KEY POINTS

- The plan will help Saylor "address personal obligations, as well as acquire additional Bitcoin" to his personal account

- The MicroStrategy executive chairman said he can sell 400,000 shares of his vested options until April

- Saylor is behind the explosive growth of MicroStrategy, primarily due to his bullish stance on Bitcoin

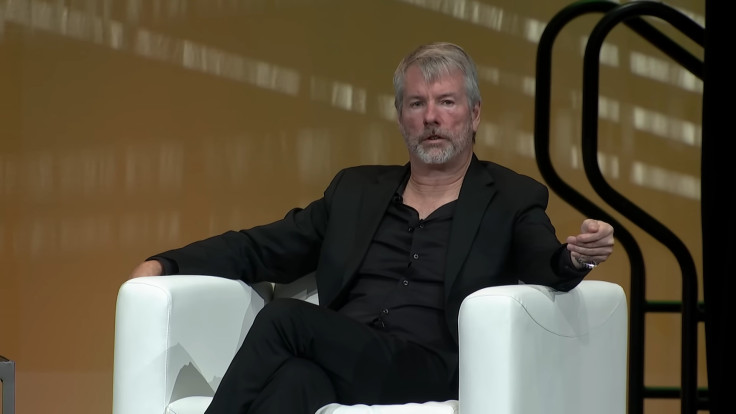

Bitcoin bull Michael Saylor, the co-founder and executive chairman of MicroStrategy, started selling off 315,000 MSTR shares and will continuously sell 5,000 shares daily until April 25, the latest regulatory filing with the U.S. Securities and Exchange Commission showed.

Saylor had commenced the sale of his stock option awards, consisting of 315,000 shares, which were originally granted to him in April 2014. These stock options will expire on April 30, the Tuesday filing read.

First disclosed in the 10-Q filing in the third quarter, Saylor, during MicroStrategy's Q3 earnings call, shared his plan to sell 5,000 MSTR shares over the next four months, subject to a certain price condition.

@saylor will sell 315,000 $MTSR shares (worth ~$216m), filing shows.https://t.co/NiwcGrIDWe pic.twitter.com/a7AuUNbLKi

— NLNico (@btcNLNico) January 2, 2024

"Exercising this option will allow me to address personal obligations, as well as acquire additional Bitcoin (BTC) to my personal account," Saylor said during the company's earnings call. "I continue to be optimistic about MicroStrategy's prospects and should note that my equity stake in the company after these sales will remain very significant."

@saylor addressed this in the MSTR fourth-quarter conference call: pic.twitter.com/PMfPq65HMb

— BitDeez (@BitDeez) January 2, 2024

"On September 19, 2023, Michael J. Saylor, the Chairman of our Board of Directors and our Executive Chairman, entered into a 10b5-1 trading plan that is intended to satisfy the affirmative defense conditions of Rule 10b5-1(c) of the Exchange Act with respect to the sale of up to 400,000 shares of our Class A common stock underlying a vested stock option, which expires if unexercised on April 30, 2024," the 10-Q filing read.

"Under this trading plan, on each trading day from January 2, 2024, to April 25, 2024, Mr. Saylor plans to exercise and sell 5,000 shares with respect to the stock option, subject to a minimum price condition. To the extent less than 5,000 shares are exercised and sold on a given trading day, the balance can be added to the number of shares exercised and sold on any future trading day up to and including April 26, 2024, which is the last date on which shares may be exercised and sold under the plan," the regulatory filing read.

Saylor is behind the explosive growth of MicroStrategy, primarily due to his bullish stance on Bitcoin. The software and business intelligence company has gained notoriety for its practice of investing in Bitcoin as part of its business strategy.

Saylor believes Bitcoin, the world's first-ever crypto asset and the largest by market capitalization, is a more resilient asset than cash reserves in terms of dealing with the loss of asset value.

On Dec. 26, MicroStrategy acquired an additional 14,620 BTC, purchased at around $615.7 million at an average price of $42,110 per Bitcoin.