There’s little doubt that raising a child is expensive. Adequate shelter, nutritious food, education, clothing, and entertainment are just a few of the things kids need to grow up happy and healthy.

The costs can quickly add up, and it’s estimated that middle-income parents spend about $310,605 on a child. No wonder some of them hope their kids will help them financially in the future.

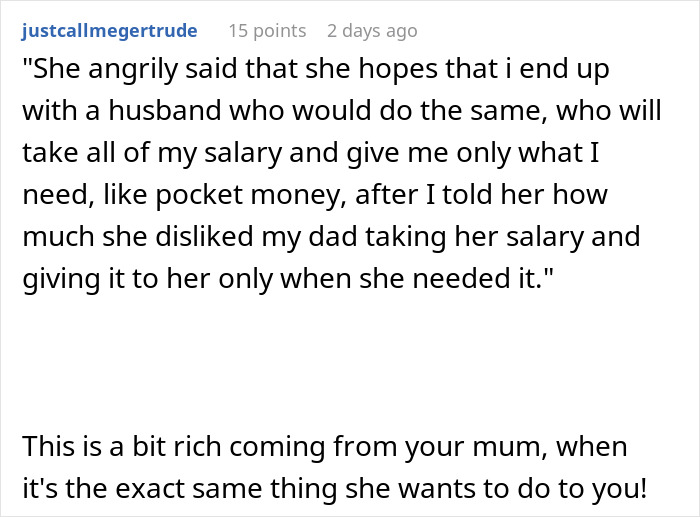

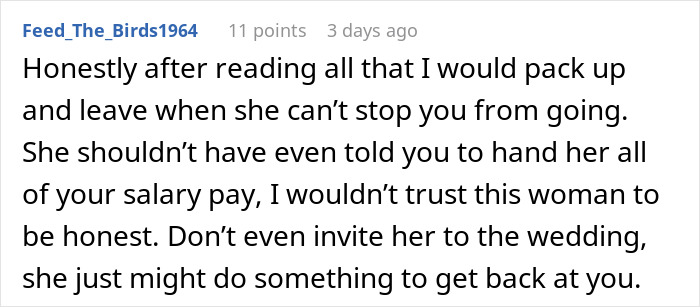

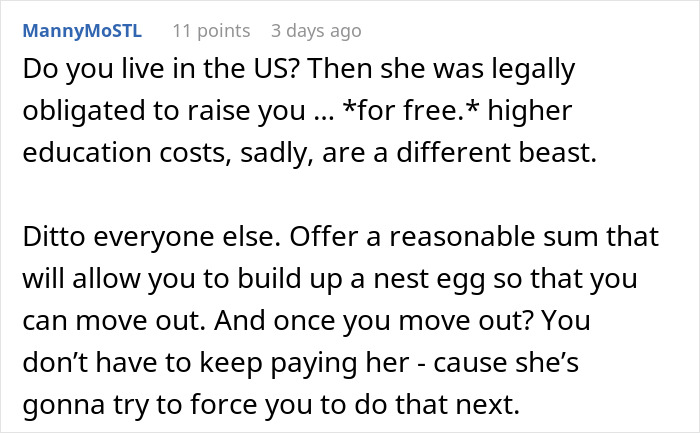

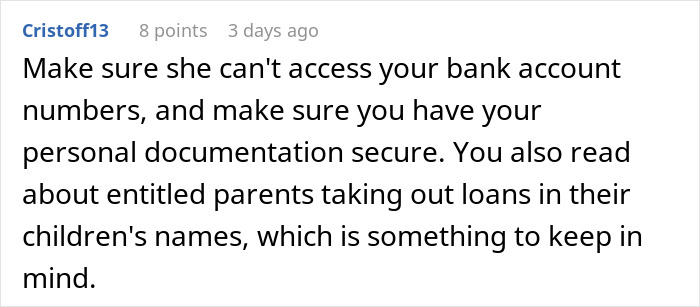

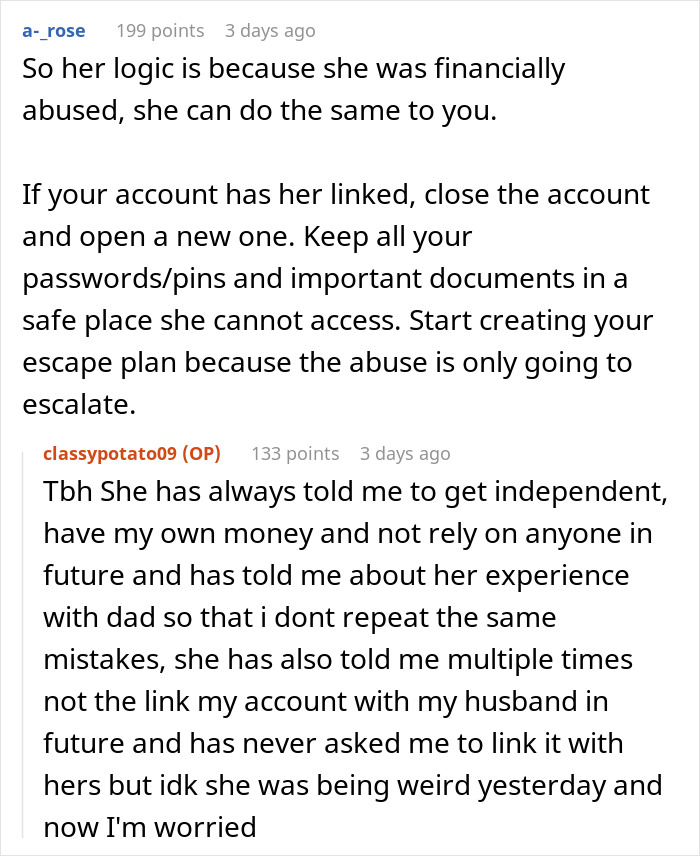

However, redditor classypotato09’s mother took this to the next level, asking for her entire salary. The daughter found such a request ridiculous and said no, which extremely upset her mom. Feeling like she’s demanding too much, the author turned to the “Entitled Parents” subreddit, asking for netizens’ opinions.

Scroll down to find the full story and a brief chat with investing and personal finance expert Ryan King from “Making Money Simple,” who kindly agreed to provide his take on financial support for parents.

Parents give a lot to their children in hopes of receiving similar help in the future

Image credits: Karolina Grabowska / pexels (not the actual photo)

But this mom demanded her daughter’s full salary, planning to leave her without a penny

Image credits: halfpoint / envato (not the actual photo)

Image credits: classypotato09

Children supporting parents financially

Image credits: Karolina Grabowska / pexels (not the actual photo)

Many adults still financially support their parents, with about a third of them saying they had given money to them in the past year. Half said they had given at least $1,000. The allowance was often paid monthly or weekly for needs like groceries and housing.

Bored Panda reached out to financial advisor Ryan King, who kindly agreed to have a quick conversation about materially helping parents. He told us that there should be no pressure and it should be a two-way effort.

“If your children financially support you in the future, then that’s fortunate and should be seen as a bonus. Parents should take the onus on themselves and educate themselves on increasing their income and investing over their own lifetime.”

He added, “It’s definitely okay for children to financially support their parents if they’re in a position to do so. For me personally, I would love to be in a position where I could do that later in life. However, it shouldn’t be a requirement, and children shouldn’t feel like they need to do that, as they will have their own financial issues and goals.”

