Micron (MU) shares have struggled, working on their third weekly decline in the past four weeks.

For now, the stock is finding support in the mid-$60s, which is promising for the bulls (I'll explain why in a second).

The semiconductor space is at an interesting juncture. Many names in the space — including Advanced Micro Devices (AMD), Intel (INTC) and others — have started to wobble a bit.

Those moves come, however, after a monstrous rally. That’s true for Micron as well.

Don't Miss: Buy the Dip in Intel as Shares Try to Ride AMD, Nvidia Momentum?

MU shares rallied 25% from the May 9 low to the May 26 high. From the first-quarter low in mid-March (which is within pennies of the year-to-date low), the rally was yet larger, at almost 42%.

Yes, that pales in comparison to stocks like AMD and Nvidia (NVDA), but it’s still a pretty impressive return.

With the earnings report scheduled for June 28, investors are trying to gauge whether the stock has fallen enough to price in any additional risk or if whether it needs to come down even more.

Trading Micron Stock

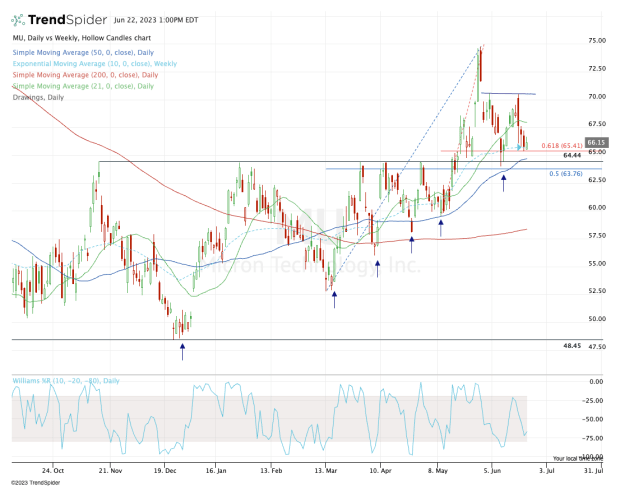

Chart courtesy of TrendSpider.com

Down about 12% from the recent high, Micron has lacked momentum while other tech stocks have gained momentum. Micron shares have fallen in four straight sessions, and today’s action -- up 0.5% at last check -- isn’t exactly inspiring.

If we measure from the recent high down to the May 9 low — the start of the current rally — the 61.8% retracement comes into play at $65.41, near today’s low. That’s also roughly where the 10-week moving average comes into play.

But a plethora of key levels sit just a bit lower.

They include the major breakout area around $64.50, the 50-day moving average just below $65 and the 50% retracement at $63.75 (when measuring from the May high down to the March low).

Don't Miss: Can AMD Stock Make New Highs? First, Here's Where Support Must Hold

The bulls need to see this area hold. Ideally, buyers will get a chance to buy the stock near the $64.50 breakout level and the 50-day moving average.

On the upside, longs will want to see Micron stock reclaim the 21-day moving average and clear the $67.50 to $68 area. That opens the door back to recent resistance at $70.50.

On the downside, a break of $63.75 and failure to regain this level could put further selling pressure on Micron stock.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.