Given the state of tech stocks and the market overall, it’s no surprise that it’s been a mixed run for Micron (MU).

The chipmaker's shares rallied 2.25% on Monday and have gained as much as 3% on this morning’s gap-up action. That action comes ahead of tonight’s quarterly earnings report after the close.

Micron is a closely watched stock when it comes to earnings. That’s due to a number of factors.

First, it doesn’t report earnings when most other tech stocks report, so it can provide some interesting intraquarter color.

Second, Micron’s a major manufacturer of NAND and DRAM products. Insight from management gives us insight into how the rest of the chip and memory industry is shaping up.

These comments are often extrapolated to stocks like Advanced Micro Devices (AMD), Nvidia (NVDA), Intel (INTC) and others.

In any regard, Micron is due to report earnings, and with today’s rally it’s clearing some key levels. The question is: Can the stock build on that momentum after the print or will it give up those levels?

Trading Micron Stock

Chart courtesy of TrendSpider.com

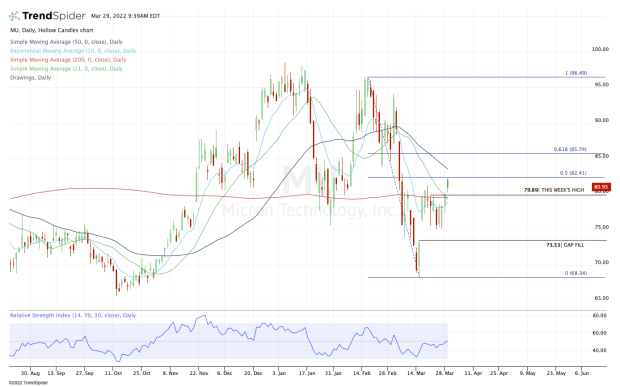

Near today’s high, Micron stock was trading near the middle of its current range — right near the 50% retracement.

That puts traders in a tough spot ahead of the quarter. It’s why I prefer to wait for the post-earnings action to see how the stock reacts to key levels.

On the downside, Micron just cleared the $80 area, a critical zone over the past month.

Not only did it push through last week’s high, but it also cleared the 21-day and 200-day moving averages. Should we get a bearish reaction, this will be the first area that the bulls look to for support.

If it’s lost — or if Micron stock simply gaps below it — the $75 area becomes key. That was support all last week, with Micron bouncing from this area in four out of five sessions.

Below that opens the door down to the gap-fill level near $73.50, followed by the $68 to $70 zone.

On the upside, let’s see if a bullish response can lift Micron stock up through this week’s high and the 50% retracement.

If so, that quickly opens the door to the 50-day moving average and 61.8% retracement.

On a move above the latter, we could be looking at a rally back into the $90s, eventually putting the $95 to $97 resistance area in play.