There’s no other way to put it: Tech is marred in a bear market. Many stocks are down 40% to 50% or more.

Not Microsoft (MSFT), though.

The stock is currently 27% below its all-time high and has suffered a peak-to-trough decline of 31%.

On June 21 I noted that Apple (AAPL) was the only FAANG stock outperforming Microsoft in these regards. Along with Alphabet (GOOGL) (GOOG), these stocks are forming a nice trio of strength vs. the rest of its tech peers.

Now, I want to peel back even more layers of Microsoft.

Versus FAANG, Microsoft has the best profit margins in the group, with 37.6%. Meta (META) (formerly Facebook) is second at 31.2%. No other component is above 28%.

As for valuation, 27 times this year’s earnings may seem a little rich at first glance — especially compared with Apple and Alphabet at 22 times and 20 times earnings, respectively.

Investors should remember, though, that Microsoft is forecast to generate 18.5% revenue growth this year and 14% growth next year, alongside 15% earnings growth in both 2022 and 2023.

So not only are we talking about sector-leading profit margins, a fortress balance sheet and robust cash flow, we’re talking about solid and — more important — dependable top- and bottom-line growth.

For what it’s worth, Apple is forecast to generate single-digit earnings and revenue growth this year and next year, whereas Alphabet has solid revenue-growth (forecasts, 15% in 2022 and 2023, while earnings this year are expected to be flat.

Trading Microsoft Stock

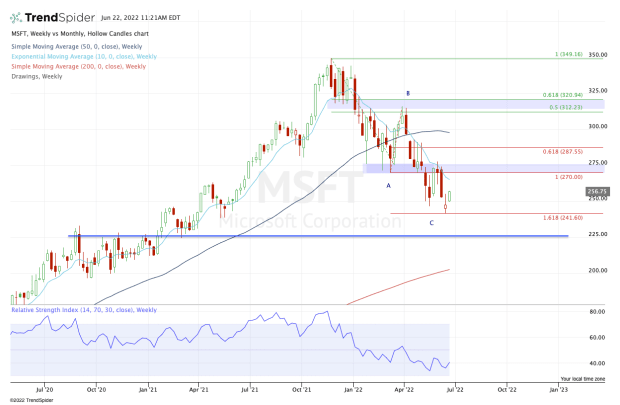

Chart courtesy of TrendSpider.com

Do FAANG-leading profit margins ensure that Microsoft stock is done going down? Of course not! We’re in the throes of a bear market and anything can happen in this environment.

The stock could rally 40% from the lows and still not retest the high. It could fall another 20% and test its 200-week moving average (putting it down 42% from the highs). Do not rule out anything in a bear market.

That said, the correction has been very orderly thus far.

After a 23% correction to the first-quarter lows, Microsoft stock retraced about half its losses, then broke the lows and traded down to the 161.8% downside extension — nearly to the penny.

Amid this correction, we’ve seen support turn to resistance twice,, at $315 and $270.

Now that the stock is trying to rally, the bulls have a tough hill to climb.

On the upside, Microsoft needs to reclaim $270 and active resistance, the latter of which comes from the declining 10-week moving average.

If it can do that, perhaps we can get a larger move to the upside and potentially even have a low to work with.

If Microsoft stock can’t make that type of progress, the low near $240 remains vulnerable.

On a close below this mark, the door opens down to $225, then the rising 200-week moving average. For the long-term investor, these areas appear to be buying opportunities.

.png?w=600)