of the loan. By 2022 more than 55% of first-time borrowers and 34% of remortgagers had home loans with terms of more than 30 years.

Mortgage terms are getting longer

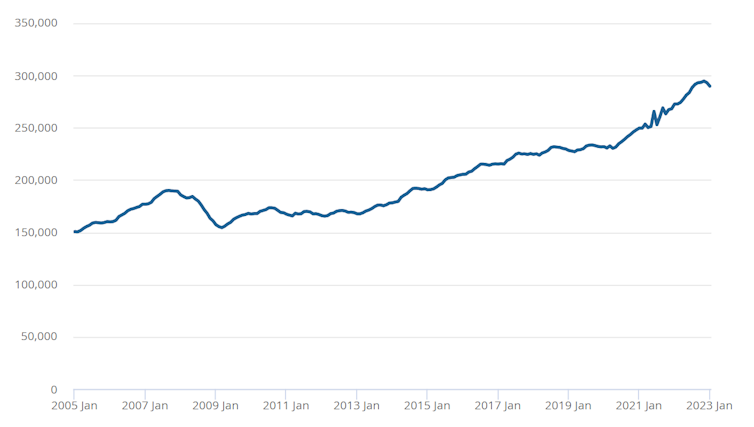

This recent resurgence is most likely due to the affordability benefits of marathon mortgages. Extending the term of a loan allows borrowers to stretch out the repayment costs of a mortgage over time. It also allows people to purchase a more expensive home – an important benefit in today’s market where average house prices have rocketed from £190,000 in 2009 to just shy of £300,000 in 2023.

House prices have been rising

Long-term mortgages also help borrowers qualify for mortgages under the stricter affordability rules introduced by the UK’s financial regulator in 2014. These rules require lenders to ensure that borrowers have sufficient monthly income to cover living expenses and other debts after their mortgage payments.

Spreading the cost to around 40 years allows marathon mortgage holders to reduce monthly costs, passing affordability assessments. Marathon mortgages do not seem to be a current concern for the regulator.

Of course, a marathon mortgage borrower could shorten their term over the years as they remortgage to avoid the lender’s standard variable rate. Also, if the base rate decreases over time, interest payments will fall and the overall mortgage will become more affordable. And, of course, any future increase in income allows a borrower to overpay during the term of the loan.

On the the other hand, long-term borrowing means significantly higher interest payments. For example, a household borrowing £250,000 at a rate of 5% for 25 years would pay a total of £188,600 in interest over the lifetime of the mortgage (assuming, for simplicity, that the interest rate does not change over the life of the mortgage). But borrowing for 40 years would result in total interest payments of £328,930 – a staggering £140,330 difference.

Marathon mortgages may also mean borrowers must make repayments well into their 70s considering the average age for first-time buyers outside London is now around 33. For some this may mean continuing to pay a mortgage into retirement. This should be a key consideration when considering long-term borrowing. It would certainly impact financial security after retirement so careful planning and independent financial advice is crucial.

No-deposit mortgages

Rising rents, coupled with soaring prices of other essential expenses such as food and energy bills, have left many first-time buyers struggling to save for a deposit. No-deposit products help first-time buyers break this cycle by swapping rental costs with mortgage payments, allowing them to eventually own their home.

Skipton Building Society’s recent launch of a “100% mortgage”, which means borrowers don’t need a deposit, aims to help first-time buyers of homes of up to £600,000 get onto the property ladder.

Such products were commonly available before the 2008 financial crisis. But the sharp fall in house prices since – mainly the 20% drop between 2007 and 2009 – is reported to have left around a million households stuck in negative equity. This is when your home is worth less than the mortgage you owe on it, leaving you unable to sell your properties.

The danger now is that the average house price today is much higher than the pre-financial crisis period (£300,000 versus £190,000). So, if such price drop were to happen in the near future, the impact would be even more devastating for no-deposit mortgagers. Although a crash does not seem to be on the cards, downward pressure on house prices is expected.

Read more: UK house prices: history says the market is in for a long slowdown not a crash

As we experienced in the aftermath of the 2008 financial crisis, relaxed lending criteria combined with borrowing beyond means can have dire consequences. It’s important for borrowers to be aware of these risks and to be very cautious when thinking about borrowing for the long term, particularly without a deposit.

Alper Kara does not work for, consult, own shares in or receive funding from any company or organization that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

This article was originally published on The Conversation. Read the original article.