Because of rising costs of living and a longer life expectancy, more children are driven to help their aging parents. Retirees often face higher medical expenses, which can quickly empty out their savings. In fact, 10% of children said their parents had outlived their nest eggs.

Often, adults looking out for their families have children of their own and are referred to as the “Sandwich generation.” They are sandwiched between the obligation to care for their parents and kids, both requiring financial, physical, and emotional help.

With the pressure of juggling their own careers, personal issues, and retirement, they are under a lot of financial and emotional stress. In some cases, they even have to work longer than their retirement age because of added financial responsibilities.

Surprisingly, over 75% of Americans believe that adult children should support their older parents, and this may explain why many are doing it even when risking their own finances.

Helping aging parents to be more financially independent

Image credits: Andrea Piacquadio / pexels (not the actual photo)

For those who aren’t fortunate enough to help their parents or are trying to break generational patterns, King advises having a thorough conversation and setting boundaries. “I understand this may be a difficult situation or conversation, but it can go some way to help resolve the situation. ”

Other options include, for example, finding the reason for their budget deficit, which can help identify possible solutions. There are still some people who find it difficult to manage their money, so helping them change their spending habits lowers their expenses.

If it’s a costly medication, children can recommend taking a generic drug or using a money-saving app. If they’re spending a lot of money on entertainment, they may need some activities like volunteer work or a part-time job (assuming they can).

Parents might consider selling their house, buying a smaller one, renting a more affordable one, or moving in with their children (when possible). Downsizing or relocating may be cheaper overall, reducing costs.

Using social benefits or tax breaks is also a great way to reduce expenses. Some medical fees for elders are tax-deductible. So, if children are covering half of their living costs, they can ask for a price reduction. Lastly, consulting a professional to help parents with their retirement plans is another good idea.

Commenters supported her decision