Microsoft bulls are hoping the software giant will calm worries about weakening corporate IT spending when it shares earnings and guidance on Tuesday afternoon.

Among analysts polled by FactSet, the consensus is for Microsoft to report September quarter (fiscal first quarter) revenue of $49.66 billion (up 10% annually) and EPS of $2.31.

Microsoft typically shares quarterly sales guidance for its three reporting segments – Productivity and Business Processes, Intelligent Cloud and More Personal Computing – during its earnings call. The company’s December quarter revenue consensus stands at $56.16 billion (up 9%).

Eric Jhonsa, Real Money’s tech columnist, will be live-blogging Microsoft’s earnings report, which is expected after the bell, along with its earnings call, which is scheduled for 5:30 P.M. Eastern Time.

Please refresh your browser for updates.

6:42 PM ET: Microsoft's call has ended. Shares are down 6.7% after-hours to $233.93 after Microsoft beat FQ1 estimates, reported a 3% Y/Y drop in commercial bookings and issued below-consensus FQ2 sales guidance for all three of its reporting segments.

Forex (expected to have a 5-point impact on FQ2 and FY23 sales growth, after having a similar impact on FQ1's growth) remains a major headwind for the company, as does weak PC demand (Windows OEM revenue is expected to drop by a mid-30s % in FQ2, excluding a revenue deferral's impact). Microsoft also indicates it's seen some softening in deal activity among SMBs.

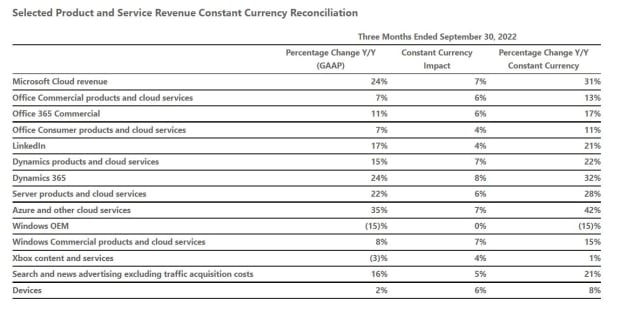

On the bright side, LinkedIn, Dynamics and search/news ads saw healthy double-digit growth in FQ1, and Office commercial and consumer revenues each rose 7%. Azure revenue rose 35% in dollars and 42% in constant currency, with Microsoft guiding for 37% CC Azure growth in FQ2.

Thanks for joining us.

6:34 PM ET: Last question is about Microsoft's long-term advertising ambitions.

Nadella divides Microsoft's ad business into two parts: LinkedIn and everything else. Argues LinkedIn will continue benefiting from its unique data and rising engagement. Elsewhere, he sees Microsoft's ad sales on its own properties (Bing, Windows Start, etc.) benefiting from the installed-base growth it saw during the pandemic, and ad sales on 3P properties benefiting from new deals like the one recently struck with Netflix.

6:30 PM ET: Nadella argues efforts by businesses to optimize their IT spending will accelerate cloud migrations.

"This is a period where cloud is going to gain share, because we're still in the early innings of adoption. And so we just want to invest going into it with that mindset," he says.

6:27 PM ET: A question about future Office 365 commercial growth.

Hood says Microsoft still has room to grow Office 365 seats in areas such as frontline workers. Also notes there's still more room to grow ARPU via new features, E5 up-sells, etc.

6:25 PM ET: Hood says PCs will be "a tough market" for Microsoft in FY23, while noting PC usage remains above pre-pandemic levels. Says Microsoft wants to maintain "a steady hand" in this environment when it comes to investments, but is responding to the macro environment by slowing spending growth. Also notes opex growth will fall sharply as Microsoft laps the 1-year anniversary of the Nuance/Xandr deals and hiring surges.

6:21 PM ET: A question about AI services, and one about energy costs.

Nadella asserts Azure has differentiated AI training and inference services, and that the company's AI investments are also enabling differentiated first-party services such as GitHub CoPilot. Hood indicates energy costs didn't rise significantly in FQ1, but will grow later in the fiscal year.

6:18 PM ET: A question about Office 365 deals.

Hood says there was a slowdown in Office 365 deals among SMBs and partners, as well as in the E3 SKU. Good momentum indicated for E5 plans. Suggests Microsoft will benefit in time from new features added to E3, and from improved execution.

6:16 PM ET: Another question about Azure spending trends.

Hood says the Azure guide reflects both optimization efforts and new workloads. Also notes there's a slowdown in growth for cloud workloads billed on a per-user basis.

6:14 PM ET: First question is about slowing CC Azure growth and Microsoft's expectations for FY23 Azure growth.

Hood says there's "inherent volatility" to the Azure growth number. Says FQ1 growth was "generally in line" with Microsoft's expectations, and that there was a strong focus during the quarter among both Microsoft and its customers to optimize Azure spend. Suggests there was little more of a slowdown among smaller Azure customers. Reiterates Microsoft remains very positive on the long-term Azure opportunity.

Nadella joins Hood in asserting it's in Microsoft's interests to help customers optimize their Azure spend.

6:09 PM ET: The Q&A session is starting. Microsoft shares are now down 6.2% after-hours.

