Monster Beverage Corporation (MNST) markets and distributes energy drinks and alternative beverages in the U.S. and internationally. Its offerings include energy drinks, iced tea, lemonades, juice cocktails, fruit beverages, and more. With a market cap of $47.8 billion, Monster operates through Monster Energy Drinks, Strategic Brands, Alcohol Brands, and Other segments.

The Corona, California-based beverages giant has significantly underperformed the broader market over the past year. MNST stock has plunged 10.8% over the past 52 weeks and 6.1% on a YTD basis compared to the S&P 500 Index’s ($SPX) 23.3% surge over the past year and 2.6% gains in 2025.

Narrowing the focus, Monster has also underperformed the industry-focused Nasdaq Food & Beverage ETF’s (FTXG) 4.8% decline over the past 52 weeks and a marginal 91 basis points dip in 2025.

The growing preference towards healthier alternatives and competition faced from new unlisted players has notably impacted Monster’s performance.

Monster Beverage’s stock prices plunged 1.1% after the release of its disappointing Q3 results on Nov. 7. The company reported a modest 1.3% year-over-year growth in net sales to approximately $1.9 billion which missed the Street’s expectations by 1.8%. Meanwhile, the company observed a massive 9.9% increase in its operating expenses to $519.9 million, which led to its operating margins contracting 199 basis points compared to the year-ago quarter to 25.5%. Its operating income for the quarter dropped nearly 6% year-over-year to $479.9 million and its adjusted EPS of $0.40 missed analysts’ estimates by 4.8%.

MNST is set to announce its fiscal 2024 results in the upcoming month and analysts expect a 4.5% year-over-year increase in its non-GAAP earnings to $1.62 per share. However, the company has missed analysts’ consensus estimates in each of the past four quarters.

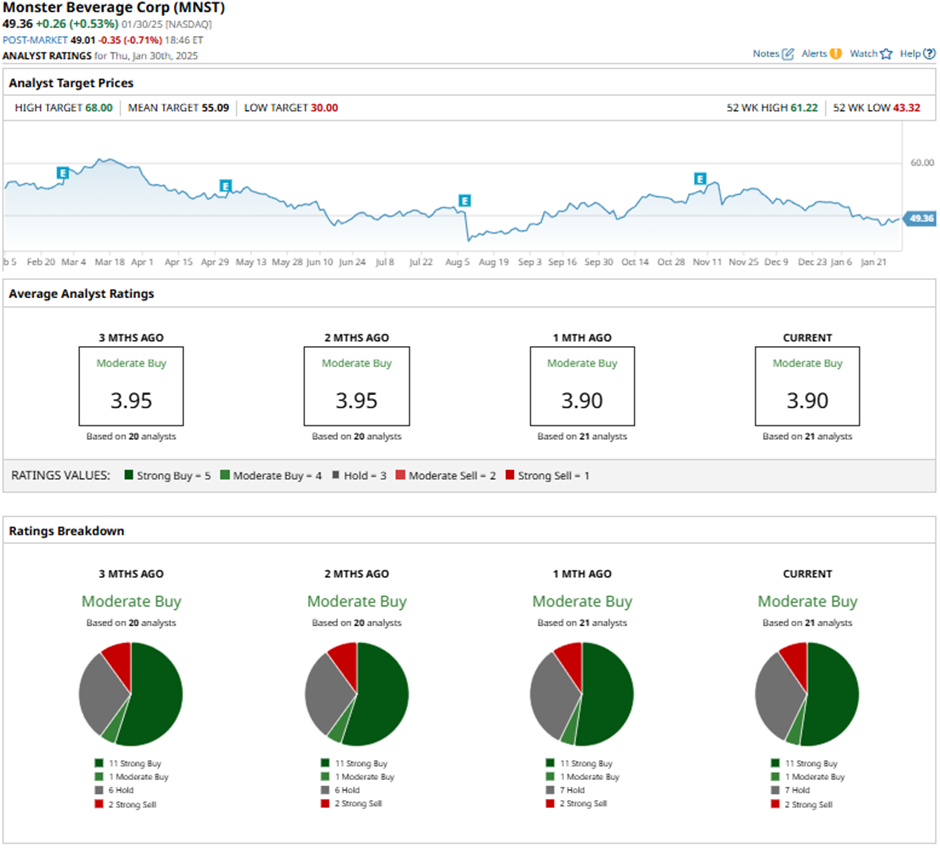

Despite the lackluster performance, the consensus view on MNST is moderately bullish. Among the 21 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings, one “Moderate Buy,” seven “Hold,” and two “Strong Sell.”

This configuration has been mostly stable over the past year.

On Jan. 22, RBC Capital analyst Nik Modi maintained a “Buy” rating with a price target of $59 which indicates a 19.5% premium to current price levels.

MNST’s mean price target of $55.09 suggests an 11.6% upside potential from current price levels.