The stock market continues to recover from Monday's brutal sell-off, yet third-quarter earnings outlooks are pressuring some companies.

The S&P 500 is up 1%, and the tech-heavy Nasdaq Composite added 1.1%. The Dow Jones Industrial Average gained 0.6%, and the Russell 2000 Index rose 0.4%.

Nvidia lost 0.2% midday, while Tesla is down 1.2%. Other Mag 7 stocks are up.

Shutterstock/TS

S&P 500 big stock movers today

Five S&P 500 stocks making big midday moves are:

- Fortinet Inc (FTNT) +25.9%

- Axon Enterprise Inc (AAXN) +18.9%

- Global Payments Inc (GPN) +8%

- Enphase Energy Inc (ENPH) +5.3%

- MGM Resorts International (MGM) +5.1%

The worst-performing five S&P 500 stocks with the largest midday drop are:

- Super Micro Computer Inc (SMCI) -16.3%

- Airbnb Inc (ABNB) -12.8%

- Charles River Laboratories International Inc (CRL) -11.2%

- Emerson Electric Co (EMR) -6.6%

- Bio-Techne Corp (TECH) -6%

Stocks also worth noting with significant moves include:

- Apple (AAPL) +2.5%

- Tesla (TSLA) -1.2%

- Nvidia (NVDA) -0.2%

- Amazon (AMZN) +2%

- Rivian (RIVN) -2.6%

- Lyft (LYFT) -12.1%

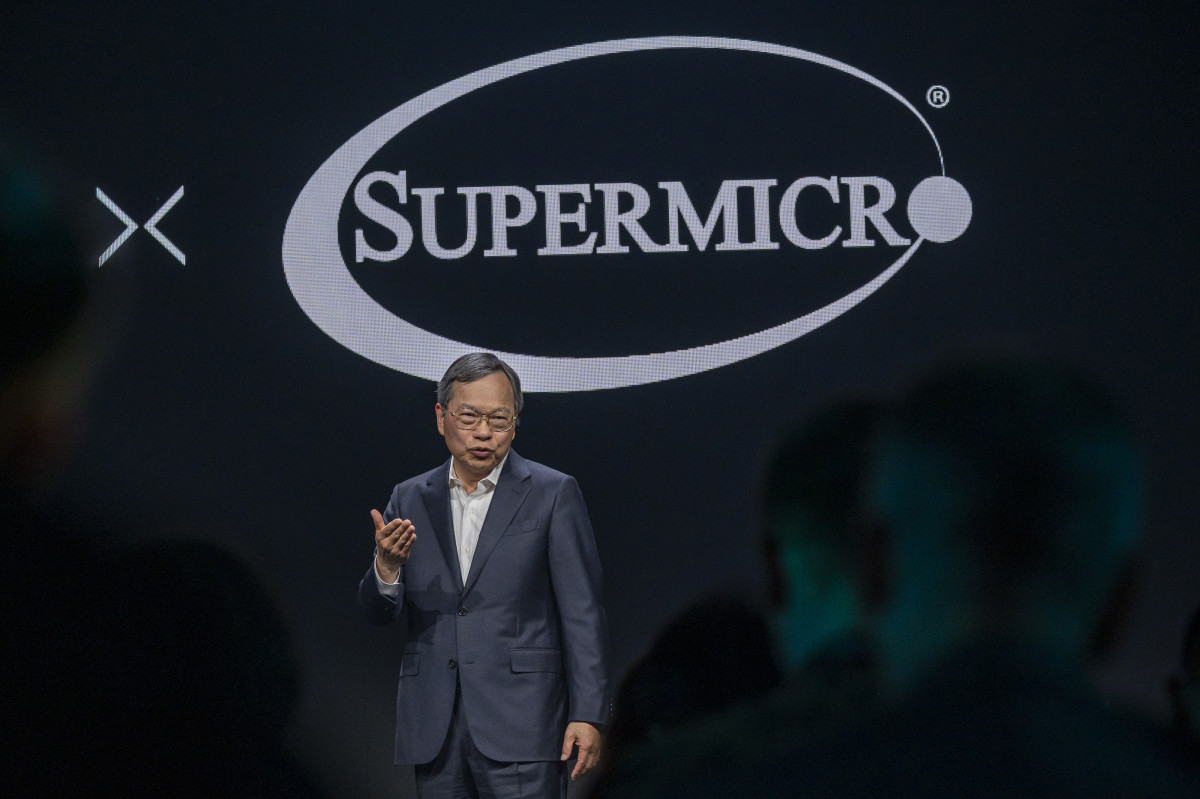

Super Micro slumps on earnings miss

Super Micro Computer stock tumbled 16% midday following the release of the fourth quarter and full-year financial results for fiscal 2024.

The server company reported earnings per share of $6.25 for the fourth quarter ended June 30, which fell short of Super Micro's previous forecast of $7.62 to $8.42 and missed the $8.25 analyst estimate. Quarterly revenue was $5.31 billion, slightly below the $5.32 billion forecast.

Related: Analysts overhaul Super Micro stock price targets after Q4 earnings

Super Micro's gross margin for fiscal Q4 was 11.2%, the lowest margin Super Micro has reported since it began releasing quarterly results in May 2007.

The company said during the earnings call that it is facing component shortages and could have sold more products if it had more supply, particularly for liquid-cooling components.

Super Micro stock is up 80% year to date because of AI-driven server demand, but it has lost over 40% over the past month. The company also announced a 10-for-1 forward split of its common stock, set for October 1, 2024.

Airbnb tumbles after slowing US demand

Airbnb stock lost 12% midday after the company released weak earnings results.

The homestay rental company earned 86 cents a share in the second quarter, missing the anticipated 92 cents per share. The revenue of $2.75 billion slightly beat the $2.74 billion expected.

Related: Airbnb CEO reveals a major mistake during pandemic layoffs

The company warned in a letter that there have been “some signs of slowing demand from U.S. guests,” a sign that the US economy is still under pressure and travelers are cautious about discretionary spending.

Lyft down despite earnings beat

Lyft stock slid 12% midday after it announced upbeat second-quarter earnings and weak guidance in the morning.

The rideshare company reported a revenue of $1.44 billion, beating the estimated $1.39 billion. The company earned $0.24 a share for the quarter, surpassing the forecasted $0.18.

More Tech Stocks:

- Sony’s Bungie criticized for layoffs after CEO spends millions

- Nvidia stock tumbles in tech slump amid questions over key chip

- Analysts adjust Palantir stock price target ahead of earnings

The company also posted weak gross booking and third-quarter guidance. Lyft’s gross bookings for the June quarter totaled $4.0 billion, hitting only the lower end of its previous estimate of $4.0 billion to $4.1 billion. It continues to project gross bookings for the September quarter to fall within the same range.

Lyft’s rival Uber reported strong earnings yesterday, with revenue hitting $10.7 billion and EPS reaching 47 cents, both of which beat estimates. Uber stock added over 10% yesterday and is up 4% midday today.

Related: Veteran fund manager sees world of pain coming for stocks