6:08 PM ET: Forex is now expected to be a 5-point headwind to FY23 revenue growth. Microsoft still expects double-digit FY23 revenue and op. income growth on a constant currency business. FY23 operating margin is expected be down 1 point Y/Y in dollars and roughly flat in CC.

Operating expense growth is expected to "moderate materially" over the course of FY23.

6:06 PM ET: Headcount growth is expected to be "minimal" on a sequential basis.

6:05 PM ET: Quarterly sales guidance:

Productivity and Business Processes - $16.6B-16.9B vs. a $17.25B consensus

Intelligent Cloud -$21.25B-$21.55B vs. a $21.82B consensus

More Personal Computing - $14.5B-$14.9B vs. a $16.91B consensus

Azure revenue growth is expected to be sequentially lower by about 5 points in constant currency. Windows OEM revenue is expected to drop by a high-30s %, or a mid-30s % excluding the year-ago revenue deferral. Gaming revenue is expected to decline by a low-to-mid teens %.

6:01 PM ET: Hood says forex will have a 5-point impact on FQ2 revenue growth. She also says "materially weaker PC demand" will remain a headwind for both Windows and Surface revenue, and that ad sales face pressure.

On the other hand, commercial bookings are expected to see solid growth amid a slightly larger expiry base.

5:57 PM ET: Windows OEM revenue (officially down 15%) was down 20% excluding the impact of a year-ago revenue deferral boost. Devices revenue (up 2%) benefited from a large HoloLens deal, and was hurt by consumer Surface revenue seeing a low-double-digit decline.

5:54 PM ET: Azure saw continued moderation in consumption growth, with Hood noting Microsoft continues working with clients to help them "optimize" their Azure consumption.

5:53 PM ET: LinkedIn saw better-than-expected growth in Talent Solutions (job recruiting offerings), but headwinds for its ad sales.

5:52 PM ET: Hood says Office Commercial and LinkedIn performed better than expected in FQ1. She adds that Microsoft did see Office deal moderation outside of E5 plans.

5:51 PM ET: Headcount rose 22% Y/Y, with a 6-point boost from the Nuance and Xandr acquisitions.

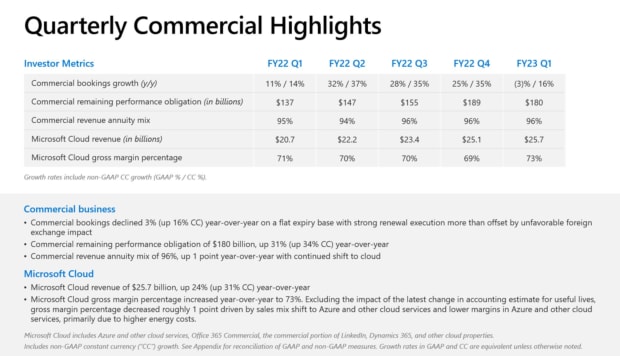

5:49 PM ET: Regarding bookings, Hood says Microsoft continued seeing strong long-term Azure deal activity, as well as strong demand for relatively costly E5 Office 365 subscriptions.

5:48 PM ET: Hood says many of the macro trends Microsoft saw in FQ4 continued to weaken in FQ1, and that PC demand continued to deteriorate.

5:47 PM ET: Amy Hood is now talking.

5:47 PM ET: More than 20M people are said to have used Microsoft's cloud gaming services to stream games to date. Gaming engagement is said to be up across platforms.

5:46 PM ET: Nadella says LinkedIn now 875M+ registered members, and that it saw record engagement. Record engagement is also claimed for the Edge browser, Windows Start content feed and Bing.

5:43 PM ET: The Microsoft Viva customer experience/engagement platform is said to have over 20M users. More than 860K organizations are said to use Microsoft's security solutions, up 33% Y/Y.

5:42 PM ET: Now onto Teams. Nadella asserts Teams is retaining users and growing engagement, with minutes of usage outpacing e-mail for many corporate users and strong growth in the use of third-party apps integrating with Teams.

5:40 PM ET: Nadella asserts Microsoft's Power BI business intelligence platform is outgrowing the competition. Adds that Power Apps (app development tools) now has more than 15M MAUs, up more than 50% Y/Y. Power Automate (business process automation) is said to have more than 7M MAUs.

5:38 PM ET: Nadella once more talks up Azure, highlighting major customer wins and its feature set in areas such as databases and machine learning. Azure ML revenue is said to have risen over 100% Y/Y for 4 quarters in a row.

Also mentioned: GitHub now has more than $1B in annualized recurring revenue and more than 90M users.

5:35 PM ET: Nadella reiterates Microsoft will invest in growth areas, while being "disciplined" about its cost structure.

He also says Microsoft expects its broader commercial business to grow about 20% in constant currency in FY23.

5:33 PM ET: Satya Nadella is talking.

5:32 PM ET: Microsoft's call is starting. IR chief Brett Iversen is going over the safe-harbor statement.

5:29 PM ET: Microsoft's call typically features prepared remarks from CEO Satya Nadella and CFO Amy Hood, after which the execs field questions from analysts. Guidance is typically shared by Hood towards the end of her prepared remarks.

