KEY POINTS

- MicroStrategy made the announcement as more companies adopt their own Bitcoin strategies

- Bitcoin prices have been down by 6% in the last seven days

- MicroStrategy last purchased BTC in April, bringing its total holdings to over 214K

Tech firm MicroStrategy already holds over 200,000 Bitcoins, but apparently, this stash isn't enough as the company founded by BTC maximalist Michael Saylor announced it intends to offer $500 million worth of convertible senior coins to snap up more of the world's largest cryptocurrency by market cap.

"MicroStrategy intends to use the net proceeds from the sale of the notes to acquire additional Bitcoin and for general corporate purposes. The notes will be offered and sold to persons reasonably believed to be qualified institutional buyers," the company said in a Thursday press release.

The convertible senior notes are due in 2032, and holders can convert the notes into cash, shares of the company's class A common stock, or a combination of cash and shares at MicroStrategy's election.

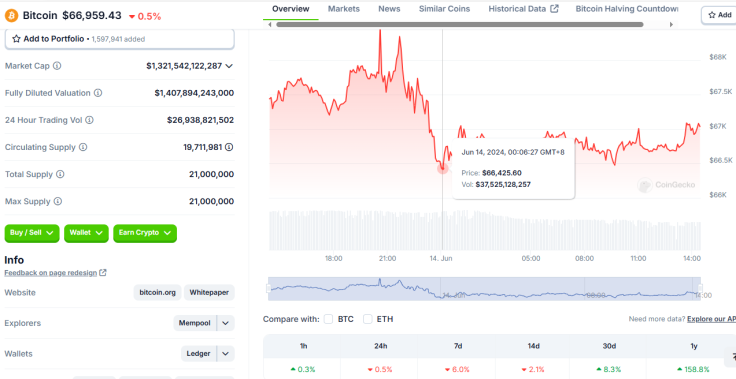

Interestingly, MicroStrategy's investor offering was made during the digital currency's price downturn. From trading at around $67,500 Wednesday, Bitcoin added $1,000 before retreating to around $66,400 Thursday, according to CoinGecko data. As of early Friday, the coin bounced back but remained below $67,000. It has also been down by 6% in the last seven days.

MicroStrategy's announcement comes as more companies, both non-crypto and those that are, in a way, involved in the digital assets space, adopt their own Bitcoin treasury strategies.

The latest company to join the BTC strategy frenzy is DeFi Technologies, a publicly traded firm just like MicroStrategy, which said it has adopted Bitcoin as its primary treasury reserve asset. DeFi Technologies said it believes the digital asset's unique characteristics put it in a position to be used as a "reasonable hedge against inflation."

Late last month, health-tech firm Semler Scientific also adopted a Bitcoin strategy, purchasing $40 million worth of BTC as it believes that the token is "a reliable store of value and a compelling investment."

MicroStrategy's last known Bitcoin purchase was late in April, when it obtained 122 BTC for $7.8 million, bringing its total holdings to 214,400. At the time, prices were also stagnant as the Bitcoin community had barely finished the halving event wherein mining rewards were split in half.

Despite BTC prices in the lows since the halving, Saylor has remained positive, saying earlier this week that Bitcoin "protects" people who invest in the world's first decentralized digital asset. He is attending BTCPrague 2024 where he will discuss the "21 Rules of Bitcoin" Friday night as a keynote speaker.