KEY POINTS

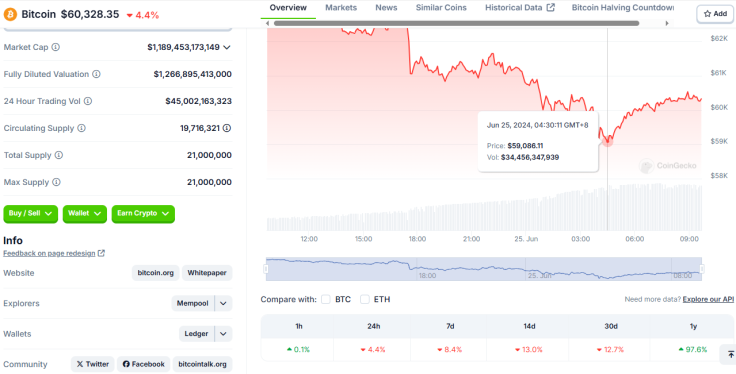

- Bitcoin slumped to $59,086 at one point on Monday

- One X user pointed to BTC's volatility and price reactions to conflict

- 'Hodlers' are trying to steady the rocking boat by calling the dip a buy opportunity

Bitcoin has crashed below the $60,000-line – $13,000 far from its glory days in mid-March – and the X community has had mixed reactions to the volatility of the world's largest decentralized digital asset by market value.

Data from CoinGecko shows that at one point, BTC dropped to $59,086 on Monday. It closed the day at over $61,000 but has since retreated once more to $60,000, as of early Tuesday morning. The digital currency's volatility has had crypto users shaking over the past few days, ever since Bitcoin started falling below $65,000.

Users on X (formerly Twitter) have expressed different views about the coin's plunge, with prominent Bitcoiner Marty Bent suggesting that there may be "some liquidity crisis on the horizon that is metastasizing behind the scenes."

One user suggested that Bitcoin's volatility may stem from "conflict," saying the digital asset appears to be "much more sensitive to fear than gold" since it plunges each time an escalation of war is reported.

Well-known BTC critic Peter Schiff didn't pass the chance to slam the asset. He said "the bear is still young," indicating prices won't rise to significant levels anytime soon. One user asked whether the coin will ever hit $100,000 as other analysts have predicted.

Despite the pessimism surrounding the digital asset, "hodlers," or crypto owners who refuse to sell their assets regardless of price action or market sentiment going down the drain, are holding the line for newbie Bitcoiners or small owners.

Bob Burnett, the CEO of BTC mining firm Barefoot Mining, presented a level-by-level drop of the digital currency from $62,000 through $54,000 – the last figure being what he said is the stage when miners "reach the full depth of Hell and turn to ashes." However, he said the "Phoenix will rise from the ashes though so don't worry."

When Bitcoin drops to $62K it means miners enter limbo and the first circle of Dante's Hell.

— Bob Burnett (@boomer_btc) June 24, 2024

At $61K they descend another level into Hell, the heat turns up and profuse sweating commences.

At $60K they descent to level three and mashing of teeth occurs.

At $59K you will…

Interestingly, hashrate data showed that Bitcoin's mining hashprice fell nearly 52% Monday afternoon. For Uphold's Martin Hiesboeck, U.S. miners will continue selling to keep their business afloat during this critical time for the BTC mining sector.

Crypto analyst @rektcapital said the coin's downturn is taking place "in an effort to build a base from which it could springboard from to higher levels in the range," suggesting that a spike may occur after Bitcoin completes the low-range period.

#Bitcoin has dropped ~$74K to ~$60K in the last 3 months

— Rajat Soni, CFA (@rajatsonifnance) June 25, 2024

Anyone who studied Bitcoin is buying

Anyone who only bought to make money is selling

When the price drops, Bitcoiners see an opportunity

While average retail investors (who don't understand markets) see weakness

Rajat Soni, who calls himself the "Bitcoin guy," said anyone who has studied the digital currency "is buying" at this time, taking advantage of the slump to stack up on sats – the asset's smallest unit.