Microsoft Corporation (NASDAQ:MSFT) gapped up about 1.4% higher on Wednesday due to a continued bullish reaction to a double bottom pattern that the stock printed on Monday and Tuesday, but then fell down to close the gap intraday.

A double bottom pattern is a reversal indicator that shows a stock has dropped to a key support level, rebounded, back tested the level as support and is likely to rebound again. It is possible the stock may retest the level as support again, creating a triple bottom or even quadruple bottom pattern.

The formation is always identified after a security has dropped in price and is at the bottom of a downtrend, whereas a bearish double top pattern is always found in an uptrend. A spike in volume confirms the double bottom pattern was recognized, and subsequent increasing volume may indicate the stock will reverse into an uptrend.

- Aggressive bullish traders may choose to take a position when the stock’s volume spikes after the second retest of the support level. Conservative bullish traders may wait to take a position when the stock’s share price has surpassed the level of the initial rebound (the high before the second bounce from the support level).

- Bearish traders may choose to open a short position if the stock rejects at the level of the first rebound, or if the stock falls beneath the key support level where it created the double bottom pattern.

Want direct analysis? Find me in the BZ Pro lounge! Click here for a free trial.

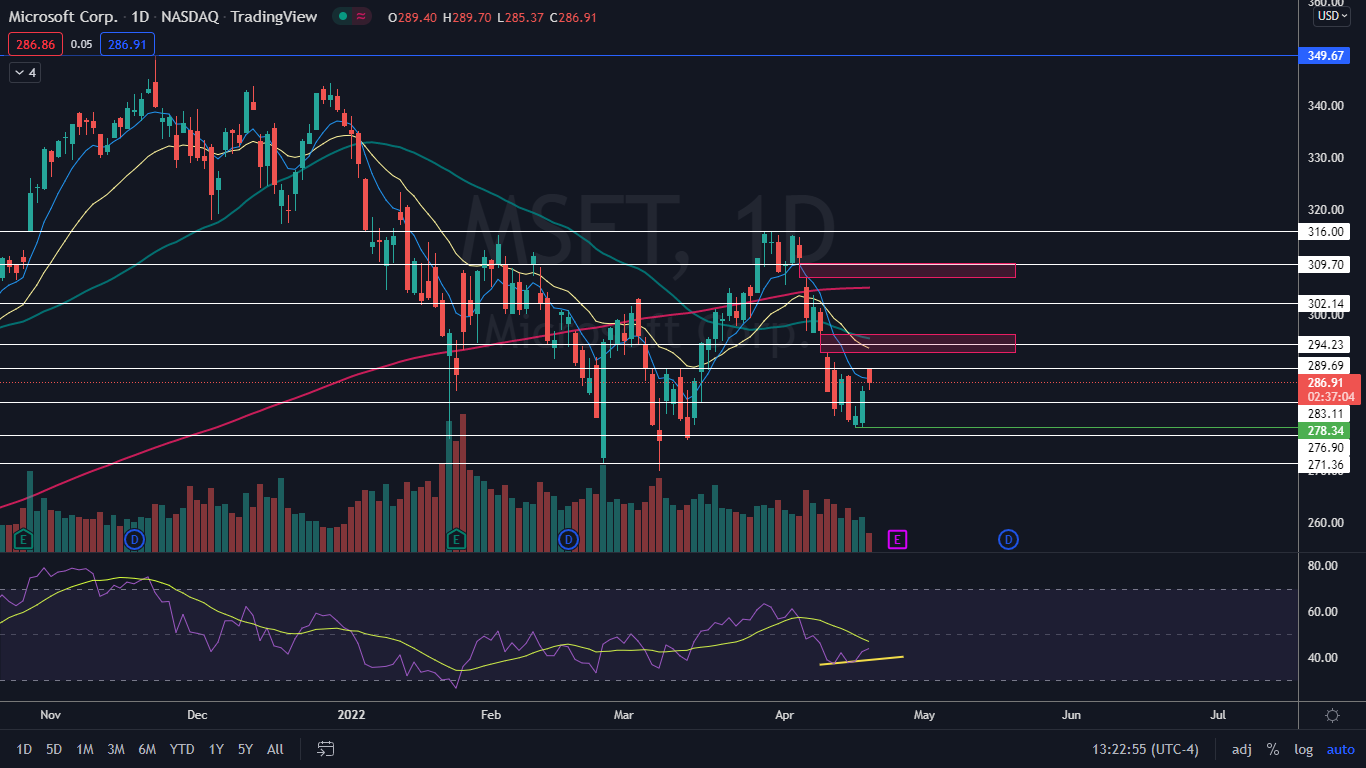

The Microsoft Chart: Microsoft tested the $278.34 level on Monday and Tuesday and wicking and bouncing up from the area, which created the double bottom pattern. Although Microsoft was trading lower intraday than where it opened on Wednesday, the decline caused the stock to fill the lower gap, which will give bulls more confidence going forward.

- Microsoft has two gaps above on the chart, with the closest between $292.61 and $296.28 and another between the $307 and $309.87 range. Gaps on charts fill about 90% of the time, making it likely Microsoft will rise up to fill the empty trading ranges in the future. If the stock is able to fill the highest gap, it will represent about a 7% increase from the current share price.

- Microsoft has developed bullish divergence, with the relative strength index making a series of higher lows, while the stock has made a series of lower lows between April 11 and Tuesday. For the divergence to correct, Microsoft will need to trade up even higher to print a series of higher lows.

- If Microsoft closes the trading day above the $287.50 level, the stock will print a hammer candlestick on the daily chart, which could indicate higher prices will come on Thursday. If the stock is going to begin trading in an uptrend following the double bottom pattern, Microsoft will eventually need to form a higher low, which would provide bullish traders who aren’t already in a position a solid entry.

- Microsoft has resistance above at $289.69 and $294.23 and support below at $283.11 and $276.90.

See Also: Here's Why Analysts Remained Bullish On Microsoft Despite Price Target Cut