Microsoft (MSFT) on Wednesday is enabling investors to let go a sigh of relief, as the software giant reported earnings and the shares rallied to 52-week highs.

With its $2.2 trillion market cap, Microsoft carries a lot of weight, both in investor sentiment and weighting in the U.S. indexes.

On Tuesday U.S. stocks had suffered their worst one-day performance since March 22, so a bearish reaction from Microsoft — and Alphabet (GOOGL) (GOOG), which also reported last night — could have set up the market for more losses today.

Don't Miss: Can Nike Stock Sprint to New 2023 Highs? Here's the Level to Watch.

Instead, Microsoft delivered a top- and bottom-line beat, which is propelling the shares higher on the day. At last check they were up about 8%.

The rally is helping the Nasdaq and S&P 500 recover some of Tuesday’s losses, and now investors want to know how much more upside Microsoft stock might have.

Trading Microsoft Stock

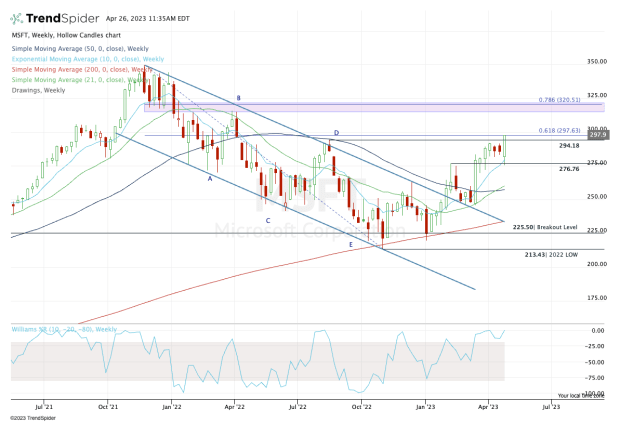

On the weekly chart above, you will notice this week’s strong bullish engulfing candle.

That’s as this week’s range literally engulfs last week’s range. Microsoft had opened this week below last week’s low and is now trading above last week’s high.

The stock is also powering above the August high of $294.18, and investors need to see it hold above this mark.

If it can do so, it keeps the 61.8% retracement (from the 2022 low to the all-time high) in play at $297.63. The shares are currently near this mark.

Don't Miss: McDonald's Reports and the Stock Presents a Buy-the-Dip Opportunity

This is a great post-earnings reaction for the bulls. From here, they’ll want to see Microsoft stock clear the 61.8% retracement and the $300 level. In that scenario, it opens the door to the $315 to $320 zone.

That zone contains the 78.6% retracement, as well as a previous support/resistance area.

On the downside, a break back below the August high near $294 puts recent resistance back in play near the $290 to $291 zone.

If Microsoft continues lower and can’t hold its short-term moving averages, the gap-fill at $281.60 is potentially in play.

For now, the bulls remain in firm control of the stock price.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.