The stock market is trading higher midday. The S&P 500 added 0.65%, while the tech-heavy Nasdaq Composite climbed 1.03%. The Dow Jones Industrial Average inched up 0.03%, and the Russell 2000 Index rose 0.12%.

Trending stocks:

Nvidia added more than 3% and again is trading above $130. All Magnificent 7 stocks are up.

PepsiCo traded higher after it reported Q3 earnings that beat estimates but missed on revenue and lowered full-year guidance. Qualcomm dropped 0.9% after KeyBanc's downgrade. DocuSign surged as S&P Dow Jones Indices said it would join the S&P MidCap 400, replacing MDU Resources.

S&P 500 big stock movers today

Five S&P 500 stocks making big midday moves are:

- Edwards Lifesciences (EW) +5.3%

- Palantir Technologies (PLTR) +5.3%

- Palo Alto Networks (PANW) +5%

- Carnival (CCL) +3.7%

- Brown & Brown (BRO) +3.4%

The worst-performing five S&P 500 stocks with the largest midday drop are:

- Super Micro Computer (SMCI) -7%

- Marathon Petroleum (MPC) -6.9%

- Freeport-McMoRan (FCX) -5.1%

- Albemarle (ALB) -4.5%

- Valero Energy (VLO) -3.9%

Stocks also worth noting include:

- Nvidia (NVDA) +3.5%

- Alphabet (GOOGL) +0.2%

- Amazon (AMZN) +0.5%

- Qualcomm (QCOM) -0.9%

- PepsiCo (PEP) +1%

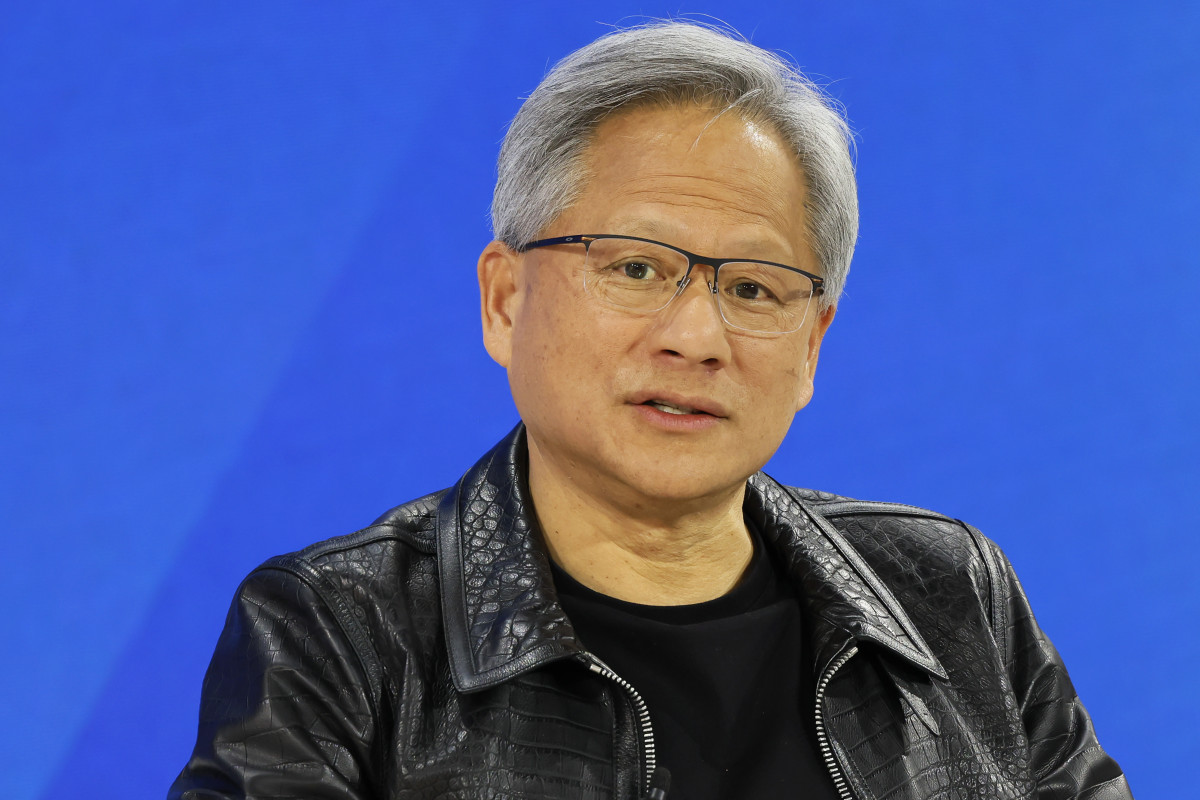

Nvidia trades higher on supply chain shift

Nvidia's stock rose 3.5% midday after the Financial Times reported that Foxconn was constructing the world's largest factory in Mexico to produce Nvidia's most advanced AI servers. This move suggests a shift in Nvidia's supply chain away from China.

Foxconn's chairman, Young Liu, said at the company’s annual technology showcase in Taipei that the new plant, in Guadalajara, would assemble Nvidia’s GB200 Blackwell AI servers.

Related: Nvidia CEO's bombshell raises the bar for the stock

Foxconn is one of the world’s largest contract electronics manufacturers. It also produces iPhones for Apple.

Liu said that the boom in artificial intelligence “still has some time to go.” and that demand for Foxconn servers based on Nvidia’s upcoming Blackwell chip is “much better than we thought.”

Qualcomm falls on analyst downgrade

Qualcomm lost 0.9% after KeyBanc downgraded the company to sector weight from overweight without a price target, thefly.com reported.

KeyBanc previously saw Qualcomm as an edge AI player due to its role in handsets and PCs. However, since these markets haven't developed as expected, Qualcomm is unlikely to benefit from a replacement cycle or receive a market premium as an edge AI leader until the market builds, the analyst says.

Related: Analysts reboot Qualcomm stock price target on Microsoft deal

Qualcomm currently manufactures the modem chips used in iPhones. However, the analyst also says Apple will create its own modem.

Qualcomm stock is up 18.5% year-to-date.

PepsiCo pops despite revenue miss

PepsiCo gained 1% after the company reported for the fiscal third quarter ended Sept. 7.

The company earned $2.31 a share adjusted, higher than the $2.29 analyst consensus forecast. Revenue of $23.32 billion missed the $23.76 billion projected by Wall Street.

PepsiCo also lowered its full-year outlook, now expecting a low-single-digit-percent rise in organic revenue, down from its prior outlook of 4% growth.

Organic revenue excludes sales generated from recent acquisitions. It reflects revenue derived from a company’s current operations, products and customers.

More Retail Stocks:

- Target makes bold clarification to return policy amid alarming trend

- Analyst revisits Costco stock price target, rating ahead of earnings

- Nike shares swoosh higher after new CEO is named

PepsiCo CEO Ramon Laguarta said that North American sales faced a “subdued category performance,” and that the company was also dealing with ongoing impacts from product recalls at Quaker Foods and disruptions in certain international markets due to geopolitical tensions.

“I think it’s part of the economic cycle that we’re in, and that will reverse itself in the future, once consumers feel better,” Laguarta said during the company’s earnings call.

Related: The 10 best investing books, according to our stock market pros