Microsoft shares opened lower on July 31 after the software and cloud services giant reported better-than-expected earnings but missed slightly in the expected growth of a key driver.

Microsoft (MSFT) closed Tuesday at $422.92, off 0.9%. But shares tumbled nearly 8% to $389.20 within minutes of releasing the company's fourth-quarter earnings report.

The report set off a contest between investors who were bullish or bearish on the company.

The bears won. The shares reached reached as high as $427.61 at 4:55 p.m. before sliding back again, according to Nasdaq data. The last trade, just before 8 p.m. ET, had the stock at $411.25, down nearly 2.8% from the close.

Related: Analysts adjust Palantir stock price target ahead of earnings

They were lower in Wednesday's premarket trading as well, and were trading about $415 at last check.

Given the reaction to Microsoft's earnings report, the next question is whether analysts will start revising their price targets on Microsoft lower. The average price target on the stock is $500, according to Zack's Research. The high target is $600.

Image source: Brad Barket/Getty

A slight miss on one business is hitting the stock

Microsoft released its earnings report into what may be best described as a can't-win environment.

The company earned $2.95 a share, a penny ahead of Wall Street estimates. Revenue rose 15% to $64.7 billion, above analysts' forecasts of $64.4 billion.

But revenue for Microsoft's Azure cloud division, its biggest growth driver, were up 29%, just shy of Wall Street's 30% forecast. Overall Intelligent Cloud revenue rose 19% to $28.52 billion, just missing Wall Street's $28.7 billion forecast.

At the same time, the euphoria over artificial intelligence that erupted in 2023 and carried over into 2024 has faded dramatically in the past month or so.

The issue remains this: Billions of dollars are being spent on investments into artificial intelligence development and related applications. And many investors, as they are wont to do, are getting anxious.

And some have been selling. The Nasdaq Composite Index is off 8.2% since hitting an all-time high on July 11. Nvidia (NVDA) has fallen 26% since peaking at $140.76 on June 20.

In Microsoft's case, capital expenditures totaled $19 billion in the fiscal fourth quarter alone, up nearly 78% from a year earlier and $55.7 billion for the fiscal year.

Microsoft's CFO blames supply chain

Wall Street "doesn't have a lot of patience," Daniel Morgan, senior portfolio manager at Synovus Trust, told Reuters. "They see you spending billions of dollars and they want to see a pickup in revenue of that amount." The company holds shares in Microsoft.

AI projects have not yet generated a lot of revenue for their promoters, except maybe Nvidia (NVDA) , and shares have been hit. Google parent Alphabet shares fell 6% a week ago because of complaints about all the spending.

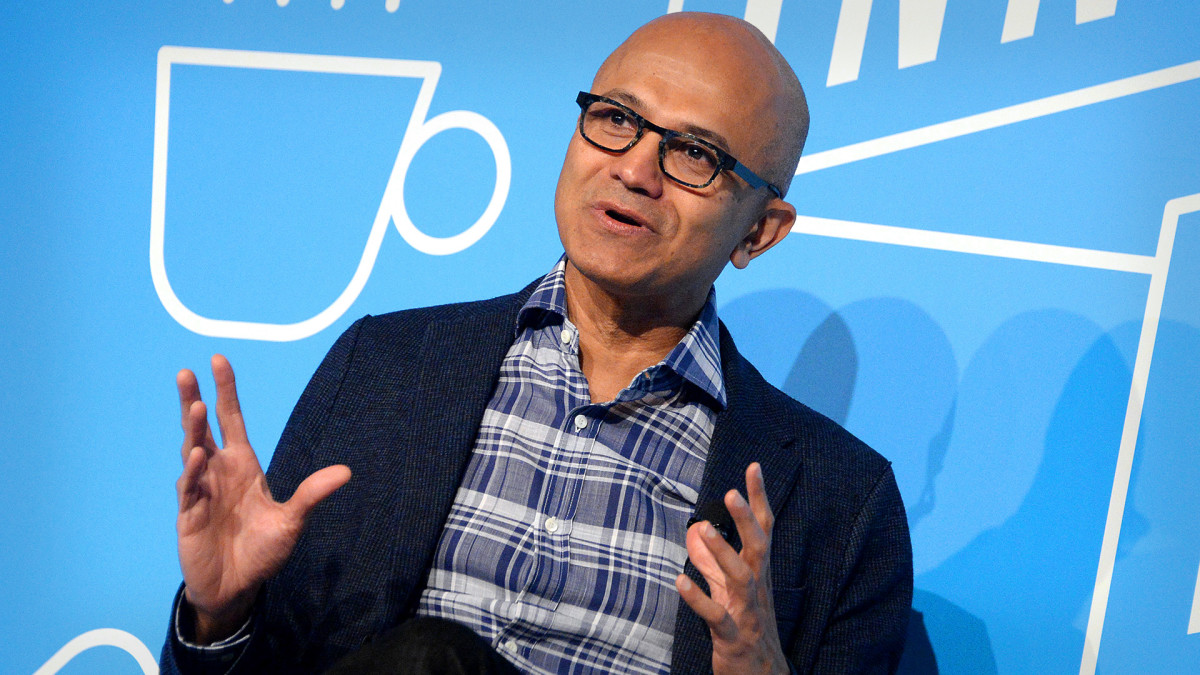

But the profits are coming, Microsoft CEO Satya Nadella insisted on Tuesday's earnings call. (The transcript, generated by the Motley Fool, is available on Nasdaq's site.)

More Tech Stocks:

- Analyst revisits Nvidia stock price target after Blackwell checks

- Cathie Wood unloads shares of rebounding tech titan

- Big tech company files Chapter 7 bankruptcy, closes abruptly

Microsoft has persuaded thousands of companies to acquire its AI offerings, and Nadella said feedback is positive.

But during the call Chief Financial Officer Amy Hood said one reason the revenue growth missed expectations was soft demand in some European markets and limits on the availability of AI-related hardware.

That's a polite way of saying companies like Nvidia are so swamped with orders that they can't meet all the demand right away.

The point Nadella and Hood emphasized is investing in AI takes time and money, and both are critical to Microsoft's future.

So the stock will slump, and when — and if — the profits roll in, the shares will move up. Microsoft had to endure a lot of complaining about developing its cloud computing expertise. And it is now valued at more than $3 trillion.

If there's any solace for Microsoft, others will face the same music. Facebook parent Meta Platforms (META) reports earnings Wednesday, with Apple (AAPL) and Amazon.com (AMZN) due Thursday.

Related: Veteran fund manager sees world of pain coming for stocks