5:26 PM ET: Hi, I'm back to cover Microsoft's earnings call, which should start in a few minutes.

4:59 PM ET: I'm taking a short break, but will be back to cover Microsoft's earnings call, which kicks off at 5:30 PM ET and will feature the company's quarterly sales guidance. Shares are down 2% AH to $245.75 after Microsoft beat FQ1 sales and EPS estimates, albeit while reporting a 3% Y/Y drop in commercial bookings amid heavy forex pressures.

4:55 PM ET: While Windows came under pressure, Microsoft's cash-cow Office franchise continued to chug along in FQ1. Office 365 commercial seats rose 14% Y/Y (matching FQ4's growth rate) and Microsoft 365 consumer subs rose 1.6M Q/Q and 7.2M Y/Y to 61.3M.

4:49 PM ET: Along with its guidance, any comments Microsoft shares on its call about deal activity will be closely watched, particularly given that commercial bookings fell slightly in dollars (July guidance was for bookings to see "healthy growth").

Also, any update shared for Microsoft's FY23 (ends in June 2023) sales and profit outlook will get attention. In July, Microsoft said it expects "double-digit revenue and operating income growth in both constant currency and U.S. dollars" in FY23.

4:45 PM ET: Microsoft's commercial RPO (contract backlog) totaled $180B at the end of FQ1. That's down 5% Q/Q (contract timings played some role), but up 31% Y/Y (34% in CC).

4:40 PM ET: Microsoft ended FQ1 with $107.3B in cash/equivalents and $48.6B in debt. Should regulators approve, the company is set to spend $68.7B in cash to buy Activision Blizzard.

4:35 PM ET: Overall, forex had a 5-point impact on Microsoft's FQ1 revenue growth (11% dollar-based growth vs. 16% CC growth). That's in line with what the company guided for in July.

4:33 PM ET: An overview of how key Microsoft businesses performed in FQ1. As the numbers show, businesses tied to PC demand and/or consumer tech spending (Windows OEM, devices, gaming) lagged, while others generally saw healthy growth.

4:27 PM ET: Microsoft remains lower post-earnings: Shares are down 2.2% AH. As a reminder, quarterly guidance, which tends to have a big impact on how Microsoft trades the day after earnings, will be shared on the call.

4:24 PM ET: Compared with the guidance Microsoft issued on its July earnings call, the Productivity and Business Processes segment (it covers Office, Dynamics and LinkedIn) topped guidance, while Intelligent Cloud (covers Azure and server software) and More Personal Computing (covers Windows, gaming, hardware and ads) were in-line.

Intelligent Cloud came in near the low end of Microsoft's guidance range, while More Personal Computing came in near the high end.

4:18 PM ET: Operating expenses rose 15% Y/Y in FQ1, which compares with 11% revenue growth and 14% FQ4 opex growth. Microsoft has signaled it's looking to slow its spending growth, and recently carried out layoffs.

4:13 PM ET: $4.6B was spent on buybacks in FQ1, down from $7.8B in FQ4 and $6.2B in the year-ago quarter.

Capex totaled $6.6B, down from $8.7B in FQ4 and $7.3B in the year-ago quarter.

4:10 PM ET: Notably, Microsoft discloses in its earnings slide deck that commercial bookings fell 3% Y/Y in FQ1, after having grown 25% in FQ4. Forex was a major headwind (bookings rose 16% in CC, which compares with 35% CC growth in FQ4).

4:07 PM ET: Some key revenue growth rates:

Office commercial +7%

Office consumer +7%

LinkedIn +17%

Dynamics +15%

Windows OEM -15%

Windows commercial +8%

Xbox content/services -3%

Search/news ads +16%

Devices +2%

4:05 PM ET: Azure and other cloud services revenue rose 35% Y/Y (42% in CC), slightly below a 36.5% consensus.

4.03 PM ET: Shares are down 2% after hours to $245.62.

4:02 PM ET: Results are out. FQ1 revenue of $50.12B beats a $49.66B consensus. EPS of $2.35 beats a $2.31 consensus.

4:00 PM ET: Microsoft closed up 1.4% to $250.66. Earnings should be out shortly.

3:58 PM ET: Microsoft's Azure revenue growth figure will once more get close attention. Azure revenue grew 40% Y/Y in FQ4 (46% in constant currency), and the FQ2 consensus is at 36.5%.

3:54 PM ET: Microsoft's stock is going into earnings down 25% YTD, amid a 28% drop for the Nasdaq. But shares have risen 14% from a 52-week low of $219.13 (set two weeks ago).

3:51 PM ET: The FactSet consensus is for Microsoft to post FQ1 revenue of $49.66B and EPS of $2.31.. And the FQ2 revenue consensus (Microsoft shares sales guidance on its call) is at $56.16B.

The guidance might ultimately have a large impact on how Microsoft trades tomorrow -- both because December is a seasonally big quarter, and because a lot of investors have been on edge about demand trends and forex headwinds.

3:47 PM ET: Hi, this is Eric Jhonsa. I'll be live-blogging Microsoft's earnings report and call.