Finding out your college fund is no longer available is enough to make anyone’s heart sink. And even more so if it was repurposed to finance a solution that’s equivalent to duct-taping a structurally-compromised house.

A mother recently turned online for some perspective on whether she has done the right thing by using her younger daughter’s college fund to help her other daughter with no job, health issues, four kids, and a boyfriend.

Stepping in to help a family member in need is definitely a good thing to d0, but not at the expense of another family member

Image credits: seventyfourimages (not the actual photo)

A mom turned to the internet for some perspective on whether she should’ve sacrificed her daughter’s college fund to help her sister

Image credits: Yannamelissa (not the actual photo)

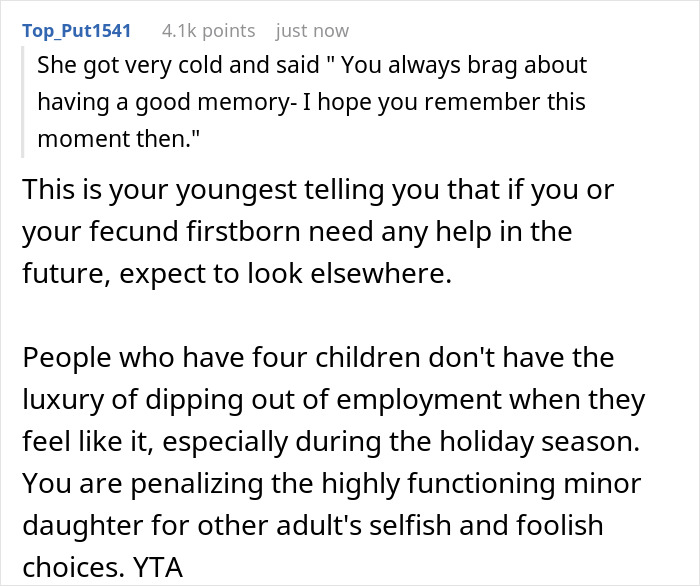

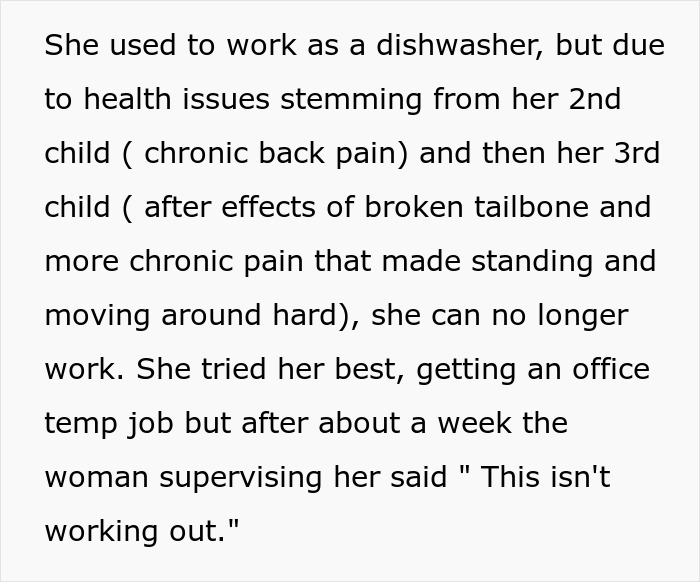

Image credits: Throwaway23fw

The younger daughter was not amused, coming back with “you always brag about having a good memory—I hope you remember this moment then”

The story goes that this one mother has two daughters—24 and 17. The older one has recently given birth to her fourth child, which in and of itself is a joyous thing, right?

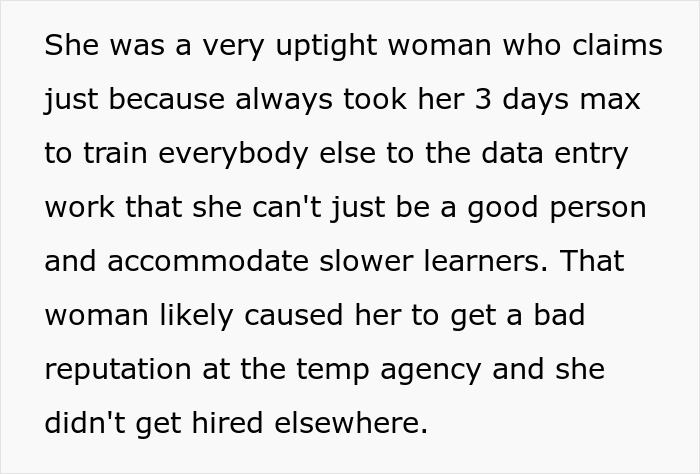

Sure. But the context is that since child #2, the daughter developed health issues which only got progressively worse with each consecutive birth. To make matters worse, her health has effectively forced her into office jobs, the search for which isn’t going all that well.

Pair that up with a boyfriend who’s barely making ends meet with his Walmart job and their recent eviction from a rented house where they secretly let the boyfriend’s brother and his girlfriend live in exchange for a split in rent.

Things aren’t looking good. The mom has a lot of empathy for the daughter, so she wanted to help. However, the way she decided to remedy the situation was to sacrifice her younger daughter’s college fund. That’s said to be enough to pay a large chunk of a 2-year community college tuition.

Needless to say, the teen wasn’t all that thrilled about having her future sabotaged like that. Once the news dropped, she grew cold and told OP “you always brag about having a good memory—I hope you remember this moment then.” They haven’t spoken since.

The commenters were not amused either, calling the mom out for enabling a deadbeat daughter in her poor decision making

The mom posted the story on r/AITAH where it garnered 11,700 upvotes in just 16 hours. But the post’s upvotes didn’t indicate a positive verdict for the mom.

Folks were quick to point out a slew of problems with this, the main one being that both the older daughter and her boyfriend are immature. If that wasn’t the case, they wouldn’t have gotten to a point of having more kids than they could support. Let alone, would’ve already done something serious about it.

Others pointed out favoritism. The mother’s solution was to essentially reward the older daughter’s poor life choices at the expense of the younger daughter’s future. As a result, neither her nor the older daughter should expect any help from the younger daughter in the future.

What’s more, OP took away the money from a daughter who was actually putting in the effort to make something of herself. And now the mother made it harder to do that.

Not all is lost, though, as there is more than one way to finance an education

Now, yes, the fact that there is no more college fund coming from the parents is definitely a huge bump in the road. But the opportunities are still out there.

Getting a job is probably the most common go-to when it comes to funding studies. Sure, that does mean all work and no play, and it will likely not cover all of the expenses, but it’ll surely alleviate much of the burden.

This can be paired up with taking out a federal student loan. These are flexible in their repayment schedules after graduation. But grants and scholarships are considered better options because you can get the same benefit without having to pay it back.

Besides these, students can also apply for tax credits to reduce some of their tuition costs as tax returns, research tuition assistance programs provided as part of certain employee benefits, or simply minimizing your college costs by considering a lower-cost college.

Whatever the case, we’d love to hear your thoughts on the matter. Who do you side with and what would you do in this situation? Share your takes and stories in the comment section below!

It was a YTA verdict across the board, netting the post itself nearly 12K upvotes